Sovereign ESG intelligence

ESG, climate, natural capital and political risk intelligence for sovereign debt investors

Enabling benchmark sovereign ESG indices with our Ratings and analytics

Our award-winning Sovereign ESG Ratings are used as a key input by J.P. Morgan’s ESG (JESG) Index Suite, providing investors with a robust sovereign ESG perspective through an industry-leading suite of fixed income ESG indices.

Legal & General Investment Management (LGIM) use the depth, breadth and accuracy of our portfolio of ESG risk analytics, which outperformed alternative data across a broad set of criteria, to power their Index Fixed Income Sovereign Risk ESG Future World fund range.

Our sovereign ESG intelligence solutions

Our Sovereign ESG Ratings, risk analytics and research support investment managers, asset owners, hedge funds, and benchmark index providers with the data-driven intelligence needed to fully incorporate ESG and develop industry-leading sovereign ESG investing strategies.

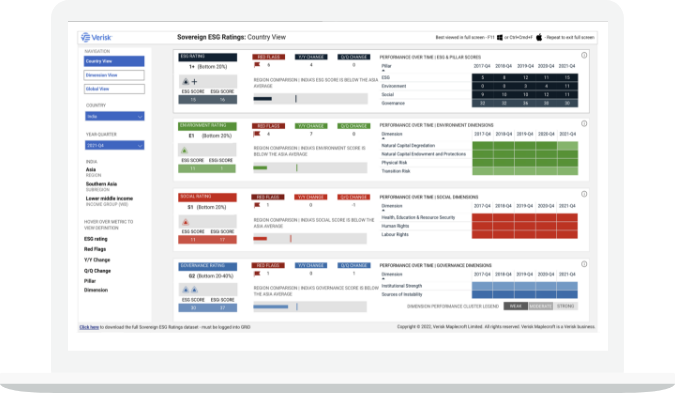

Sovereign ESG Ratings

ESG imperatives demand a different approach to sovereign ESG analysis

Learn more

Unrivalled sovereign ESG data

Our Sovereign ESG Ratings and scores offer investors a unique perspective to analyse, understand and price material ESG, climate, natural capital and political risks for sovereign debt issuers.

Forward-looking projections

Our unique Projections data provide forward-looking, simulation-based ESG and political risk projections for 130+ markets, delivering an unmatched, data-driven investment perspective.

Expert analyst intelligence

Our 50+ ESG and country experts deliver proactive, data-driven insights and briefings on key markets and events, enabling you to make smarter, more informed investment decisions.

Custom ESG and climate risk advisory

Where you have a particular need, we have the in-house expertise to deliver custom research, support and advice on sovereign ESG, climate, natural capital and political risks.

What’s different about our sovereign ESG intelligence?

Proprietary sovereign ESG data

Our Sovereign ESG Ratings set a new standard for sovereign ESG analysis. They build on our industry-leading Global Risk dataset, spanning 1200+ proprietary indicators and covering all ESG, climate, natural capital, human rights and political risks.

Sovereign ESG expertise

Our 50+ ESG and country analysts – many with years of on-the-ground experience in emerging markets – underpin our proprietary data and provide you with in-depth intelligence and advice on incorporating ESG and political risks into investment decisions.

Customisable approach

Your sovereign ESG investment approach is unique to you, so we provide flexible, customised solutions designed to fit your needs, whether that’s a data feed, analyst research, custom advisory work, all of the above, or something in between.

Benefits

Price in sovereign ESG factors

Research into our Sovereign ESG Ratings and data shows clear relationships with government bond spreads

Make informed decisions

Draw on our expert analysts’ specialist knowledge to better inform your investment decision-making

Align with client values

We cover all material and ethical sovereign ESG issues so you can build products that suit your clients

Report against regulations

Use our sovereign ESG data to define exclusion lists and thresholds to comply with reporting requirements like SFDR

Supporting investors through pioneering sovereign ESG research:

Sovereign ESG Ratings: Setting a New Standard

Our whitepaper finds human rights and transition risk are now highly material for sovereign bond pricing

Amundi: ESG and Sovereign Risk - What is Priced in by Bond Markets and Credit Ratings?

Our ESG data informs Amundi study into sovereign bonds and credit ratings

EDHEC-Risk Institute: Measuring and managing ESG risk in sovereign bond portfolios

Our sovereign ESG data underpins EDHEC study into the impact of ESG factors on sovereign bonds

Related content

Insights

Solutions

Sovereign ESG Ratings

ESG imperatives demand a different approach to sovereign ESG analysis.