Geospatial ESG investing

Learn more

Regulators bear down on Brazil deforestation risk

The ink was barely dry on COP26 when it emerged that the Brazilian government had sat on the latest deforestation figures, so to as to save President Jair Bolsonaro some awkward questions during the summit. Bolsonaro had avoided Glasgow, opting instead for an investment roadshow in the Middle East.

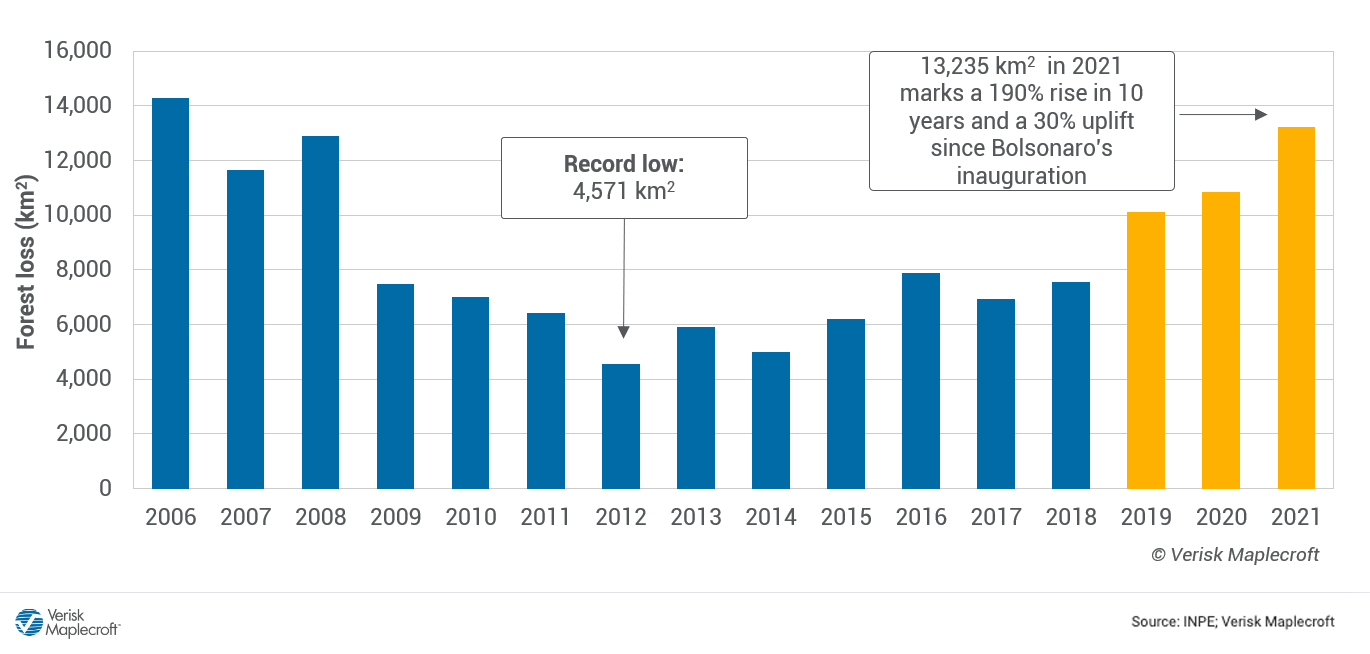

But there is no getting around the fact that the continued runaway deforestation in Brazil can be linked directly to Bolsonaro’s attitude towards environmental protection – which at best is dismissive, and at worst encourages illegal behaviour. Latest figures, covering the period from 1 August 2020 to 31 July 2021, were the highest since 2006, and the equivalent to an area almost 11 times the size of Los Angeles.

Unfortunately, with an election due in October 2022, and an economy in paltry shape, Bolsonaro’s near term priority is not preservation of the Amazon, but self-preservation, as he looks to secure a second term.

The implications for financial investors and corporates with interests in Brazil are overwhelmingly negative. As noted by Will Nichols, head of our Environment and Climate Change Research team, companies investing in or sourcing from the country need to be aware of the growing scrutiny of deforestation risks on the part of Western regulatory and financial bodies.

Just last month, the UK passed its new Environment Act, which contains a “comply or explain” mandate on deforestation for UK businesses importing forest-risk commodities. (Those are yet to be confirmed.)

The EU is also considering a major piece of legislation requiring suppliers to prove that products including beef, soy, coffee, cocoa, and palm oil have not contributed to deforestation.

Our Commodity Risk Dashboard identifies 17 raw materials produced in Brazil as being at extreme risk of association with deforestation, with another two flagged as high risk

Some of these commodities, including coffee, soy and cotton, do have sustainably produced alternatives. However, it is also clear that these every day staples are highly associated with corrupt practices, meaning that it is challenging for organisations to verify sustainability credentials even with robust due diligence.

And as well as regulatory action in the UK and EU, such items could also fall foul of ESG purchasing rules for supermarkets and retailers, along with added risk of consumer protests/boycotts.

What is to be done about this complex situation in Brazil? Despite the Glasgow Declaration on Forests and Land Use, the international community has limited levers to pull. Endemic corruption and mistrust in Bolsonaro’s leadership means that a scheme he suggested whereby richer countries would pay Brazil to preserve the Amazon was a non-starter.

Bolsonaro and other stakeholders are very quick to level accusations of ‘interference’ and ‘colonialism’ at European governments. Indeed, the Brazilian Association of Soya Producers (Aprosoja), took strong umbrage at the EU’s proposal to ban imports linked to deforestation, slamming it as “an affront to national sovereignty” and “trade protectionism dressed up as environmental concern”.

Nonetheless, inserting ESG conditions into trade agreements, following the EU-Mercosur example, could start to move the needle.

Similarly, opportunities for concerned investors to sway the government towards more sustainability policies may crop up in future sovereign debt negotiations.

Clearly however, these will take some time to have the desired impact, and in any case could be circumvented by the lack of visibility along value chains, Nichols notes.

In the meantime, investors should be working to adjust internal processes to navigate a challenging compliance landscape, given that the continued loss of the Amazon will taint not only associated commodities and companies but also the international financial sector, including banks and institutional investors.

Eileen Gavin

Principal Analyst, Global Markets & Americas

ESG+ Matters notification

SubscribeChart of the week

Quote of the week

He hasn’t saved the world. He could have done it but he hasn’t.

Winnie Byanyima

Executive director of UNAIDS, comments on Pfizer CEO Albert Bourla in the Financial Times

What we’re reading

- Net-zero asset owner alliance calls for scaling blended finance to invest in emerging markets, UNEFPI, 29 November 2021.

- Egypt raises $3bnin ESG loan debut, Global Capital, 30 November 2021.

- China secures giant volumes of US LNG, Wood Mackenzie, 30 November 2021.

- Biodiversity Insight 2021, Environmental Finance.

- Bonds to bridge the gender gap: A practitioner’s guide to using sustainable debt for gender equality, UN Women, IFC, ICMA, November 2021.

- Building more resilient and sustainable global value chains through responsible business conduct, OECD (2021).

- What is Waystar Royco’s true valuation?, FT Alphaville, 30 November 2021

- The 2021 Leaders List: The 30 Most Responsible Asset Allocators, Responsible Asset Allocator Initiative (RAAI), November 2021.

- Rise of ESG adds to pressure on European defence companies, Financial Times, 01 December 2021.

- EU delays introduction of SFDR standards again, Environmental Finance, 01 December 2021.