The conflict in Gaza has raised threat levels across the region, bringing longstanding geopolitical tensions to the fore between countries and groups where the risk of overstepping red lines is high. With no end in sight, the reverberations of the crisis will continue to weigh on global supply chains and distressed regional economies. Here, we unpack some of the key issues and developments to watch in the region throughout 2024.

Risk of regional war will not subside until there is a resolution in Gaza

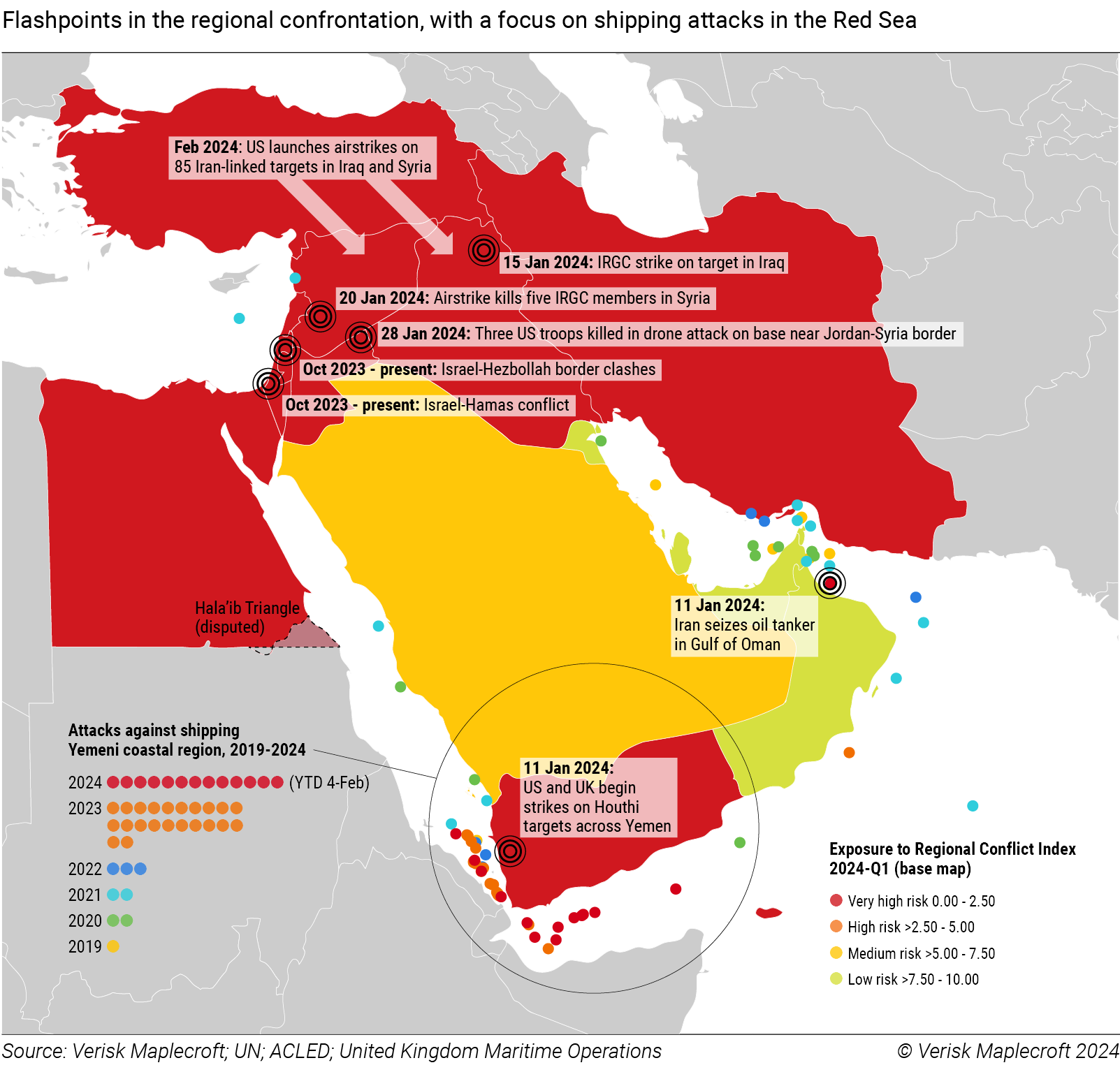

The outbreak of conflict in Gaza kicked off a regional confrontation that puts Israel and its key ally, the United States, at direct odds with Iran’s network of militant groups throughout the region. The resulting proxy conflict is disrupting global shipping flows and threatening a fragile security situation – where 11 of the 20 countries we monitor in the region are already rated very high risk on our Exposure to Regional Conflict Index (see map below).

The latest major flashpoint was the January 28 drone strike by an Iran-aligned militant group which killed three US troops. The calibrated US response, which so far includes 85 strikes on Iran-linked targets across Iraq and Syria, shows how Washington is attempting to degrade the capabilities of Iranian proxies while avoiding a direct conflict with Iran. An all-out war between the US and Iran (and/or between Israel and Iran) remains an unappealing option for all parties, but the risk of miscalculation is rising.

The risk of regional war, though not our base case, will hang over the Middle East until there is a resolution to the Gaza conflict. A hostages-for-ceasefire deal may be the most likely path to a resolution, though whether that will result in a temporary pause or an enduring cessation to hostilities is the key question. Even if an enduring ceasefire deal is reached, the question of how post-war Gaza will be governed will continue to dictate regional tensions throughout 2024.

Red Sea security crisis stretching global supply chains

Unlike the short-lived Suez Canal disruption in 2022, there is no immediate solution in sight to the evolving Red Sea security crisis. As the map above shows, UK and US attacks against the Houthis have not prevented or deterred the group from striking against international shipping. A big part of the challenge is that the Houthis don’t need to physically prevent ships from passing through the Red Sea; they only need to present enough of a threat to make war risk premiums prohibitive.

The threat posed by the Houthis has more than halved cargo volumes through the Red Sea. This vital link in global supply chains, accounting for 15% of global trade, remains severely disrupted. As most shipping liners and tankers are compelled to take the long route around Africa, inflationary pressure is set to mount, especially in Europe. For governments trying to ease the long-running cost of living crisis, the Red Sea security crisis comes at a bad time.

Crucial year for Saudi Arabia’s Vision 2030

The clock is ticking on Saudi Arabia’s Vision 2030 reform programme.

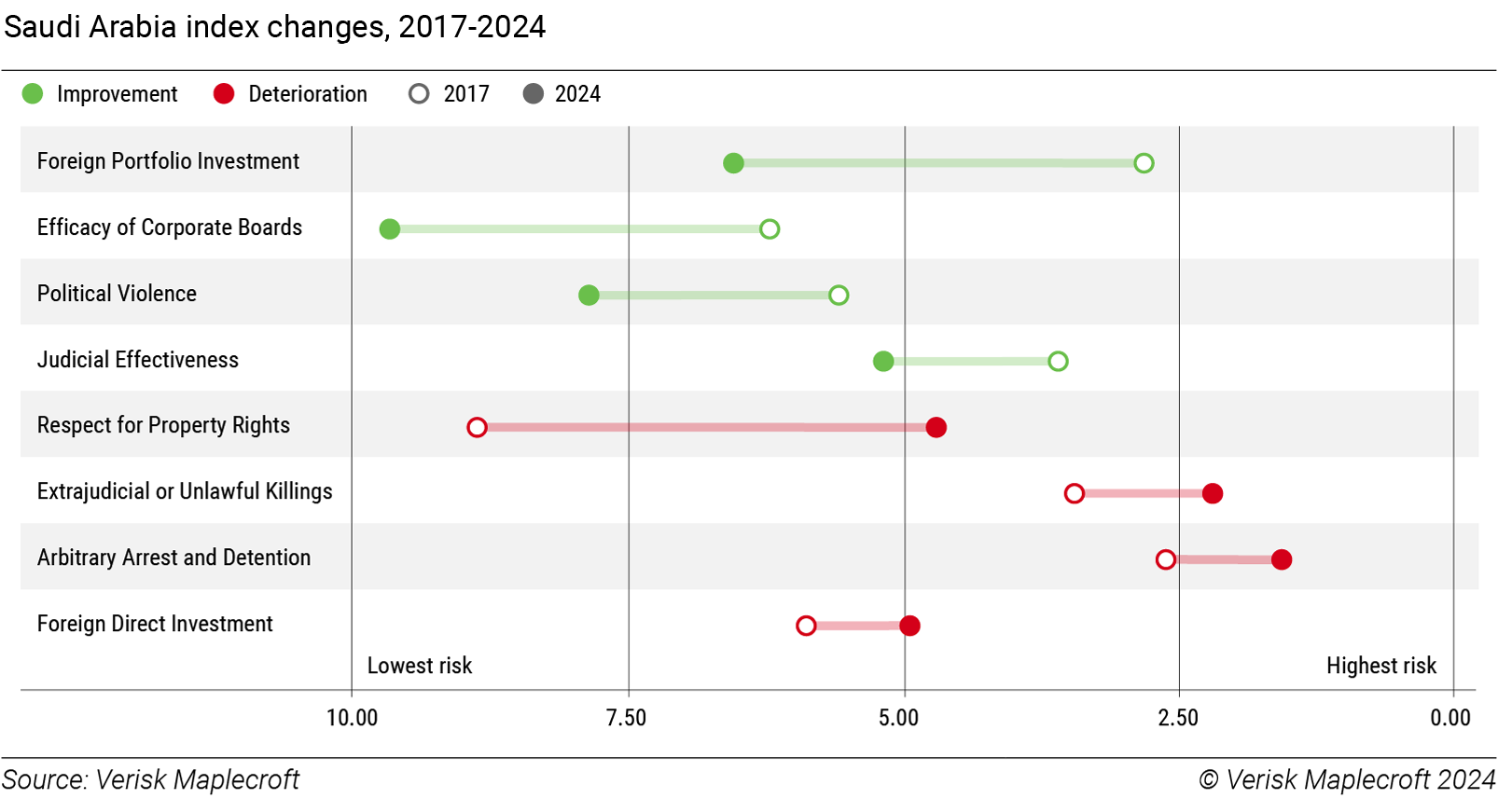

Now in its eighth year, Crown Prince Mohammed bin Salman’s roadmap for economic diversification has delivered greater social freedoms for Saudi citizens. Yet foreign investors remain unconvinced by the vision for a new Saudi Arabia. As the chart below shows, the kingdom has seen significant progress on a range of regulatory and political issues. But, as our data shows, challenges over governance and human rights remain. Escalating regional conflict only adds further complexity for the government in Riyadh.

If ambitious targets are to be met, Saudi Arabia needs to turn this around sharply. Otherwise, the country will still be viewed more as a source of funding than a destination for FDI. Inflows last year are unlikely to have exceeded the USD7.9 billion (0.7% of GDP) recorded in 2022. This is far behind the target of 5.7% by 2021, and a long way from the aim of USD100 billion by 2030.

Financial distress portends potential unrest

Egypt, Lebanon, and Tunisia face deepening economic crises in 2024, unless bailout deals can be secured with the IMF. Egypt’s existing loan programme with the fund reached an impasse in 2023 over Cairo’s lack of progress with reforms. Exogenous shocks beyond Egypt’s control – including the hit to Suez Canal traffic – are a useful plank for Cairo to secure a renegotiated deal. But Egypt will still need to push through currency reform to secure a deal with the IMF. This is likely to include a major currency devaluation by Egypt’s central bank, which will hit the population in their pockets and likely stoke discontent.

Lebanon is seeking an IMF bailout to execute an economic turnaround, but cannot do so while its parliament fails to choose a government capable of approving a deal. Tunisia’s President Kais Saied has criticised what he calls the “foreign diktats” of the IMF even as the risk of financial default ticks up. Presidential elections in November could spark civil unrest if the economy continues to falter. Egypt, Lebanon and Tunisia are all categorised as high risk on our predictive Civil Unrest Index, which forecasts the likelihood of large-scale protests over the next 12 months.

The Sovereign ESG landscape: Will investors prioritise E over S and G in the GCC?

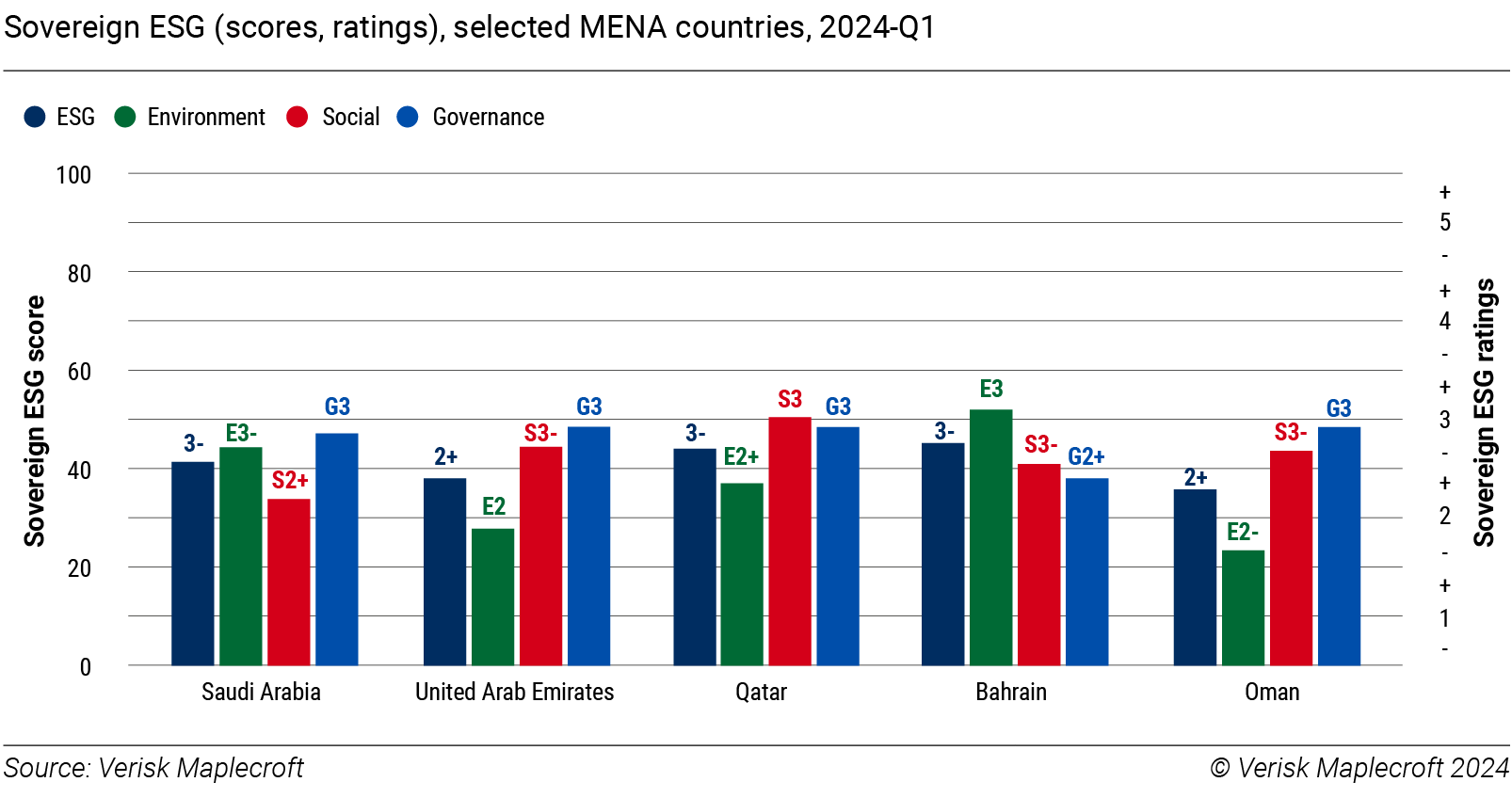

Following the December 2023 COP28 climate talks in Dubai, which put the GCC under global scrutiny, ESG investors may see more outward climate change mitigation commitment from the hydrocarbon-producing countries within the Gulf Cooperation Council (GCC). Oman recently published its first sustainable finance framework, and it is likely that, given the accelerating growth in green and sustainability-linked bonds in the region, other GCC members will follow suit – except the UAE which already has an established green taxonomy.

However, increasing regulatory requirements for disclosure on human rights will keep investor caution towards the GCC elevated. Our data shows that human rights performance remains unchanged in the region. And some Europe-based funds have excluded Gulf-based companies from their portfolios over concerns around social risks. More investors could follow suit, increasing external pressure on GCC states to introduce regulatory changes that improve their social and governance performance.