Sovereign ESG Ratings: Countries to Watch in 2023-Q2

by Emma Whiteacre,

This insight draws on analysis from our Sovereign ESG Ratings 2023-Q2 update research report. Download the report now if you would like to read the full analysis.

Our 2023-Q2 Sovereign ESG Ratings show that ESG issues remain hostage to competing political and economic priorities. Forced to navigate between higher borrowing costs and tight budgetary constraints on one side, and short-term political demands to alleviate cost of living pressures or deliver benefits to electorates on the other, many governments are at risk of letting certain environmental and social goals with longer-term impact horizons slide.

Sovereign debt investors, currently enjoying a surfeit of issuance and generous yields, can use ESG analysis to understand which government issuers are more successfully navigating these challenges, and where there may be opportunities to engage to support policymaking. While such scrutiny can be testing, an additional layer of accountability should serve to contribute to better ESG outcomes over the longer term.

This quarter, the ratings of six countries have been upgraded, including the United Arab Emirates (from 2+ to 3-) on improvements in its Human Rights dimension, and Turkmenistan (from 2 to 2+) on a better governance performance (of which more below).

However, 25 countries were downgraded on deteriorating performance in particular dimensions, notably:

- Bolivia, from 2 to 2-, on G (Government Stability)

- Brazil, from 3- to 2+, on E and G (Natural Capital Degradation and Health, Education and Resource Security)

- Gabon, from 2+ to 2, on S (both Health, Education and Resource Security and Labour Rights)

- Kazakhstan, from 3- to 2+, on S (Labour Rights)

- New Zealand, from 5- to 4+, on S (Labour Rights)

Panning for insights – delving into the ratings model

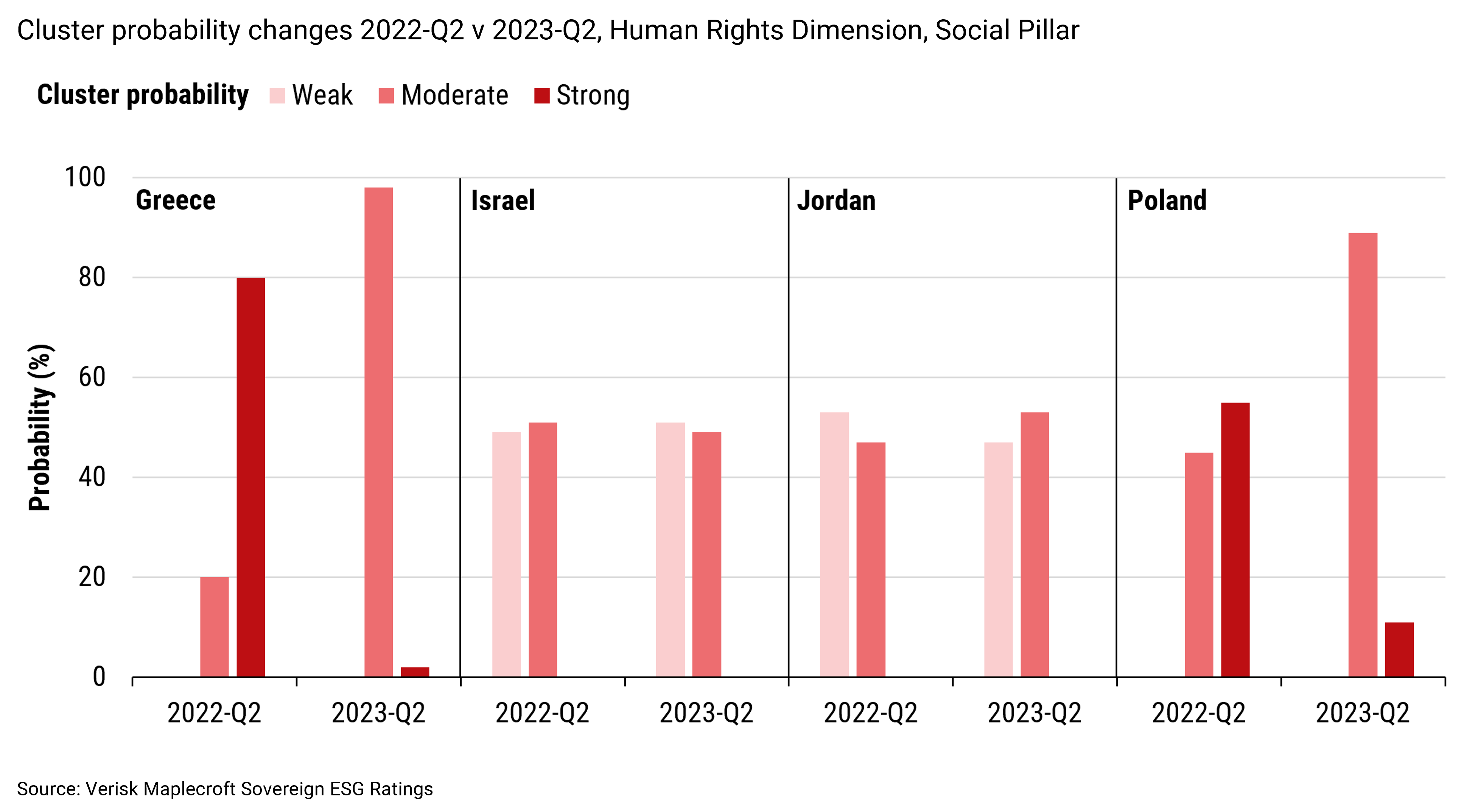

Interrogating our Sovereign ESG Ratings for market-relevant insights is a fruitful exercise. By focusing on the headline rating and its score out of 100, you can derive granular insight into how a country is faring, its overall trajectory and where it ranks globally. A deeper dig into the E, S and G pillar scores provides a quick sense of where a country sits against its global peers for each on a 15-point scale. But for greater issue-specific understanding, the Ratings’ cluster analysis for each of the nine ESG dimensions in our model, offers some unique perspectives on developing trends and risks. This assesses the probability of a country being in the weak, moderate or strong clusters of countries in each dimension, and where that country has outperformed or underperformed its peers.

Together, the unique scoring system of the Sovereign ESG Ratings delivers meaningful insight into important on-the-ground developments that might warrant consideration in thematic portfolio construction, impact investing or engagement with sovereign issuers.

What do the clusters tell us?

Over the past year, since 2022-Q2, countries have shifted between clusters 59 times. This represents less than 1% of all updates over four quarters, reflecting the stability of the model. But when changes occur, they can be meaningful. We have assessed some of these moves and the context around them below.

Sovereign ESG evolution – the E load

Over the past year, since 2022-Q2, 21 countries have been upgraded on our 15-notch ratings scale and 45 countries have been downgraded. At a more granular level, the scores (out of 100) of 109 countries have deteriorated over the year, while 88 have improved. In Q2-22 the average overall ESG score in our model was 51.08/100; it is now 50.04.

This decline is concentrated on environmental factors – the average change in the E pillar score across all countries was a fall of -1.4/100, compared with a minimal decline in the S pillar (0.15) and tiny improvement in the G pillar (0.04). Nonetheless, there are some developments on the E front that warrant optimism - important policy improvements in China and Australia are of particular note, while recognising that both are climate laggards with much work still to do.

Social

Overall, we have seen improvements in global Human Rights provisions over the past year, with 130 countries’ scores improving while 60 countries worsened. On a regional basis, the Americas, Africa and Asia are doing better, MENA countries on the whole have seen little change, while Europe and Oceania have witnessed a deterioration. In particular though, Greece, Israel, Jordan and Poland have seen a slippage in protections that have led to cluster changes in our ratings.

Governance

Finally, we have seen some positive momentum on Governance performance over the past year too. The average G score on a global basis has improved marginally, with 108 countries seeing improvements and 83 seeing deteriorations. The data shows that countries frequently exercise a trade-off between institutional stability and fundamental freedoms, with the Philippines and Turkmenistan enjoying greater stability at a significant social cost, although Tanzania and South Africa have both seen recent Governance gains through reformist momentum in the former and well-exercised judicial independence in the latter.

Filtering out the noise

Distilling the complexities of all of countries’ environmental, social and governance characteristics down is a big task, and each is subject to a disparate set of drivers. While there are useful overarching global narratives, their impacts are certainly not felt in a uniform manner or on synchronised timescales. But by using comprehensive datasets and advanced data science techniques, we can exclude a lot of the noise around issues to really understand what’s going on, and isolate trends that can really have a material impact on investment outcomes.

Download the full report to find out more about the countries seeing the biggest shifts on the Sovereign ESG Ratings.