Geospatial ESG investing

Learn more

Indebted EMs turn back to Beijing post-pandemic

Coming out of the pandemic, EMs are faced with the dilemma of how to withdraw fiscal support at a time when economic growth is nowhere near recovered, and high inflation is a serious problem.

And with public debt at elevated levels and access to international credit markets reduced, many EMs are very constrained in their options.

But one thing is clear, China continues to be an attractive option at a time when multilateral support from the likes of the IMF remains difficult to access, and even now, still comes with conditions attached that are often politically impossible for governments to deliver.

That’s not to say China is a great option long term (as many EM borrowers, particularly in sub-Saharan Africa, will now attest to) – but short term, and when the chips are down, it is often the only game in town.

Argentina and Ecuador are two good examples. Both are currently struggling to renew IMF agreements. And the presidents of both countries – who could hardly be more different, one a conservative former banker and the other a radical left-wing populist – were this weekend in Beijing, ostensibly for the Winter Olympics opening ceremonies, but more specifically cap-in-hand to President Xi.

Ecuador, one of Latin America’s two dollarised economies (along with El Salvador) was in fiscal difficulty well before the pandemic – prompting a USD17.4 billion restructuring with international bondholders in August 2020, which paved the way for a new USD6.5 billion EFF with the IMF in September 2020, of which USD4.0 billion was frontloaded for emergency disbursement. Of USD1.5 billion due in 2021, US700 million remained outstanding at year-end, with a further USD1 billion due in 2022. Total public debt is now put at USD73 billion –70% of GDP.

Thanks to stronger-than-expected GDP growth (4.1%) and a rebound in tax returns in 2021, Ecuador exceeded the (conservative) end-year fiscal targets agreed with the Fund.

But the Fund has delayed its latest review and disbursement owing to Lasso’s October 2021 decision – taken under extreme political and social pressure – to suspend planned reductions in the country’s generous fuel subsidies, worth some 2.1% of GDP. Absent a coherent plan to address the subsidies issue, the IMF will remain concerned about fiscal stability moving forward. As a dollarised economy, Ecuador depends heavily on maintaining fiscal credibility.

Amid a 2022 budget financing gap of USD10 billion, Quito’s plans will rely more heavily on domestic bond issuances this year, to the tune of USD4.7 billion (the highest in a decade).

But Guillermo Lasso has also gone to Beijing intent on renegotiating USD4.1 billion in bilateral debt (fully 90% of the total), launching talks on a bilateral free trade agreement (FTA) and (potentially more problematically) ‘un-tying’ oil from the sovereign’s debt repayment schedule with China, which has been very disadvantageous for Ecuador.

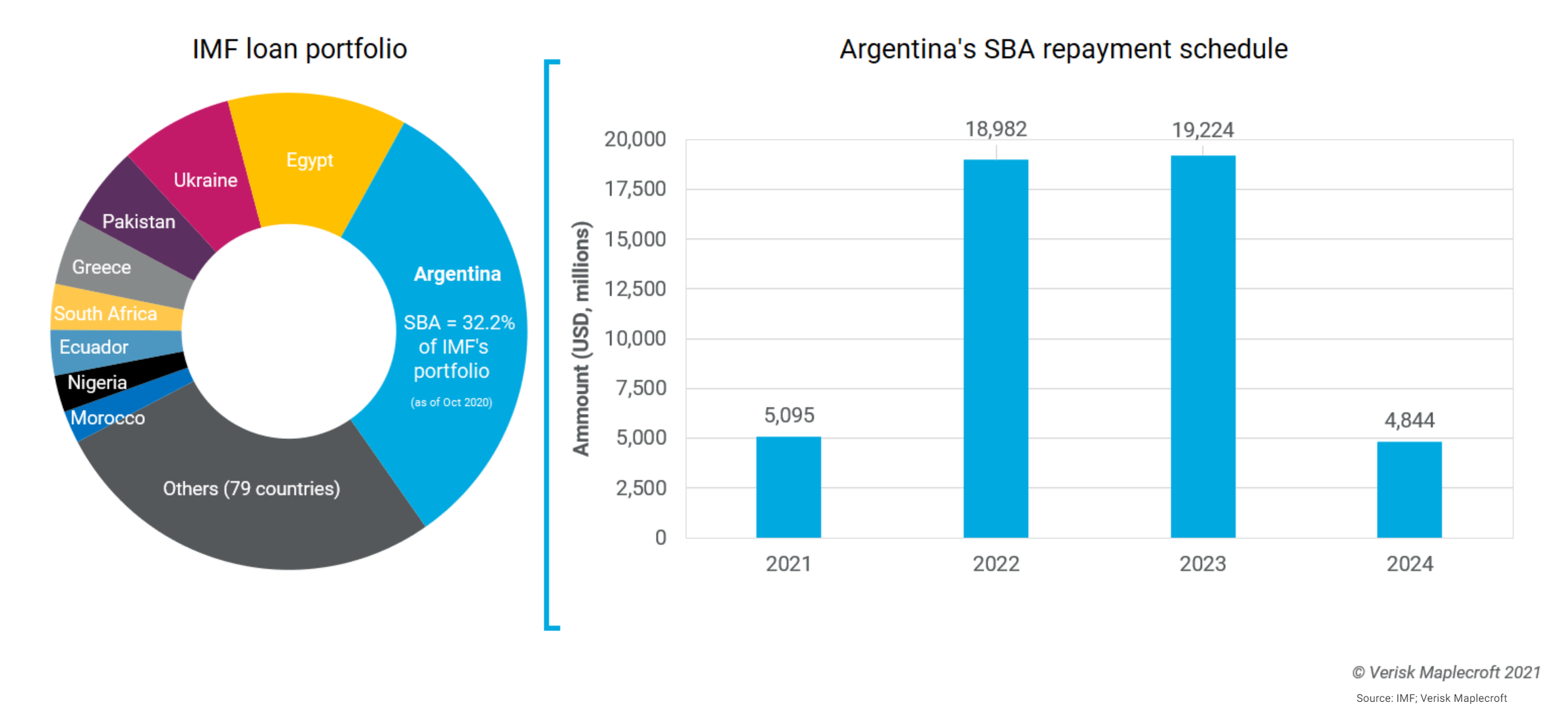

Argentina’s Alberto Fernández, meanwhile, landed in the Chinese capital following his announced ‘preliminary understanding’ with the IMF for a USD44.5 billion debt rescheduling that would see the Washington-based fund allow Buenos Aires to kick the debt can down the road – for the umpteenth time – and, by the way, without a whole lot of the usual fiscal reform measures.

Even as some questioned whether the multilateral had lost its mind in agreeing to such a soft deal – this would be serial-defaulter Argentina’s 22nd IMF bailout since the South American country first joined the organisation in 1957 – the radical left-wing faction in power behind Fernández dramatically denounced the deal and said it would not support it. Whether it will go ahead at all thus remains to be seen.

As such, Fernández is hedging his bets with Beijing, where he hopes to extend a USD19 billion currency swap arrangement (potentially crucial to Argentina’s reserves position in the absence of the IMF deal). He will also sign-up Argentina to China’s Belt & Road Initiative, a move that will hardly go down too well with the Fund as it tries to convince members to sign off on the new deal for Buenos Aires.

Argentina’s adhesion to the Belt & Road will bring the total number of LAC counties in the initiative to 34, with Brazil and Mexico effectively the only remaining absentees of the region’s big economies.

In South America, for instance, Bolivia, Chile, Ecuador, Guyana, Suriname, Uruguay and Venezuela have all signed up, and if a leftist president is elected in US-allied Colombia in March, it may well go the same way.

China is already by far Brazil’s biggest trading partner anyway – and if the left-leaning Lula da Silva returns to the presidency in October next, Beijing will certainly take the opportunity to cultivate closer political and diplomatic relations – Lula being a firm advocate of a ‘multi polar’ world.

How the IMF and the (distracted) Biden administration respond to all this activity in Washington’s ‘back yard’ remains to be seen, but there is little doubt that China has come out of the pandemic having lost none of its financial or strategic influence in regions including Latin America and Sub-Saharan Africa.

Whether the US likes it or not, a multi-polar world is becoming reality.

Eileen Gavin

Principal Analyst, Global Markets & Americas

ESG+ Matters notification

SubscribeChart of the week

Quote of the week

For our meeting today, our oilmen have prepared very good new solutions for the supply of hydrocarbons to the People’s Republic of China, and another step forward has been taken in the gas industry.

Vladimir Putin

Vladimir Putin in Beijing, 4 February

What we’re reading

- Trends to watch in 2022 - Climate and environment, Verisk Maplecroft, 25 January 2022

- The Tarnished Taxonomy: Who will decide the fate of EU green investments? Gokhan Taymaz, The Executive Perspective, LinkedIn Pulse, 26 January 2022

- Shell/hydrocarbons: rampant oil profits reduce incentive to cut carbon, FT Lex, 3 February 2022

- Carbon footprint gap’ between rich and poor expanding, study finds, The Guardian, 4 February 2022

- Who Makes Foreign Policy in China?, The Diplomat, 4 February 2022

- Fresh blow to Elon Musk's Tesla as India rejects call for tax breaks, The Times of India, 4 February 2022