The Trendline - Asia: Risks to watch

by Reema Bhattacharya and Joseph Parkes and Emma Whiteacre,

APAC faces another year of geopolitical tension driven by US-China great power competition. But with direct conflict a remote prospect, Asia’s shifting regulatory landscape and domestic political risks will be the most material dynamics for business to watch in 2023. Global sustainability trends will challenge the region’s traditional competitive advantage, while growth sectors like technology present escalating ESG risks. At the sovereign ESG level, China’s falling governance scores could prove an enduring challenge for Beijing, and India’s transition remains muddy, despite strong demand for the rollout of its first green bond.

A year of calculations but no conflict

An accidental clash in the Taiwan Strait remains the most plausible trigger for military escalation in Asia, but China is unlikely to chance its arm this year. Military conflict between the US and China, therefore, remains a distant prospect for now, not least because both superpowers are preoccupied with domestic challenges. That does not mean this will be a year of geopolitical stasis in APAC though.

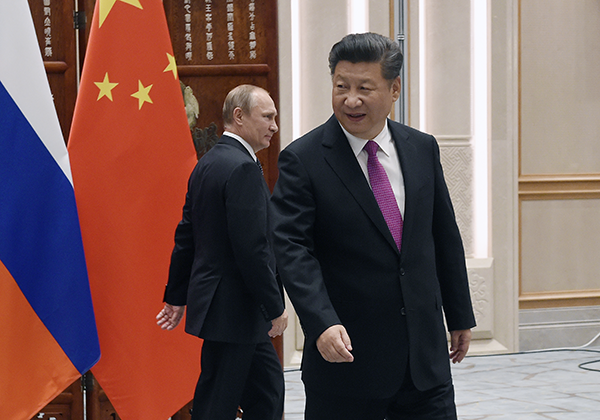

The region’s middle-powers are responding to the geopolitical currents inflamed by the Russia-Ukraine conflict by levelling up their military capabilities, establishing new regional architectures, and forging new areas of cooperation, both with and without the US and China. The next year will be one of positioning, by the end of which we will have a clearer view of the regional strategic landscape. The US’s key allies – Australia and Japan – will lead the middle power defence build-up, but they will seek to do so while maintaining key trade and economic relationships with China. Elsewhere, hedging strategies will predominate as countries aim to strike a balance between the world’s two superpowers (see visual below).

Manufacturing hubs grapple with political risks and onslaught of global sustainability regulations

Asia’s emerging economies will gain from suppliers diversifying away from China. However, resurgent political risk will stem the tide of investment inflows in key manufacturing hubs. Malaysia, beset by political uncertainty in the last five years, is unlikely to see its fortunes revive in 2023. An uptick in political instability in the run-up to elections in Thailand and Bangladesh in 2023, and Indonesia in 2024 will challenge the stability of major supply chain linkages.

The new wave of global human rights due diligence laws will test manufacturers’ proven model of relying on the region’s vast supply of cheap labour and raw materials. While there are no mandatory sustainability reporting laws in Asia, upcoming EU legislation – namely the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDD) will turn up the demand for voluntary disclosures from developed markets. As the world pivots towards responsible sourcing, legal quagmires and negative headlines will become the new reality for global businesses that turn a blind eye to their APAC supplier networks.

Asia’s digital revolution built on shaky ESG foundations

Asia’s burgeoning digital ecosystem, supercharged by pandemic-related lockdowns, will remain the fastest-growing sector in 2023. Many regional governments have rolled out the red carpet for foreign investors, offering up cheap land and easing market entry norms, while domestic regulations still play catch-up with requisite standards and rules to govern the entire digital economic value chain.

This year the rapid proliferation of data centres will have to contend with increasing power outages, rising water stress in drought-prone areas, and flood risk in cities with poorly planned public infrastructure. Data companies and content platforms will also have to wrestle with a discernible increase in digital surveillance and censorship. Our data highlights the jeopardy, with key emerging data centre hotspots like Jakarta, Bangkok, Kuala Lumpur and Hyderabad located in countries that receive extreme-risk scores in our Right to Privacy Index. The discourse around proposed legislation in developing economies will strongly advocate jurisdictional control over data and stringent compliance mechanisms for foreign companies.

Geopolitics: A protracted US-China decoupling process will jeopardise the future of critical supply chains

The political posturing of US-China ‘decoupling’ efforts will create more longterm operational challenges for global green and technology businesses. Growing great power competition to wrest control over future markets has led both sides to reduce mutual dependence in strategic sectors like semiconductors and critical minerals. That means the US will be unwilling to take its foot off the pedal on sanctions to restrict China’s access to its technology and limit Chinese green imports. China will also double down on export regulations to deter companies from complying with such sanctions.

However, ongoing US efforts to re-shore strategic supply chains and China’s bid for self-sufficiency could prove costly, time-consuming and technically challenging for both sides. Though a complete decoupling will remain unlikely in the coming years (see visual below), strategic supply chains will become less integrated than in the past. Trade tensions will fragment the region into geopolitical camps, with global companies left on their own to navigate a minefield of regulatory and operational risks.

The Sovereign ESG landscape: Shifting social and environmental dynamics

China’s Year of the Rabbit should portend peace and prosperity post-Covid, especially with a strong economic recovery expected despite the public health consequences. But the protests and civil unrest that drove Beijing to abandon Zero-Covid highlight the fragility of the social contract, where the regime’s legitimacy rests upon its ability to provide economic opportunity and development.

This dissent is reflected in a fall in the G-pillar of our Sovereign ESG Ratings, and it may prove enduring, at a time when shifting demographics present public policy challenges.

India’s USD1 billion inaugural green sovereign bond in late January saw strong demand, reflecting the scale of investment opportunities, with a second USD1 billion issue due 9 February. India’s E-rating is below the regional average, at ‘2+’, on poor air quality and water pollution scores, but it scores relatively strongly on Transition Risk. The green bond framework explicitly excludes fossil fuel financing, yet coal remains deeply embedded in the social, economic and political fabric, explaining India’s COP26 alignment with China to ensure that coal be phased down, not out.

With a worst-possible S rating (‘S1-‘), a ‘Just Transition’ will also require major scaling of impact and/or SDG-linked capital.