The Trendline - Climate-driven unrest escalates in Europe in 2023-Q1

by Jess Middleton,

Earlier this year we analysed data from our suite of 170+ Country Risk indices to highlight the key signals that will shape the global risk environment in 2023. We found that political risk at the start of 2023 was at a five-year high, according to our data covering conflict intensity, civil unrest and government stability.

As we enter 2023-Q2, we’ve taken a look at our latest data to see how the trajectory of risk developed over the first quarter of the year.

Inflation eases but socioeconomic tensions continue to bite

In January, we predicted that runaway inflation would be one of the major drivers of political risk in the year ahead. The situation has shifted somewhat since then: 76 countries registered a significant improvement on our Inflation Index in Q2, largely as a result of falling energy prices, compared to just two that registered a significant deterioration.

That said, the cost of living crisis has yet to pass in much of the world, and the global economic outlook remains gloomy. Several countries that saw a significant improvement on the Inflation Index are still categorised as high or extreme risk, including the likes of the US, Germany and France. All told, 119 countries remain within the index’s two riskiest categories.

As such, socioeconomic tensions remain near boiling point. A further seven countries saw a significant increase in risk on our Civil Unrest Index in 2023-Q2, meaning that 100 countries now fall into the index’s high and extreme risk categories.

Unsurprisingly, the sharpest uptick was registered by Peru, where mass protests triggered by the resignation of former president Pedro Castillo saw the country move from 58th to 11th highest risk globally.

Climate protests surge in Europe

While rising living costs remain a key driver of unrest globally, our data shows that the climate crisis is adding fuel to simmering public discontent in Europe. Hungary, the Czech Republic and Portugal all registered a sharp increase in risk on the climate change activism pillar of our Climate Litigation Index this quarter, which measures the number of citizens attending climate strikes and protests. At the same time, Italy, Germany and France receive the highest risk score possible for the issue, with Austria, Belgium, Denmark, Spain and Sweden rated extreme risk.

The EU has endured a wave of activism aimed at drawing attention to climate change this year, including the targeting of cultural sites. The scale of climate-related protests is likely to increase in the months ahead as environmentally conscious citizens demand a stronger political response to the climate crisis.

“Going forward, businesses based in the region will face a higher risk of reputational – and even financial – damage if their environmental credentials are called into question by activists and regulators,” says Europe and Central Asia Research Associate Fabrizio Farina.

Figure 1: Climate change fuelling unrest in Europe

Political stability waning in Latin America

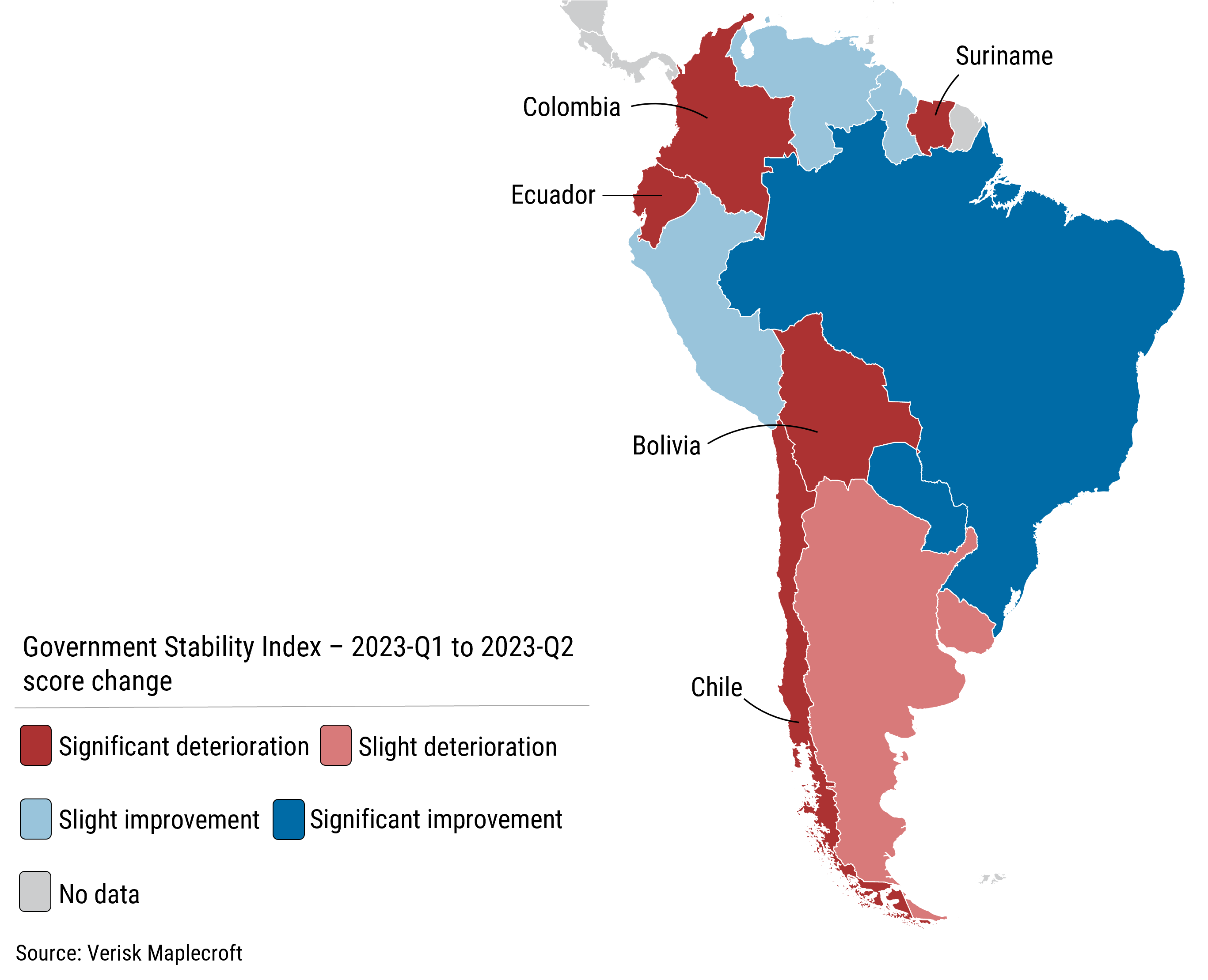

Earlier this year, our Americas team warned that the souring of the second left-wing ‘pink-tide’ could fuel political instability in 2023. Data from our Government Stability Index (GSI) suggests this prediction has already begun to play out.

Colombia, Chile and Bolivia all registered a significant increase in risk on the GSI in 2023-Q2, adding to a trend that has seen the region’s left-wing governments buckle as they fail to mount a cohesive response to long-standing social demands. Take Colombia, where coalition disputes over plans for socio-economic and political reform saw President Petro replace his finance minister amid a cabinet reshuffle in late April.

It is a similar story in Chile, where President Boric’s administration has been consistently knocked back when trying to push through key reforms. This was demonstrated last month when a proposed tax reform bill was rejected by the Chamber of Deputies, leading to a cabinet reshuffle in which five ministers were replaced.

In Bolivia, government stability is being undermined by a deepening rift between President Arce and his predecessor and key ally Evo Morales. This has prevented La Paz from mounting an effective response to the country’s myriad crises – not least a currency crisis that threatens both the banking system and the country’s ability to sustain import levels, leading to fears of shortages.

“The regulatory uncertainty created by mounting political instability will be cause for concern for the businesses operating in and sourcing from Latin America,” says Chief Analyst Jimena Blanco. “At the same time, the volatile business outlook could stifle the levels of much-needed international investment received by the region in 2023.”

Cutting edge analytics key to building resilience in the months ahead

Simmering socio-economic tensions, government instability and a fragile global economic outlook will continue to shape the political risk landscape in the months ahead. Heading into the rest of 2023, businesses that embed cutting-edge data and analytics will stand the best chance of anticipating where uncertainty could crystalise into hardening risk, helping them build resilience across their operations, supply chains and investments.