Dataset reveals increasing political risks across 27 of 40 emerging market manufacturing hubs

Multinational companies are facing rising political and security risks in nearshoring and friendshoring hubs, as they pivot their supply chains towards emerging markets to decrease exposure to widening geopolitical tensions and the strategic competition playing out between the West and China.

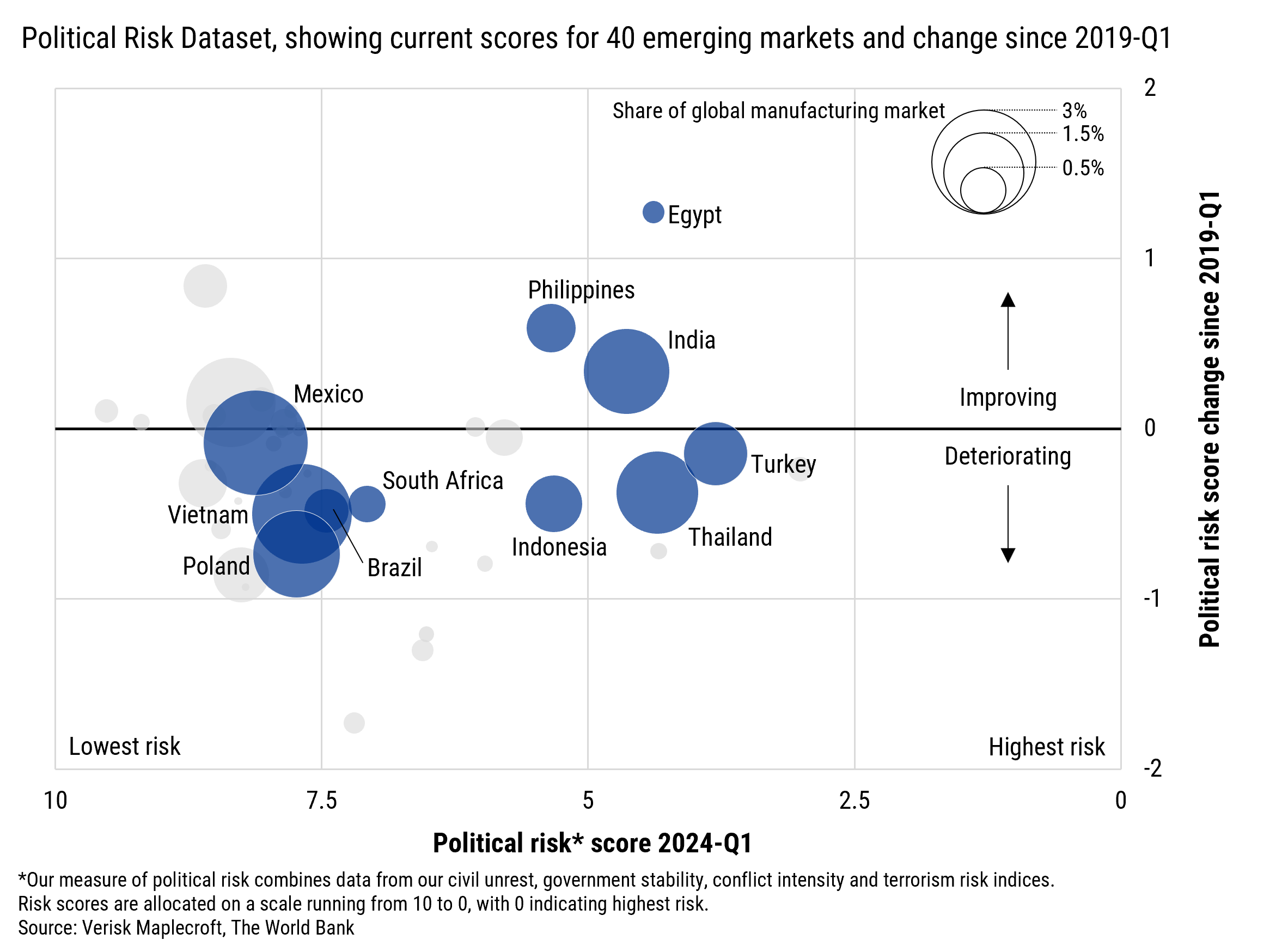

Analysing five-year trends in 40 emerging markets that make up a major bloc of the ‘nearshoring’ / ‘friendshoring’ universe, our Political Risk Dataset reveals increasing risk across a combination of issues in 27 of these countries. These include key manufacturing hubs, such as Indonesia, Mexico, Poland, Thailand and Turkey.

Civil unrest is the standout threat, but disruption from other political risks, including government instability and exposure to conflict and terrorism, are also posing challenges that need to be factored into supply chain strategies.

No region immune

With the world in a state of extended instability, political risk and disruption triggered by geopolitics, conflict and economic instability will be hard to escape across many key sourcing locations. Companies need to understand and get ahead of these localised but expanding political threats to protect flows of vital commodities and manufactured goods.

The 40 emerging markets we assessed are responsible for 20% of global manufacturing output – broadly equivalent to China – and have become important cogs for multinationals as they attempt to diversify their supply chains to build greater resilience against geopolitical risks. However, political risk is a growing threat in a significant majority of them, while remaining a consistently high risk issue in others.

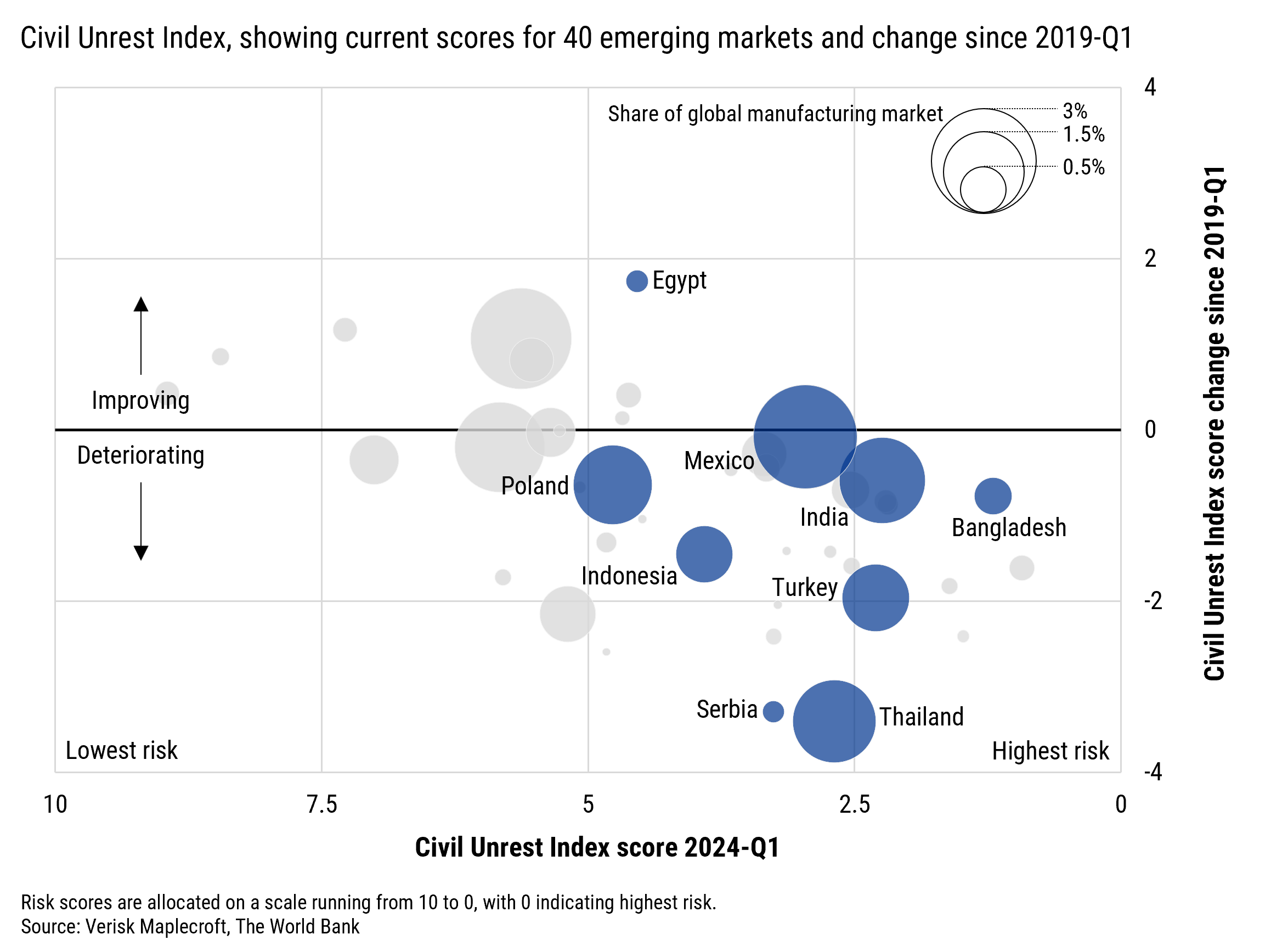

Civil unrest the key driver

Over three quarters of the emerging markets we assessed saw a rise in civil unrest risks over the last five years, including Bangladesh (ranked the 7th highest risk country for the issue globally in our Civil Unrest Index), Turkey (27th), Thailand (34th) and Indonesia (70th). The deterioration is driven by a combination of global, regional and national issues, but economic inequalities remain the top factor.

The resulting disruption from unrest in these countries has had clear implications for global supply chains. And with all of the 40 countries we assessed classed as high or very high risk for civil unrest over the next 12 months in our predictive model, the outlook for 2024 could be more turbulent.

Wage-related protests in response to inequalities have had a particular impact. Thousands of Bangladeshi textile workers forced the closure of hundreds of factories outside Dhaka in November 2023, with reports indicating that some facilities were ransacked during clashes. Widespread, coordinated industrial action at the end of 2023, including protests, also broke out in Indonesia over 2024 minimum wage levels.

In the Americas, Mexico, which has recently overtaken China to become the primary source of goods to the US, ranks as the 5th highest risk country globally on our predictive model forecasting civil unrest risks over the next 12 months. This is a particular issue on commercial highways around major urban hubs such as Mexico City, Guadalajara and Hermosillo, where blockades and protests threaten to disrupt the movement of goods and personnel.

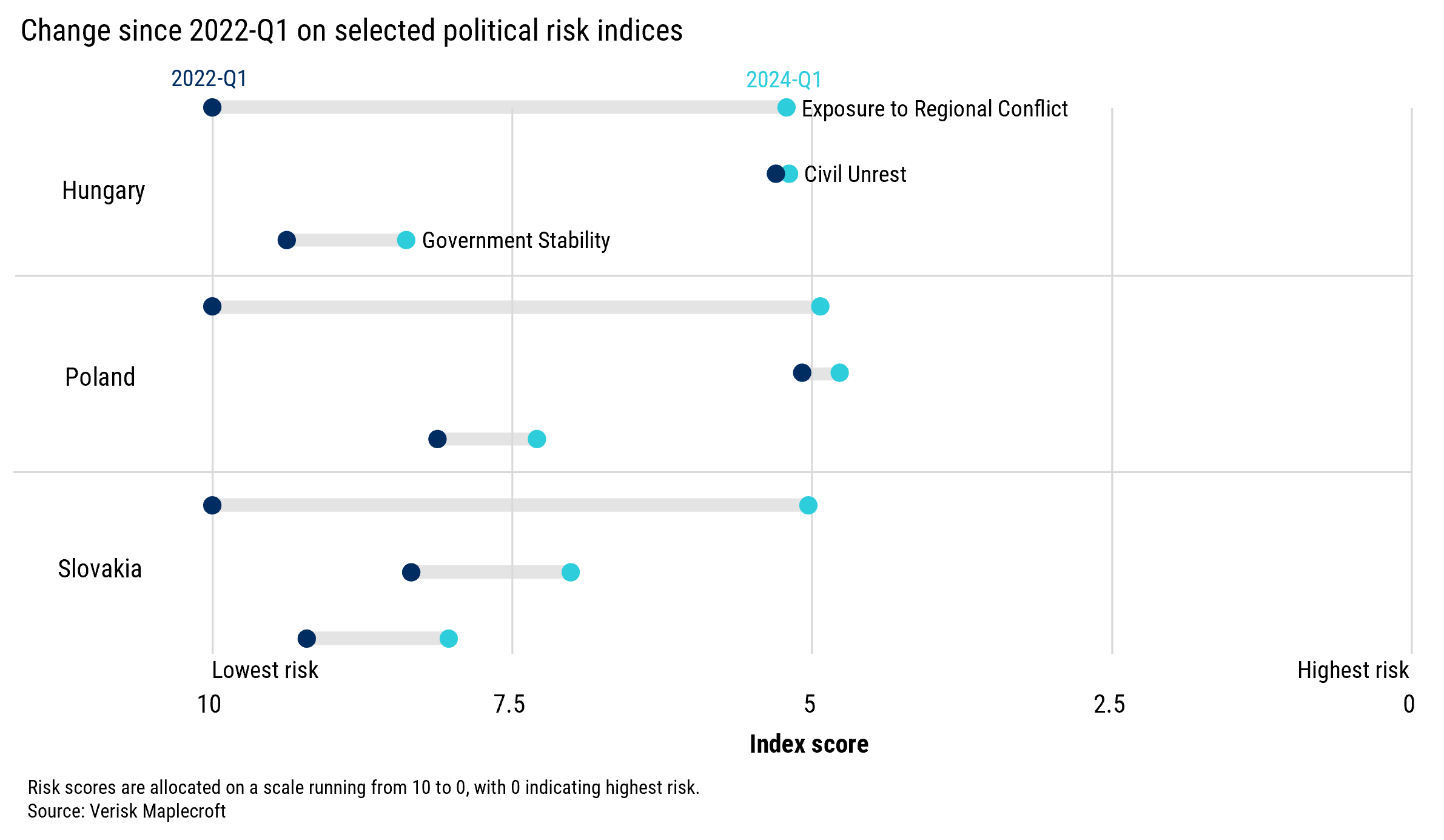

The unique impacts of regional conflict

It’s not just the Global South that is feeling the impacts of political risk. Conflict is creating waves for vital supply chain routes in Europe and the Middle East. The emerging markets of Hungary, Poland and Slovenia have all shown deteriorations in their political risk scores over the past five years. As well as the obvious sharp increase in exposure to regional conflict, these nations have all seen a rise in civil unrest risks, combined with more pronounced government instability concerns since the start of the Ukraine conflict in early 2022.

Given the geopolitical context, the deterioration is unsurprising, but it has created a unique set of emerging supply chain risks for countries bordering war-torn Ukraine. As key locations in the land-based export network that was set up to maintain supplies of Ukrainian grain globally, these countries imposed import restrictions to protect their domestic grain prices as stocks have piled up due to logistics challenges further downstream.

Since November 2023, Polish truckers have been blockading the Ukrainian border amid a dispute about Ukrainian hauliers permit-free access to the EU, disrupting supplies in both directions and causing congestion at other border crossings. Estimates suggest Ukraine’s economic losses from the dispute to date are over EUR400 million and rising.

Elsewhere, the conflict between Israel and Hamas has highlighted vulnerabilities in a vital international logistics route. A recent escalation in attacks on cargo vessels in the Red Sea by the Houthis, as Iran seeks to react to the war via its proxy in Yemen, has forced major shipping companies to suspend activities in these critical lanes. Despite US/UK attacks on the Houthis in response, the threat to shipping is unlikely to decrease soon. Without access to the Suez Canal, alternative routes from Asia to Europe and the Americas around Africa are significantly longer, with increased costs that will ultimately be passed on to consumers.

With no end in sight to either conflict, impacts in both Eastern Europe and the Middle East will continue to expose supply chains to the direct and indirect consequences as we begin 2024.

Supply chains being tested in a crucible of geopolitical tensions

International supply chains are also caught in the middle of a deepening divide between the West and China. Interstate allegiances and dependencies are increasingly shaping trade relationships as levels of sanctions and countersanctions increase in response to geopolitical tensions. The 2024-Q1 edition of our Trade Sanctions Index shows the presence of EU and US measures against finances, assets, trade and services is at five-year high, with 31 of the 198 countries assessed by the index currently subject to some form of sanctions.

Asia-Pacific remains a key area of strategic competition, leaving supply chains exposed to a geopolitical push/pull between the US and China. The US is pursuing the Indo-Pacific Economic Framework for Prosperity, which features emerging market manufacturers such as India, Indonesia, Malaysia, Philippines, Thailand and Vietnam, and includes a focus on creating supply chain resilience for key goods, as well as investment into key sectors such as semiconductors. However, China’s importance as a regional trade and investment partner means countries are highly unlikely to cut ties with the region’s largest economy, even as the US attempts to strengthen its influence.

The continuing use of trade and investment strategies by the world’s two superpowers to increase their sway in APAC and the Global South will force many countries to walk a neutral line to derive maximum benefits. For those looking at establishing future supply chain resilience, understanding these dynamics will be crucial.

More uncertainty lies ahead

As global politics becomes more fragmented and polarised, strategic competition, policy choices, security issues, and diplomatic relations will continue to buffet supply chains. These factors will be amplified by additional stressors such as the impacts of climate change, which are likely to contribute to social unrest, instability and division.

In an increasingly dynamic world, supply chain professionals looking to operate more strategically and build resilience need to create as much certainty as they can. Tracking political risks in manufacturing hubs and logistics pinch-points and using scenario analysis to map potential geopolitical shifts can help organisations understand where the next shocks could come from.