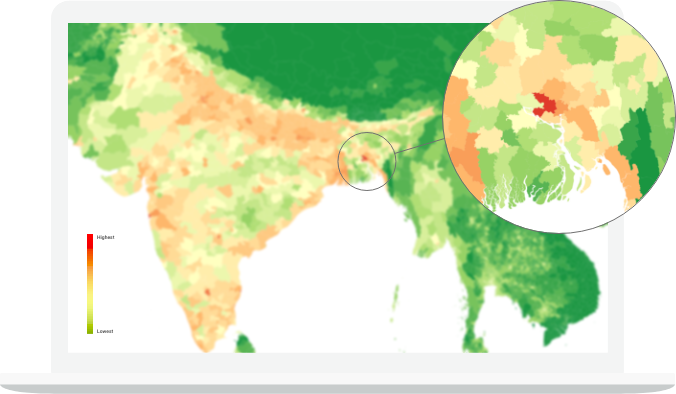

Global SRCC Predictive Scores

The market’s first predictive SRCC data solution – global in scope, granular in detail

What it does

Building on our extensive experience in quantifying political violence, the Global SRCC Predictive Scores is unlike anything else currently in the market.

- Predicts the severity of SRCC events for all admin 2 areas globally

- Engages machine learning, advanced algorithms, and geospatial analytics to provide granular and forward-looking data insights into the global SRCC risk landscape

- Validates predictions using data on actual insured losses

- Integrates historical protests, alongside demographic, economic, climate and political risk data to highlight hotspots of risk

Country level SRCC forecast

Historic protest size at admin 2 level

Concentration of people & economic value at admin 2 level

Admin 2 SRCC score

Benefits

Look forward, not back

Quickly identify portfolio exposure to future SRCC events using a data-driven predictive approach, instead of inconsistent, often qualitative, time-intensive, historical assessments

Price with confidence

Make better, more informed decisions and price policies with confidence using a quantitative assessment of SRCC risk validated against actual loss data

Prepare and protect your book

Better define your risk appetite, anticipate future SRCC related losses and control exposure by setting appropriate limits and capacity

Identify opportunity

Improve visibility on frequency, location, and size of SRCC events, revealing opportunities to underwrite new Political Violence/SRCC policies

Intelligent SRCC coverage

Capture gains and savings by creating intelligent and bespoke coverage for policy holders by using a more granular view of SRCC risk

Access with ease

Easily integrate into your Political Violence/SRCC workflows via API or Verisk platforms (Touchstone / Sequel Impact), which can be used to assess exposure accumulation

How the Global SRCC Predictive Scores help you succeed

Underwriters

Perform quantitative assessments of SRCC risk to help price and review premiums, ensure written risks adhere to exposure limits or carve out relevant risks

Exposure Analysts

Undertake assessments of future SRCC risk to your portfolio to help determine and set exposure limits, anticipate losses and refine PML (Probable Maximum Loss) estimates

Modellers

Use forward-looking data to forecast risk 12 months in advance and model SRCC exposure

Specialty Reinsurers

Assess the potential risk of SRCC events, informing scope and price of reinsurance cover

Brokers

Use granular location data to help quantify SRCC scope and inform, with confidence, on the SRCC risk profile for insurance and reinsurance cover

Would you like to learn more about how the Global SRCC Predictive Scores can help you? Speak to our experts and request a demo today.

Whitepaper

Strikes, riots and civil commotion predictive scoring – US focus

Prior to the US election in November 2024, the risk of SRCC in the United States was about the same level as it was in early 2020. This was just before the historically large riots in May and June of that year and many thought the 2024 election would be a major spark of unrest. Read this whitepaper to see how our two proprietary SRCC tools were used to assess these hazards.

DownloadRelated content

Products & Solutions

Strikes, Riots, and Civil Commotion (SRCC) Risk Model

Strikes, Riots, and Civil Commotion (SRCC) Risk Model

With the first SRCC catastrophe model to quantify risk, access numerical estimates of potential loses from SRCC events and business interruption to enable more informed decisions on insurance pricing, capital allocation, risk management, and mitigation.