Geospatial ESG investing

Learn more

Sustainable extractives - an oxymoron?

With oil and gas facilities top of mind as Europe looks to secure energy supply – even sustainable finance evangelist Mark Carney admits that ‘a smooth transition will require some limited and targeted investment in fossil fuels’ - it is worth remembering too the critical role of mining in the transition. According to the International Energy Agency, the NetZero 2050 target needs a sixfold increase in the production of energy transition minerals by 2030.

And mining’s ESG credentials are, if anything, even more problematic. From Australia to DR Congo to Peru, global majors extracting transition metals including cobalt, copper, lithium and nickel have suffered severe reputational, legal and financial blowback from environmental, social and governance failings.

By way of example, cobalt, along with palm oil one of the two commodities rated ‘extreme’ risk for land grabs in our Commodity Risk Service, has long been linked with child labour and unsafe working conditions, particularly in DR Congo.

DR Congo also has a poor record of land expropriation and forced land grabs, which is inseparable from biodiversity loss, weak governance and corruption. On-the-ground studies from DR Congo report that communities face frequent evictions, derisory compensation, and almost non-existent consultation at the hands of negligent mining companies and corrupt officials. Our commodities data also rates DR Congo’s copper, gold, tantalum and diamond industries as ‘high’ risk by weighted volume.

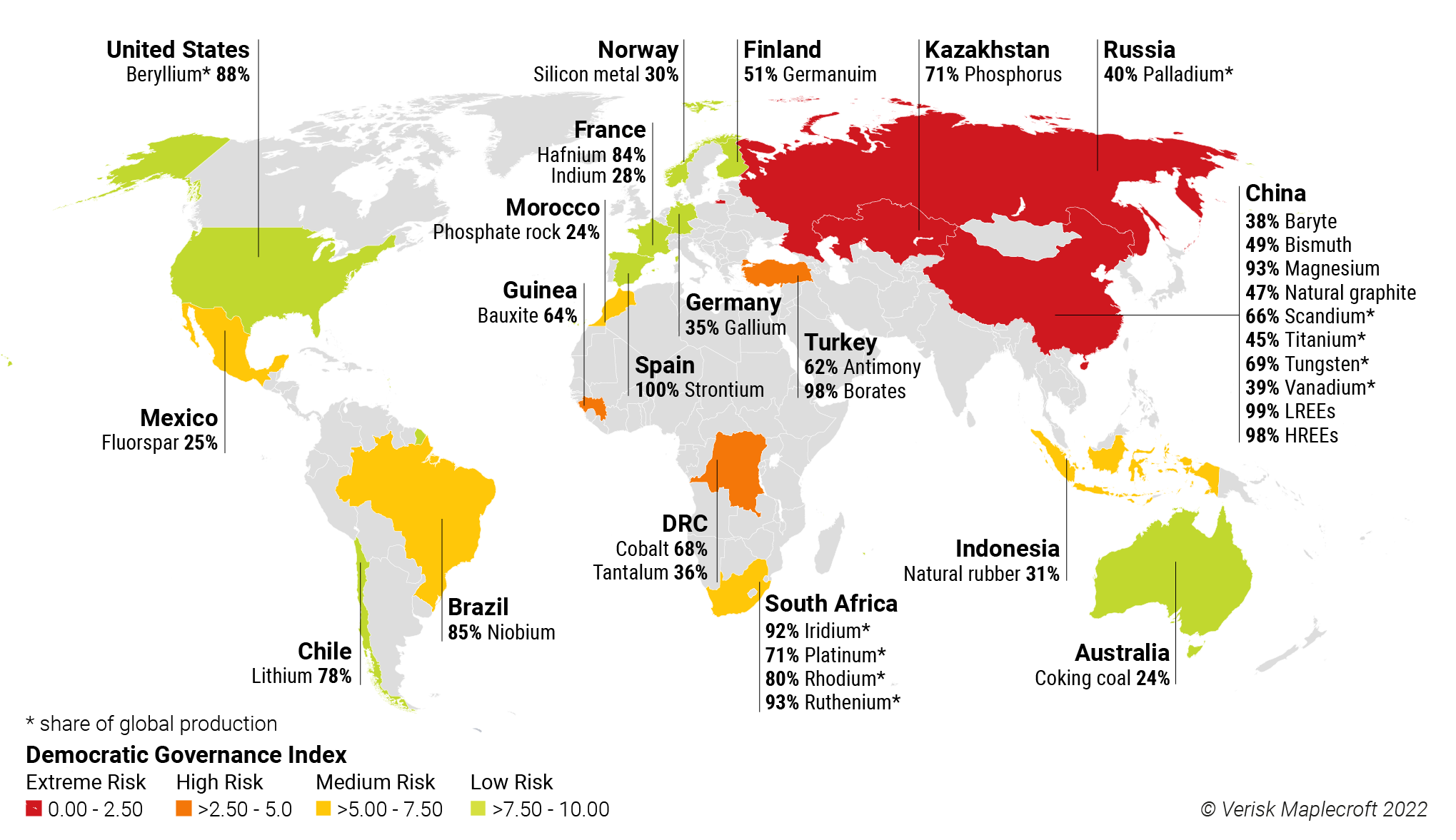

These ESG threats also impact materials other than cobalt that are crucial for the energy transition, including silicon, zinc and bauxite, which all originate from a small number of ‘extreme’ risk suppliers. Unless threats to human rights in the supply chain like these are addressed by companies and investors, it will be increasingly hard to justify labelling the likes of EV’s, lithium-ion batteries and solar panels as ‘clean’ technology’.

Transition metals are also driving an increase in resource nationalism- and not only in places like Chile, Bolivia or Indonesia. Much closer to home, the Ukraine conflict is driving the EU’s quest for strategic autonomy in critical raw materials (CRMs) - the materials the EU sees as vital to industry and the production of the goods and applications used in everyday life – including the ‘clean’ technologies key to the bloc’s transition to a low carbon economy.

While the EU’s emphasis on domestic sourcing presents opportunities for the mining sector, environmental activists are likely to oppose any efforts to boost mining operations within Europe. Social dialogue will be of central importance if the idea of domestic CRM mining is to be sold to Europe’s ESG-conscious citizens, notes our Europe Analyst, Capucine May.

Furthermore, she adds, as the EU also looks for new sources of the raw materials needed for the green transition, it must ensure it doesn’t repeat old mistakes by becoming over-dependent on a handful of source countries.

As such, strategic partnerships with aligned states like Canada, Australia and Norway will be vital, as will ESG-oriented bilateral development projects in developing countries.

This latter point is critical, as developing country communities – notably Indigenous groups – are increasingly taking their grievances with global mining corporates to international courts, where they have a much better chance of success. This is very much in line with the internationalisation of climate litigation in recent years, which has looked to hold ’Big Oil’ to account on its home turf for alleged damages thousands of miles away.

Our Human Rights Analyst, Victoria Gama says that the UK, Canada, France and The Netherlands are fast becoming the favoured places for extraterritorial litigation. And the likely adoption of mandatory human rights legislation in the EU by 2025-2026 will widen the focus for litigation. The draft of the EU Corporate Sustainability Due Diligence Directive, for instance, requires all 27 member states to pass new ‘civil liability’ legislation to ensure compensation for victims of human rights violations outside the EU.

Targeting companies on their home turf increases global scrutiny, allowing plaintiffs such as indigenous peoples to attract the attention of powerful media outlets and a larger network of consumers and investors. Larger European NGOs with global reach can also provide the resources and know-how needed to pursue these cases in court, Gama observes.

The extractives sector (mining and oil) will remain very much the focus of these extra territorial cases. And it’s not just ‘dirty’ commodities like coal and oil. The latest ‘Transition Metals Tracker’, by the UK-based Business & Human Rights Resource Centre, reports alleged abuses by some of the biggest corporate logos involved in transition metals mining around the world, and calls out the widespread abuse of land, water and Indigenous rights.

Making specific recommendations to investors, companies and governments, the report concludes that a future where climate catastrophe is averted thanks to the development of a clean energy sector built on shared prosperity and co-benefit is possible, “but this transition will only be successful with responsible stewardship of capital which builds sustainable projects, based on legitimate consent and safeguards against environmental harms to ensure the abuse that has characterised too much of the extractive sector is avoided”.

This aspiration is not new – the notion of ‘sustainable mining’ has been around for years. What’s different now is that there is more pressure on and from investors, shareholders and consumers – but much more notably via regulators and international courts - for this to be made reality.

Eileen Gavin

Principal Analyst, Global Markets & Americas

ESG+ Matters notification

SubscribeChart of the week

Quote of the week

The world does not need to choose between solving the energy crisis and climate crisis, we can do both.

António Guterres

UN Secretary General António Guterres, 12 May 2022

What we’re reading

- Turkey’s climate opportunities and challenges, Chatham House, 9 May 2022

- New Philippine President Marcos is no Duterte on foreign policy, Foreign Policy, 10 May 2022

- Cost of living crisis inflames civil unrest risks in emerging markets, Verisk Maplecroft, 11 May 2022

- Central banks can’t fend off stagflation alone, Bloomberg, 11 May 2022

- Euro to hit parity against the dollar within six months, Amundi says, FT, 11 May 2022

- FCA regulation of ESG ratings and data providers is ‘long overdue’, Responsible Investor, 10 May 2022

- BlackRock warns it will vote against more climate resolutions this year, FT Climate Capital, 11 May 2022

- Revealed: the ‘carbon bombs’ set to trigger catastrophic climate breakdown, The Guardian, 11 May 2022

- Renewable power is set to break another global record in 2022 despite headwinds from higher costs and supply chain bottlenecks, IEA, 11 May 2022

- Absolute impact: Why oil and gas companies need credible plans to meet climate targets, Carbon Tracker, 12 May 2022

- Moody’s cuts sustainable bond forecast as intensifying market headwinds pressure volumes, ESG Today, 12 May 2022

- India to enhance ESG disclosure, assurance requirements, ESG Investor, 12 May 2022