Supply chain risk

Enhancing supply chain resilience, sustainability and compliance with best-in-class global risk data

Benefits

Capucine May

Sustainable Procurement & Human Rights AnalystBenefits

- Employ a single source of global risk intelligence for all risks and locations to achieve a strategic view of resilience and sustainability across your supply chain

- Instantly identify high risk entities across your supply chain and prioritise them for engagement

- Use data to test alternative sourcing strategies and make better, evidence-based decisions

- Improve supplier screening for selection, onboarding and monitoring

- Simplify compliance with key human rights and environmental due diligence reporting regulations

- Upload your locations and access data through our intuitive platform or integrate into your internal systems through an API

How we help improve supply chain resilience and sustainability

Comprehensively assess resilience and sustainability risks across the entire supplier base

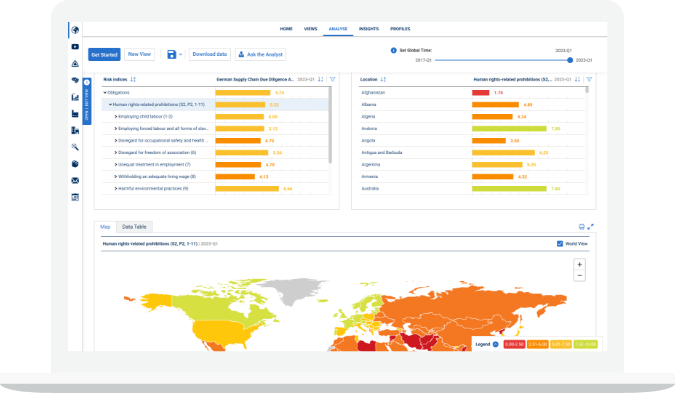

Our Global Risk Data offers a single source of unparalleled insight into the full range of resilience and sustainability risks impacting supply chains worldwide. Covering 190+ issues across 198 countries, 80 industries and 160+ commodities, you can select and access data for the risks that matter most to you from just one place. Encompassing over 30 labour, civil and political rights, the full spectrum of climate hazards and nature risks, and 60+ political risks, our country risk indices quickly and accurately pinpoint supply chain exposure worldwide.

Prioritise suppliers for performance management actions

By segmenting suppliers using metrics such as geographic risk, type (direct / indirect), industry, spend, materiality and criticality, you can identify and prioritise high-risk entities using our country risk indices, informing strategic sourcing initiatives and directing supplier performance management and auditing activities.

Understand risk across sectors

Levels of risk within a country differ for suppliers depending on what sector they operate in – child labour, for instance, is more of a concern in construction or agriculture than it is for professional services. Our Industry Risk Data provides a valuable, extra layer of country risk insight by assessing the exposure of 80 different industries to 51 environmental, social and political issues across 198 countries.

Compliance and reporting support

Aligned with the core requirements of a wide array of human rights and environmental due diligence laws, our Global Risk Data provides a unified source of risk screening metrics. It simplifies two critical tasks for businesses when complying with complex sustainability regulations – the identification and prioritisation of sustainability risks across global value chains, enabling businesses to prioritise their compliance efforts more effectively.

Advice on creating robust supply chain risk management approaches

From formulating codes of conduct and supplier monitoring to performance management programmes and contingency strategies, our specialist advisors can support you in the development of comprehensive programmes boosting the resilience and sustainability of supply chains.

Guides

How to use global risk data to build supply chain resilience

Learn how to implement a robust supply chain resilience assessment into your risk management processes

DownloadGet in touch today to discuss all of your supply chain related needs.

Related content

Webinar

How to stop the multi-risk reality toppling your supply chain

Webinar

How to stop the multi-risk reality toppling your supply chain

Explore how our supply chain solutions can help you make comparisons and decisions across multi-risk issues affecting the continuity and integrity of operations.

Solutions

Business resilience

Data-led risk solutions and advisory for business continuity and risk management

German supply chain act

World-leading LkSG Risk Analysis Dataset, guidance and expert support for compliance with Supply Chain Act risk analysis and due diligence requirements

Global Risk Data

Global risk datasets covering 150+ environmental, social, political, economic issues for 198 countries, 200+ commodities and 74 industries