Human rights and environmental due diligence in downstream supply chains

It’s not as daunting as you think

by Liudmila Chambers and Katherine Bloch,

Human rights and environmental due diligence (HREDD) is undoubtedly becoming more demanding. Sustainability and human rights are no longer buzzwords – they are essential requirements. But the expansion and globalisation of commercial value chains has created increasingly complex business networks with many tiers of suppliers, distributors and other stakeholders. Although this has benefitted businesses in terms of efficiency, cost and proximity to markets, these networks are often opaque, obscuring environmental and human rights impacts throughout the value chain.

The proposal for an EU Directive on Corporate Sustainability Due Diligence (CSDD) intends to address this by creating HREDD requirements at all levels of the value chain, including both upstream and downstream operations. While upstream suppliers have long been the focus of HREDD legislation, downstream distributors are also being targeted to facilitate greater transparency and awareness of human rights and environmental impacts in this part of the value chain.

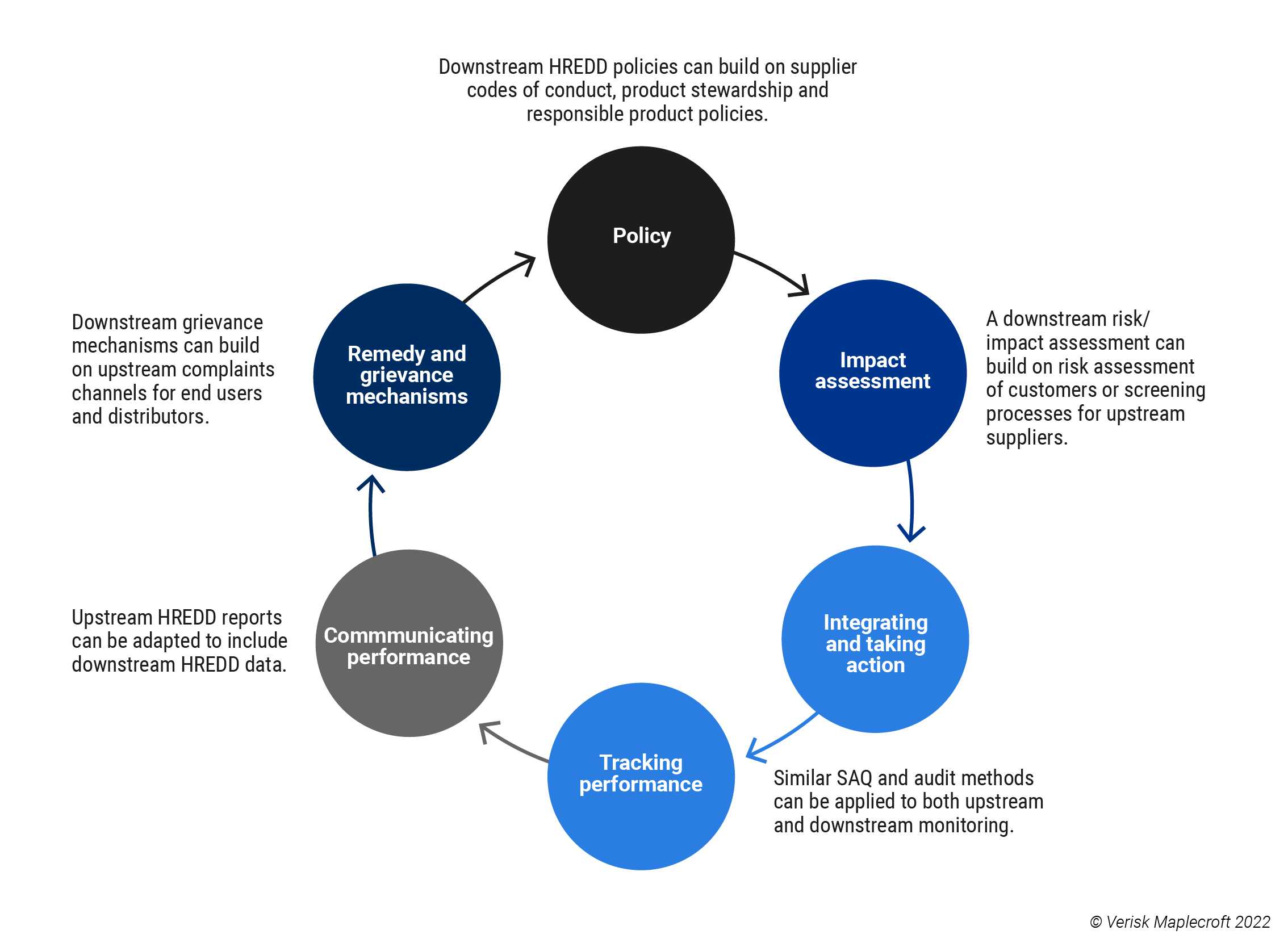

The CSDD advises that HREDD for both upstream and downstream suppliers should be integrated into corporate policy and procedures, including impact and risk assessments, monitoring, remediation, grievance mechanisms and public communication on the measures taken. But how do complex, globalised companies rewrite their policies and procedures to include transparency and accountability in the downstream? And what lessons can be learned from responsible sales and HREDD in upstream supply chains?

Lesson 1. Policies on downstream supply chain management can build on product use and marketing policies

Although it appears to be a new concept, downstream value chain policy exists in many forms. Responsible marketing, product stewardship and responsible product policies, which are well established for specific products (alcohol, tobacco) and vulnerable groups (children), hold key ideas and takeaways that companies can use to shape their own policies focusing on downstream supply chains. It is also not uncommon for companies to cover distributors in the scope of their supplier codes of conduct and related policies covering company partners. Building on these existing practices, downstream supply chain management policies can take the form of stand-alone policy documents or be integrated in existing value chain management policies.

Lesson 2. Risk assessment in downstream supply chains can be done by evaluating country risk levels and industry segments

Screening sales from the perspective of human rights and environmental compliance already happens in industries such as automotive, defence and financial services, and such practices can help inform companies looking to develop their own procedures. Risk assessments can be performed by identifying country risk exposure by utilising our suite of human rights and environmental risk indices.

In addition to country risk, companies should consider industry segments and potential end users, as high-risk users may or may not be associated with high-risk countries. If risks are considered very high or extremely difficult to mitigate, it may be in the best interest of the company to decide not to proceed with sales.

Lesson 3. Monitoring in downstream supply chains can draw on the same tools as in upstream supply chains

Similar to upstream supplier monitoring through SAQs and audits, companies can aim to collect information on their downstream partners by sending them questionnaires and conducting audits. This type of auditing is already practised in the pharmaceuticals industry, which may provide helpful guidance when companies are creating their own downstream monitoring practices.

Similar to our SMART SAQs for suppliers, SMART questionnaires can be created for customers, distributors and retailers focusing on the most relevant risk issues, where relevance is determined using our broad suite of proprietary country and industry risk indices. These can then be followed up with audits at the downstream supplier’s location, which allows the auditor to observe the physical working conditions and persons employed by the customer, distributor or retailer, as well as to observe inventory, which can ensure that no products are being diverted to end users that the auditor is not aware of.

Lesson 4. Establishing visibility in downstream supply chains may be as challenging as in upstream supply chains

Similarly to how Tier 2+ suppliers are often unknown to the company, end users may not always be known or easily-identifiable. There is no one-size-fits-all solution to this challenge, and some companies may find it harder than others, depending on the level of visibility they have over their value chain.

End users can be identified via information provided by the customer, distributor or through a retailer collecting this information and data. However, if a product goes through many transactions via third parties to end up at its final consumer, it may only be possible to achieve end-to-end (E2E) traceability by using technology such as blockchain. Various approaches to E2E traceability are already practiced in the food and pharmaceutical industries and can offer helpful lessons to other sectors.

Lesson 5. Grievance mechanisms in downstream supply chains can build on existing customer care procedures

Remedy and grievance mechanisms are an essential part of any due diligence because they give stakeholders a voice when it comes to how business operations affect their lives and livelihoods, and create opportunities for dialogue about how the company can improve. Company complaints procedures are already a staple in most industries, providing a well-established example.

In downstream supply chains, implementing a complaints or grievance procedure allows customers, distributors and end users to bring negative externalities – whether human rights violations or environmental issues – to the company's attention. This can be done through an online platform, email or phone, or alternatively through frequent and direct downstream stakeholder engagement.

How can we help with next steps?

HREDD in downstream supply chains may seem like an area that has been largely untouched and unexplored, but helpful lessons can be drawn from related fields of responsible sales and upstream HREDD. If you want to be ahead of the curve, demonstrate your leadership or simply prepare for the upcoming CSDD, we can support in developing downstream supplier due diligence policies, conducting risk assessment on customers, distributors, retailers and end users, and developing downstream supply chain monitoring tools.

A good starting point is to conduct a diagnostic to better understand where you are with your current downstream HREDD practices. More likely than not, some practices will already be in place, even if they are not organised under the HREDD umbrella. The diagnostic will help reveal current gaps and identify potential strategies for addressing them. We can then support you on a long-term basis in implementing these strategies. Contact us to find out more.