Our new data measuring labour costs and the availability of high-quality human capital identifies Southeast Asia as the most attractive manufacturing region for foreign investment based on its workforce. As companies reassess the global footprint of their operations and supply chains in reaction to rising trade tensions and geopolitical uncertainty, the research highlights the region’s enduring appeal for Western supply chains.

Vietnam, ranked 13th globally on a combined measure of our newly launched Cost of Labour Index (CLI) and Human Capital Availability Index (HCAI), stands out as the region’s best performing country, followed by Indonesia (17th), the Philippines (28th), Thailand (31st) and Malaysia (35th). Manufacturing powerhouse China (24th) also performs strongly.

Notably, despite India’s abundant labour force, the country lags behind its Southeast Asian counterparts on the strength of its human capital, which is measured on factors such as education, health, innovation and productivity. It ranks 72nd globally out of the 192 countries assessed, on par with Cambodia but behind Bangladesh (64th).

Finding locations that balance cost competitiveness with workforce capability is a rising challenge, as wages climb across developed and emerging economies alike, productivity slows and demographic pressures reshape workforce availability. Recent US tariff proposals targeting a broader swathe of exporters have clouded the wider regional outlook for Southeast Asia, but it remains a highly important hub for supply chains.

Asia’s appeal

Shifts in trade policy are increasingly influencing corporate strategies and supply chain configurations. Despite efforts at supply chain diversification away from China, including the implementation of the ‘China Plus One’ strategy, the country remains deeply embedded within global supply chains. It ranks 24th in the combined indices, supported by the quality of its workforce and still-competitive wage levels relative to advanced economies. However, manufacturing wages have more than doubled over the past decade, and heightened geopolitical tensions continue to weigh on corporate decision making.

Vietnam, the best performing country in Southeast Asia, has been a major beneficiary of the shift away from China. Average monthly wages remain competitive despite rising 20% over the past five years. And according to the HCAI it has seen improvements across key human capital factors, which has helped fuel the country’s rapid rise as a hub for electronics, textiles and consumer goods.

Indonesia (ranked 17th) follows closely, but the country’s complex regulatory environment, policy volatility and infrastructure challenges have hindered its ability to attract the level of investment in higher-value industries seen elsewhere in the region. Thailand (31st) also performs strongly, though productivity growth is slowing and demographic pressures – coupled with persistent political instability – are narrowing its longer-term investment prospects.

India’s performance is being hindered by development factors despite high levels of growth. Indeed, persistent underinvestment in education and healthcare, coupled with the emigration of highly skilled professionals, has limited the country’s ability to fully leverage its demographic advantages.

Nearshoring trade concerns

Key nearshoring hubs across the Americas and Europe emerge as prime alternatives as companies look to rebalance their operations closer to key markets. Yet even these jurisdictions are increasingly exposed to shifting trade dynamics, particularly amid renewed US tariff threats against major exporting economies.

Mexico stands out as the primary beneficiary of nearshoring. Ranked 37th in the combined indices, the country offers a mix of cost competitiveness, proximity to US markets and trade integration via the USMCA. While average earnings have risen sharply, reflecting broader improvements in labour protections and living standards, they remain well below US levels. That said, uncertainty surrounding the US-Mexico trade relationship continues to loom.

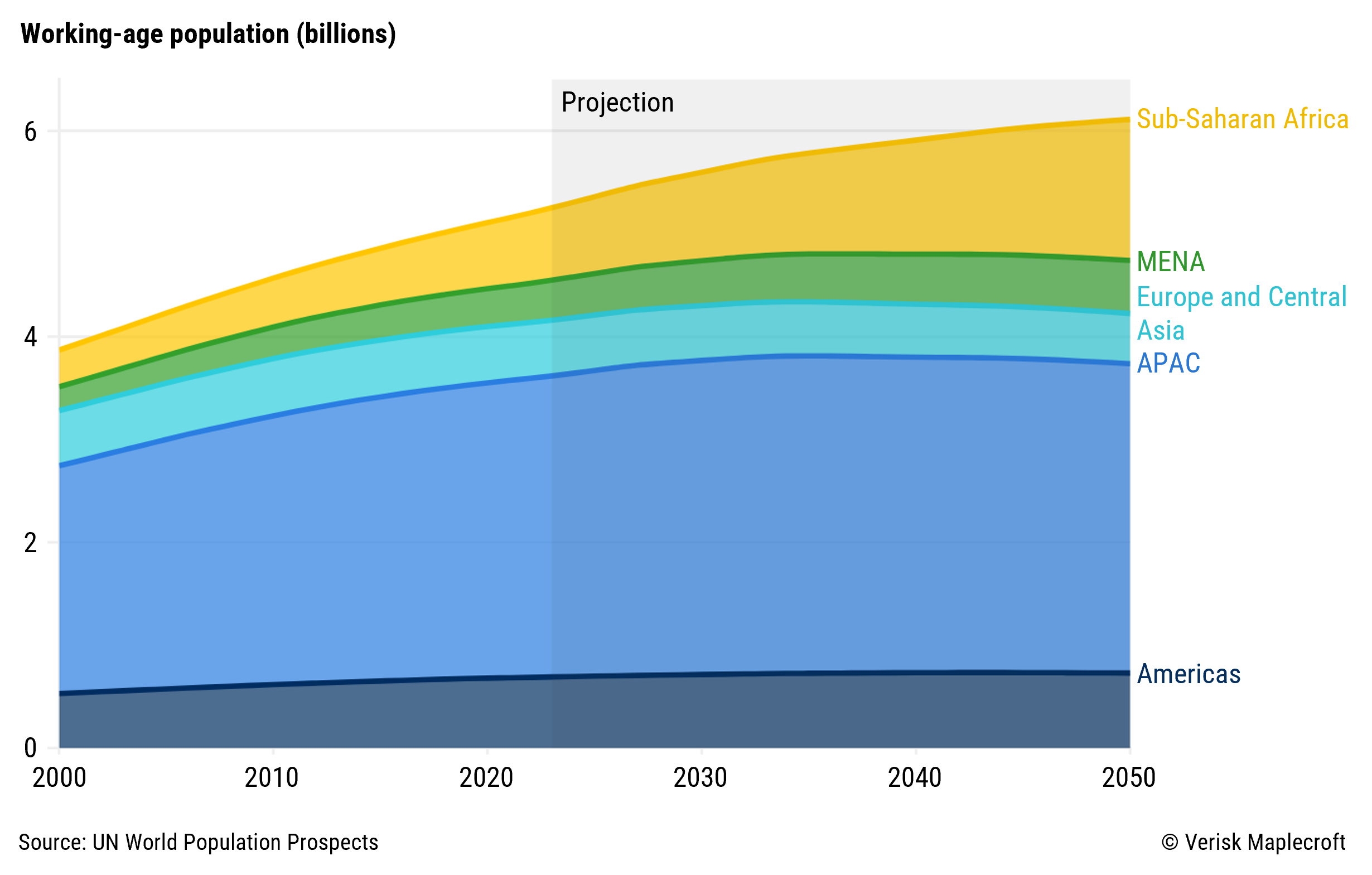

In Central and Eastern Europe, Poland, Romania, Hungary and Bulgaria continue to serve as key nearshoring destinations for European markets. Average monthly earnings typically range between USD1200–1700 – well below rates in Western Europe – while strong vocational education systems and EU regulatory stability provide a further draw for investors. But after years of sustained investment, labour markets are tightening, wages are rising, and demographic headwinds are beginning to bite. In Poland, for example, the working-age population is forecast to shrink by nearly 10% by 2040, raising concerns around future labour availability.

Organisations with a higher risk appetite could consider Former Soviet Union (FSU) states, such as Georgia, Armenia, Moldova and Ukraine, which sit towards the top of the combined global ranking. However, their relatively low-cost labour and well-educated workforce is offset by raised levels of domestic and external political risk.

Changing demographics

Unsurprisingly, advanced economies dominate the top end of the Human Capital Availability Index. South Korea leads the rankings, while the US, Germany, the UK and Australia all feature among the best performing countries globally, reflecting robust performance on the indicators assessing innovation, healthcare, education and productivity. However, declines in working-age populations across Western markets will pose an enduring challenge.

At the other end of the scale, sub-Saharan Africa remains the most cost-competitive region, with labour costs typically among the lowest globally. But lower earnings are often reflective of deeper human capital challenges, including gaps in education and workforce development. These limitations are evident in the HCAI, where Africa accounts for 17 of the 20 worst performing countries.

However, the continent’s demographic potential is increasingly difficult to ignore. The working-age population in countries such as Nigeria, Ethiopia and Tanzania is projected to expand by 40-60% in the coming decades, creating opportunities for companies prepared to invest early in skills development and local capacity.