Geospatial ESG investing

Learn more

COP26 ends without climate finance

The conclusion of COP26 left as many questions as answers. Perhaps most critically, finance remains unsolved.

Famously, developed nations have made slow progress towards an annual USD100bn fund promised to their less well-off counterparts. The lack of urgency has undermined trust throughout the COP process and the delays mean even more funding is required: escalating extreme weather has highlighted just how much the pace of emissions reductions must accelerate. In Glasgow, there was an acknowledgement of the toll on developing nations.

But the actual money…? Well, that will be dealt with in next year’s COP. With China and India railroading through a deal with the proviso on coal, developing nations had to drop claims for specific funding. Not only does that cement the trust issues bedevilling COPs, setting COP27 up for another row, but it creates threats to investments and operation in the countries and cities most threatened by climate change.

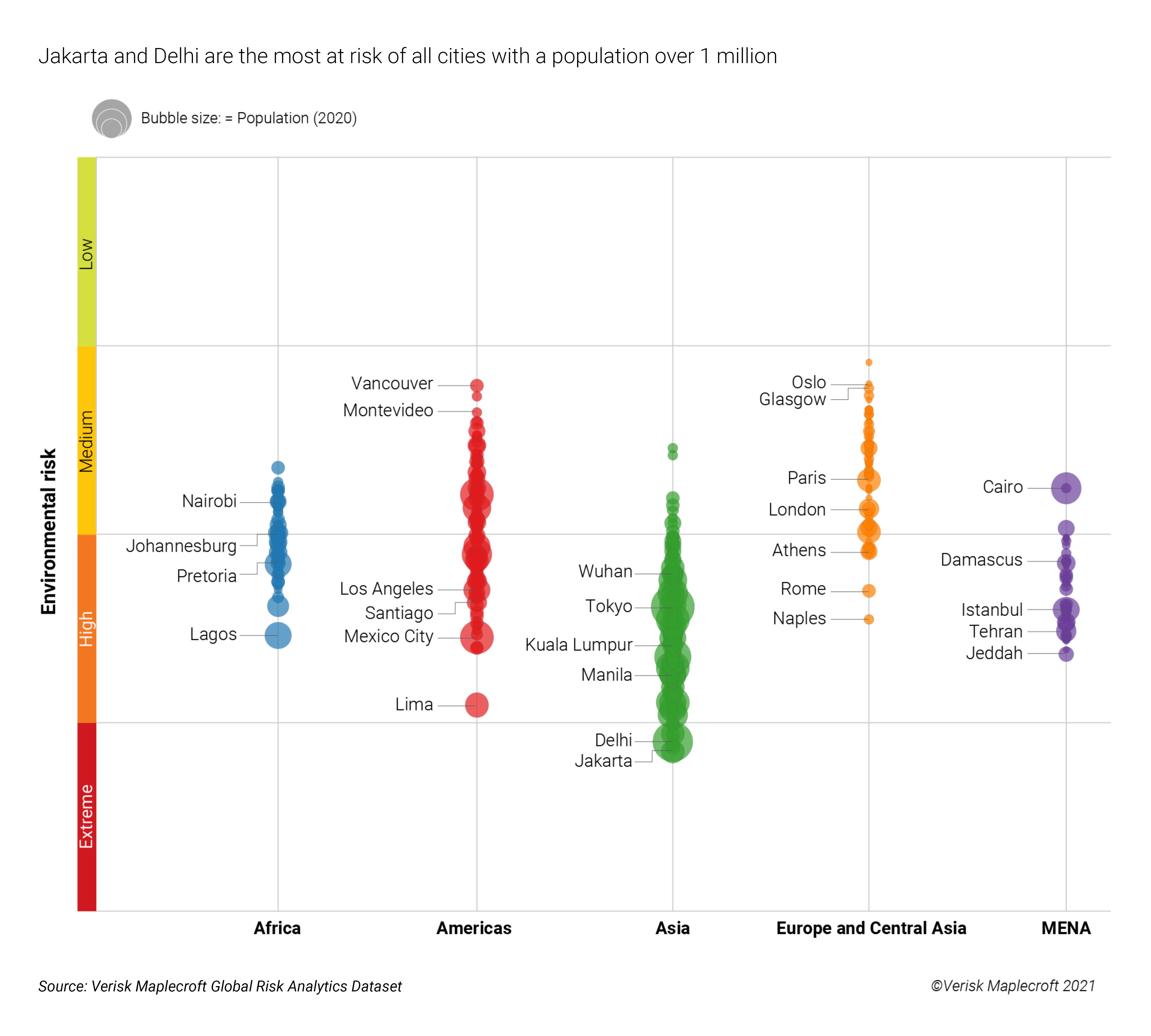

Typically, climate change vulnerability is greatest in Africa but, as our chart of the week shows, there are at-risk zones across all continents. Countries most at-risk will find it difficult to attract investment, while industries such as agriculture, construction, power, and mining will face threats ranging from extreme heat to water shortages and weather-related disruptions.

Pointing to mounting indebtedness post-pandemic, developing countries in Africa and elsewhere continue to emphasise the need for grants and highly concessional finance in support of climate adaptation.

But it is also clear that private finance also needs to step up – at massive scale - to meet the huge need in developing countries for investment in low-carbon, climate resilient economies, but also social development.

Investing in high-risk EMs is difficult - and their heavy exposure to the most adverse effects of climate change will make it even harder – by weakening their economies, social structures, institutions and political systems.

So how can financial institutions looking to invest in the transition (and profitably) in high-ESG risk developing and frontier EMs with little or no credit eligibility?

- The financial sector needs to come up with innovative approaches and instruments to mobilising funds for developing countries.

- There is growing consensus around the merits of blended transition finance, so as to scale up and spread the risk between private and public/multilateral.

- Transition, green/nature/natural capital, social, sustainable and sustainability/SDG-linked bonds look set to become the de facto instruments for the post-pandemic recovery and 2030/2050 transition.

- Peru in mid-November became the latest EM sovereign to issue a debut social bond for post-pandemic needs, while China wants foreign issuers to start selling onshore social and sustainability Panda bonds.

- The growth in ‘impact investing’ will need stringent design and documentation to verify the use of proceeds and expected outcomes.

- Progress is being made in the harmonisation of climate and sustainable finance reporting – notably via the new International Sustainable Standards Board (ISSB). Even Russia has adopted a green taxonomy for investments, broadly in line with the EU model, with the UK’s FCA (and, some way behind, the US SEC) also lining up mandatory disclosure and green/sustainable taxonomy frameworks.

- But there is a danger that these potentially risker instruments are overconcentrated in certain sectors, or regions, and among certain issuers.

Though clearly not fast enough for Greta and other activists, the temperature at Glasgow suggested that change is afoot. Financial innovation is ultimately what will take Gfanz from Mark Carney’s lofty USD130 trillion rhetoric to practical reality.

Eileen Gavin

Principal Analyst, Global Markets & Americas

ESG+ Matters notification

SubscribeChart of the week

Quote of the week

The attacks Brazil suffers when we speak about the Amazon are not fair….[the forest] is almost exactly the same as when it was discovered in 1500

President Jair Bolsonaro

President Jair Bolsonaro speaking at the launch of the Invest in Brazil forum in Dubai, 15 November

What we’re reading

- China Can’t Develop Isolated From the World, Xi’s No. 2 Says, Bloomberg

- Egypt to host next climate summit, putting a spotlight on resilience, Climate Home News

- Bonds are an ESG blind spot in investing, Financial Times.

- John Kerry: Companies that quickly embrace green tech will clean up, Financial Times.

- BHP sees need for battery metals more than doubling in 30 years, Mining.com.

- Uruguay to Push on Environmental-Linked Lending at Multilaterals, Bloomberg Law.

- A new phase for green investing, Financial Times