ESG risk factors are material for sovereign debt investing

A joint study with BlueBay Asset Management

We’ve partnered with our long-standing client, fixed income specialist BlueBay Asset Management, to release a joint research study that reveals the extent to which country environmental, social and governance (ESG) risk factors genuinely matter in sovereign debt investing.

Our work applies an innovative method of measuring country ESG risk that we have developed in an effort to support the advance of ESG investing in sovereign debt markets.

Our research findings offer several key results:

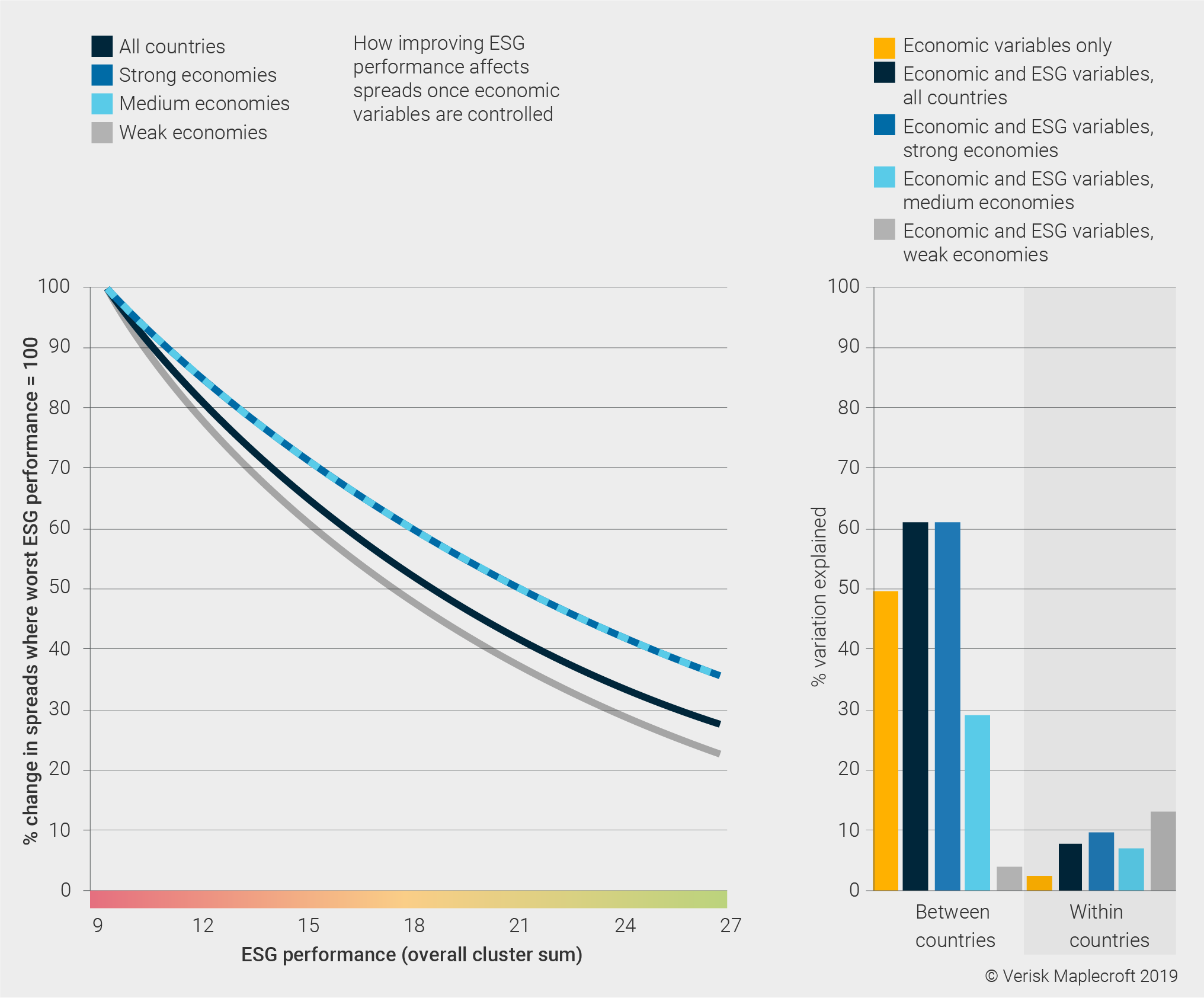

- The spreads of the best overall ESG performers are approximately 70% narrower (see Figure 1) against their benchmarks than those of the worst, once all economic differences are factored out.

- A 1-unit overall improvement in governance performance is associated with a 12% reduction in spreads. However, investors sometimes appear to be more cautious of the political risks associated with democracies than they are of those associated with more authoritarian states.

- Environmental or climate risks do not appear to be properly priced in by markets: countries with better environmental performance are either ignored or penalised.

- Our data shows that the most climate change-exposed countries are, in general, also the most biodiverse – and, while investors do partly price in physical climate change exposure, markets are rewarding countries that have substantial stocks of usable natural resources remaining.

- Investors also seem to prefer the debt of countries with weaker environmental regulations and which are not making strides towards energy transition and decarbonisation.

- Overall, this study suggests that meaningful changes in trading behaviour in sovereign debt markets have not yet resulted from the investment industry’s strategic focus on environmental and climate risks.

Download our whitepaper: 'The role of ESG factors in sovereign debt investing' below

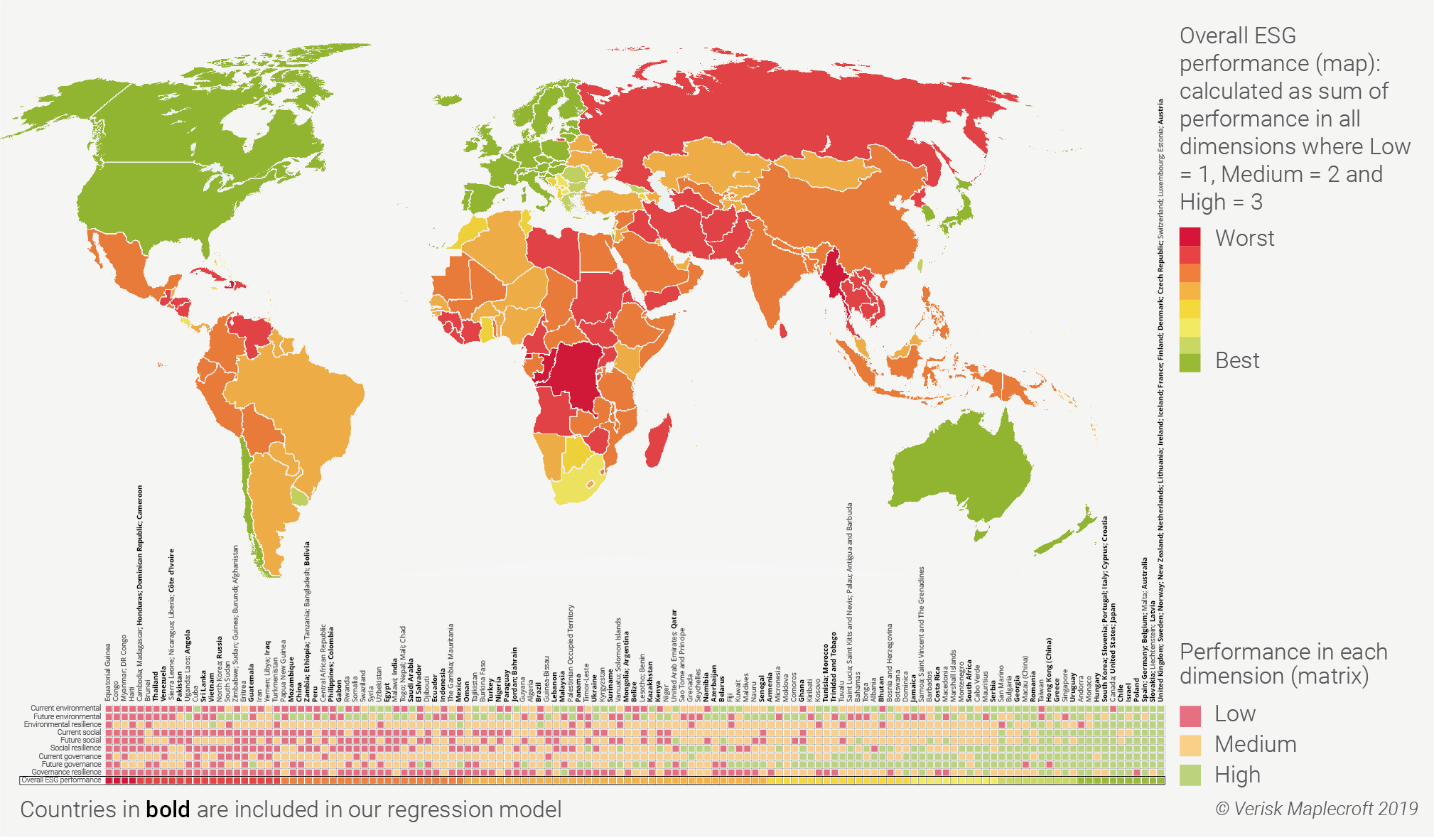

‘The role of ESG factors in sovereign debt investing’ introduces a new way of measuring sovereign ESG performance across 198 countries (see Figure 2). Using over 80 of our proprietary risk factors, our approach arguably differentiates and identifies investment-material momentum more effectively than traditional methods.

The report also comprehensively quantifies the relationship between ESG factors and sovereign bond pricing in 97 developed, emerging and frontier markets through the January 2013 to May 2018 period.

Speaking about the research findings, James Lockhart Smith, Head of Financial Sector Risk, said, “This work helps address the challenges of non-linearity and complexity that are inherent to country ESG, and strengthens the case for sovereign debt investors to factor ESG into their investment processes, which has so far proved challenging. Our empirical evidence shows that environmental or climate risk is still being materially underestimated as a risk factor by investors and indicates the potential for market repricing once perceptions change.”

Join our panel at RI Europe 2019 where we'll talk through some of our research findings

Jana Velebova, Senior Portfolio Manager, BlueBay Asset Management, said, “The extensive analysis has quantified some assumptions we have made about ESG investing in sovereign debt, and has provided valuable insight into potential areas of mispricing, or where risks are not yet being appropriately priced. From an investor and portfolio performance perspective, the research highlights the case in favour of systematically including ESG as an element of sovereign risk analysis, and points to the usefulness of engaging with sovereigns on ESG."

We plan to continue our research collaboration with BlueBay to analyse further the relationship between ESG factors and sovereign bonds.

About Verisk Maplecroft

Verisk Maplecroft is a global risk analytics company specialising in ESG, climate, and political risk data for the world’s leading institutional investors and corporations. The company combines a unique portfolio of global risk indices and data sets with expert research on countries, commodities and industries to provide a holistic approach to risk analysis that enables its clients to make better risk-adjusted decisions. Among asset owners and managers, the company is a trusted source of data and insights for the integration of ESG, climate and political risk factors in multiple asset classes, notably sovereign debt.

Verisk Maplecroft is part of the Verisk family of companies (NASDAQ: VRSK).

About BlueBay Asset Management

BlueBay is a global specialist fixed income manager investing in traditional and alternative fixed income products for institutional and private clients. BlueBay has over USD60 billion in assets under management, deployed in both public and private markets, with an established track record of performance and innovation across the fixed income spectrum.

BlueBay has offices in the UK, Switzerland, Germany, Luxembourg, US, Japan and Australia. BlueBay Asset Management LLP is wholly-owned by Royal Bank of Canada and part of RBC Global Asset Management. BlueBay Asset Management LLP is authorised and regulated by the Financial Conduct Authority.

Press contacts:

BlueBay Asset ManagementJayne Fieldhouse: +44 (0)20 7167 4013JFieldhouse@bluebay.com |

Verisk MaplecroftJason McGeown: +44 (0)1225 420 000press@maplecroft.com |