The Trendline - Europe and Central Asia: Risks to watch

by Hugo Brennan and Ophelia Coutts and Fabrizio Farina and Eileen Gavin and Capucine May,

The year ahead is set to be a turbulent one for corporates, investors and insurers with exposure to Europe and Central Asia. To help organisations understand the fast-changing risk landscape, we have identified 5 key trends to watch: the continuing fallout from the Russia-Ukraine war, Brussels' protectionist push, the ripple effects of the cost-of-living crisis, the potential for new Eurasian conflicts to erupt, and deteriorating sovereign ESG dynamics Eastern and Central Europe.

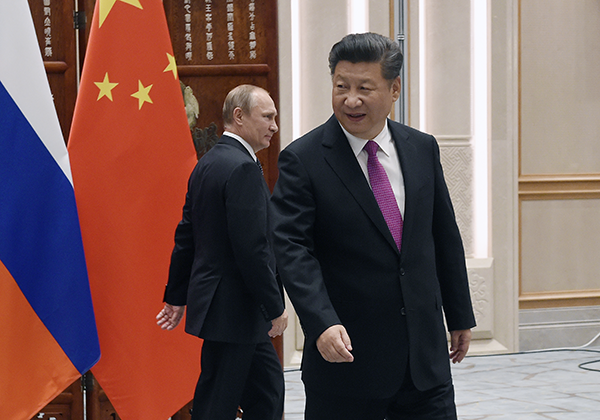

The continuing fallout from the Russia-Ukraine war

With no end to the fighting in sight, the ongoing and disruptive fallout from the war in Ukraine headlines our trends to watch. The failure of Moscow’s paper-thin Christmas ceasefire proposal reflected the gulf between the two sides: Kyiv is intent on liberating all Ukrainian territory, while Moscow still harbours hope of regime change.

Foreign firms will continue to grapple with making good on their divestment pledges. A law passed in August 2022 essentially prevents banks and energy firms from ‘unfriendly countries’ quitting Russia unless they sell their assets at heavily discounted prices to local, politically connected individuals. Those companies still operating in Russia face an elevated risk environment, from intense reputational risks associated with helping finance the Kremlin’s war-chest and facilitating Putin’s next military mobilisation drive, to direct expropriation risks and exposure to sanctions.

EU support for Ukraine will remain robust, but the absence of low-hanging fruit on the sanctions front risks some member states taking a more unilateral approach, which would result in an increasingly fragmented sanctions landscape for corporates, investors, and insurers to navigate. Moscow may further pressure-test EU unity by cutting off its remaining gas exports to the bloc, sabotaging critical European infrastructure or potentially curbing nuclear power-related exports.

Brussels going big to protect EU industry

The EU is doubling down on a more protectionist industrial policy in 2023. This continues a trend that gathered pace in 2022, when state intervention in energy markets caused an exceptional deterioration in the EU’s performance on our Resource Nationalism Index (see chart below). The rise in interventionist policies is designed to: counter the trade disruptions wrought by Covid-19 and the war in Ukraine; address concerns that energy-intensive industries will relocate to cheaper jurisdictions; and respond to punchy green investment incentives, such as the US’s Inflation Reduction Act (IRA).

The proposed European Chips Act and the Single Market Emergency Instrument – both of which are likely to be passed in 2023 – contain provisions that would allow the EU to compel companies to prioritise supply to the Single Market. The IRA has also spurred debate on whether the EU should relax its state aid rules, with countries such as France already starting to draft national equivalents. A wave of protectionism will benefit European corporates to the detriment of foreign firms and exacerbate trans-Atlantic and Sino-EU tensions, although a full-blown trade war with either in 2023 remains unlikely.

The ripple effect from the cost-of-living crisis

The ripple effect from the cost-of-living crisis in Europe is another key risk on our watchlist for 2023. The opening weeks of the year have seen disruptive strike activity in the UK, France and Italy, as public and private sector unions demand better pay and working conditions for their members amid high inflation and rising interest rates. We expect further rounds of strikes in the months ahead. As the cost-of-living crisis bites harder, pressure will build on employers to increase wages at least in line with inflation or risk talent quitting to seek better renumeration elsewhere. Another danger is that the cost-of-living crisis erodes faith in Europe’s democratic institutions and prompts citizens to take the streets to challenge their government’s perceived shortcomings. Our forecast is that the risk of civil unrest will increase in 21 out of 49 countries across Europe and Central Asia over the next 6 months. With several presidential and general elections coming up in 2023 – notably Spain, Poland, Greece, Finland, and Montenegro – we may also see incumbent governments punished at the polls as people demand change.

Geopolitics: The potential for additional Eurasian conflicts to erupt

A key geopolitical risk trend to watch in Europe and Central Asia in 2023 is the potential for conflicts beyond Russia-Ukraine to ignite. Our Interstate Tensions Index shows that bilateral tensions between Azerbaijan and Armenia have eased since the two engaged in a series of military clashes over the disputed Nagorno-Karabakh region in September 2022 (see chart). But the recent breakdown of peace talks, and Baku’s ongoing blockade, suggest a resumption of armed conflict in the months ahead is likely. A border dispute between Tajikistan and Kyrgyzstan that boiled over into deadly clashes last year also warrants close attention.

Elsewhere, tensions between Serbia and Kosovo are once again rising following a spate of violent clashes between the authorities and ethnic Serbs in northern Kosovo. A return to armed violence in Bosnia also cannot be ruled out amid an uptick in nationalist and secessionist rhetoric.

The Russia-Ukraine war provides a guide to the sort of disruptive impacts corporates, investors and insurers can expect if additional armed conflicts were to break out in Eurasia in 2023. Ranging from unexpected financial losses for the insurance sector and volatile commodity markets, to sanctions and pressure to cut business ties with the perceived aggressors.

The Sovereign ESG landscape: Russia-Ukraine ripples spread

The Russia-Ukraine fallout has set back ESG dynamics across Eastern and Central Europe, with countries including Poland, Albania, Hungary, Kazakhstan, Kyrgyzstan, Turkmenistan, Azerbaijan, Bosnia and Herzegovina, Czech Republic and Serbia all seeing Sovereign ESG declines in the past year – resting on weaker S and G scores. With economic weakness likely exacerbating social strains in 2023, sovereign investors should keep a close eye on S and G pillars, particularly in countries heading towards unpredictable elections, like Poland.

Neither has Western Europe been immune, with E and S pillar scores under pressure in nearly all countries (led by the UK), belying the current tensions between energy security and the energy transition, and also between superregulator Brussels and national governments. Longer term, however, it is clear that the E of the environmental agenda is now heavily aligned with the S of the security agenda, with the current crisis period ultimately likely to prove an ‘accelerant’ en route to net zero.