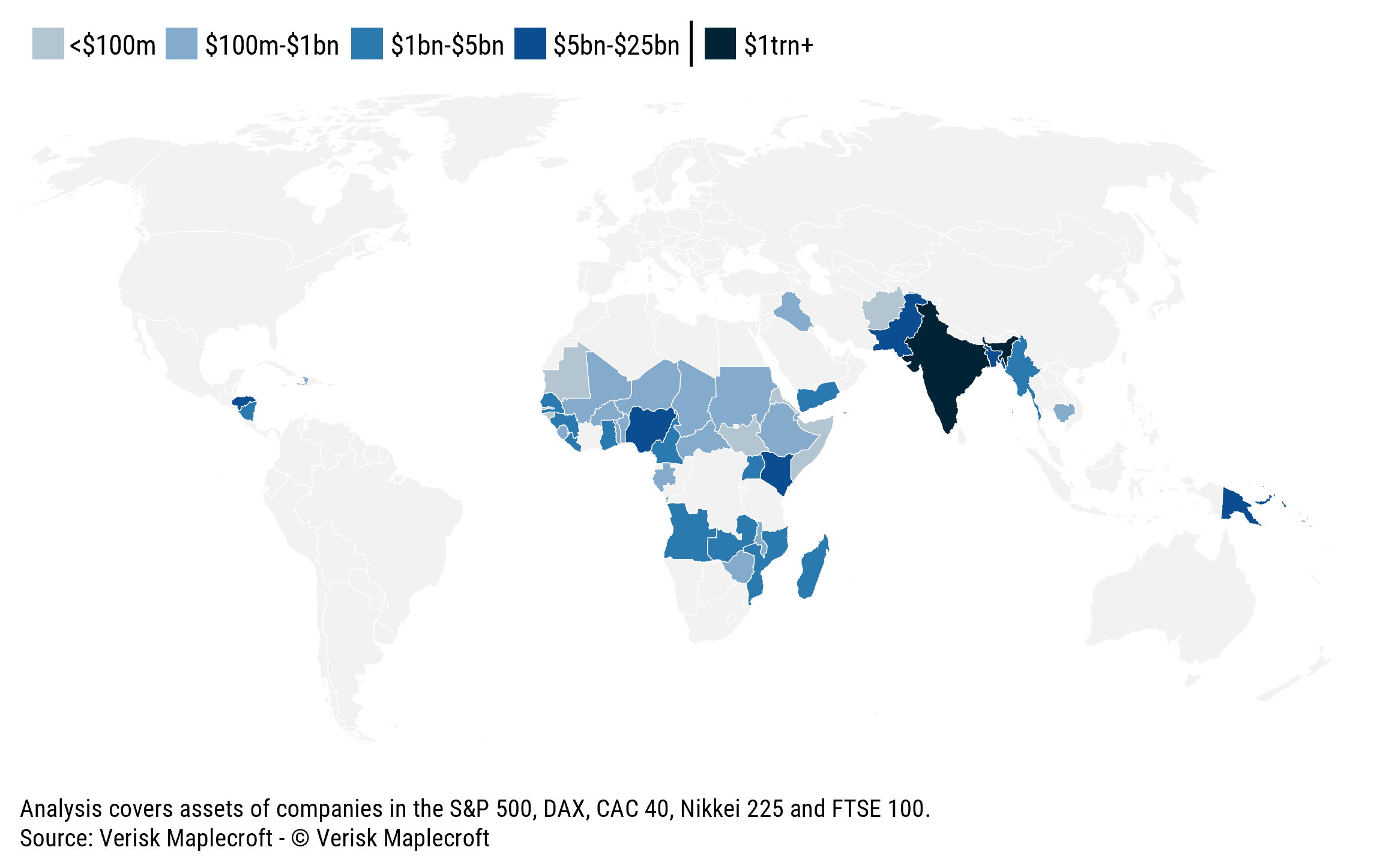

Up to USD1.14 trillion in corporate value linked to companies in the world’s five largest stock markets is located in countries expected to experience the greatest socio-economic impacts from climate change.

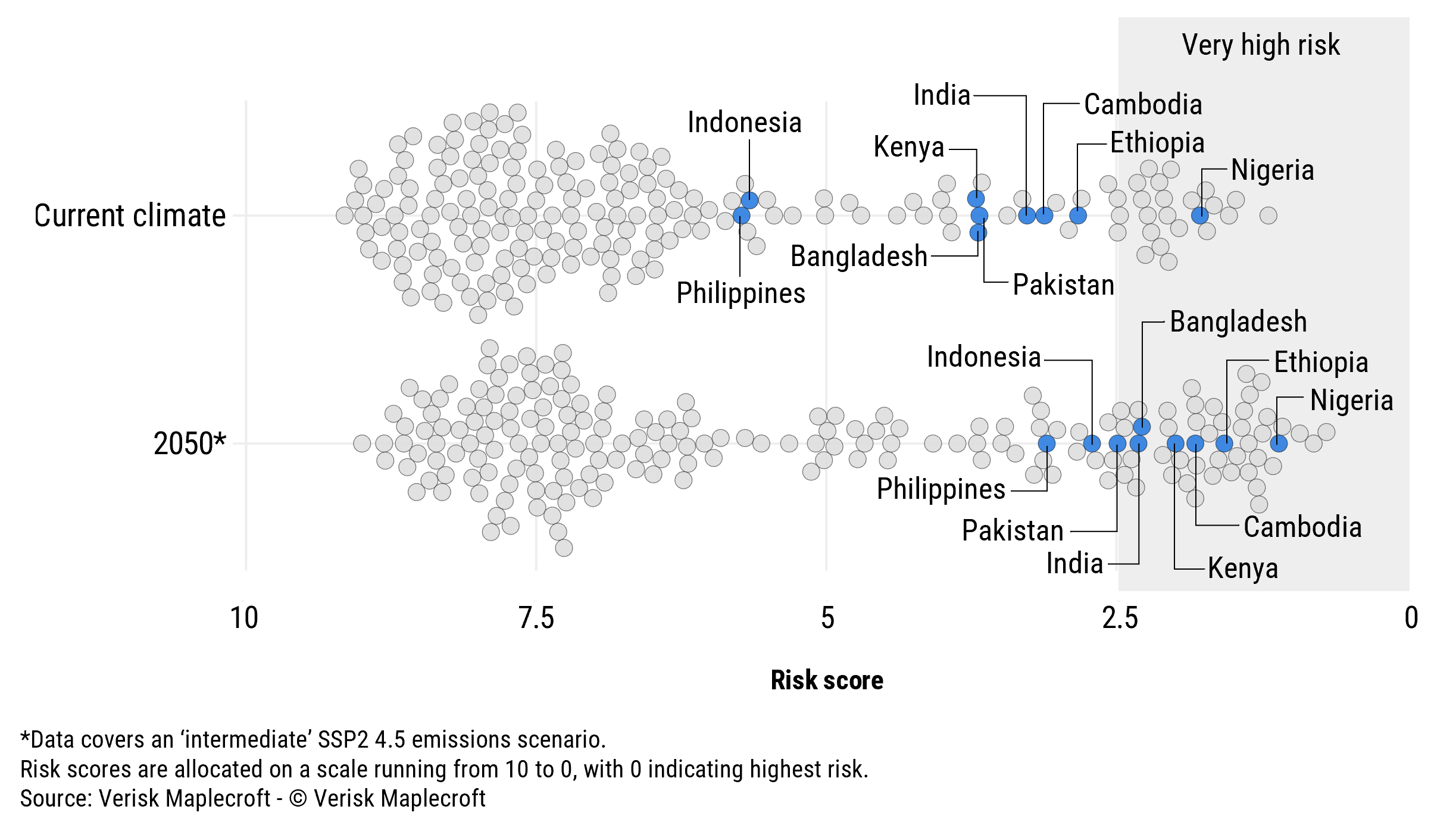

Data from our Climate Hazard and Vulnerability Index (CHVI) reveals that second-order climate risks, such as economic and political instability, poverty, migration and food insecurity could become highly impactful in 48 countries by 2050.

In an intermediate emissions scenario, where average global temperatures are likely to rise by up to 2.7°C, the number of countries that are most vulnerable to climate change doubles by mid-century, up from 24 in the current climate. Based on the current locations of assets and market capitalisation valuations, the data shows a dramatic increase in the financial exposure of companies and investors in the S&P 500, DAX, CAC 40, Nikkei 225 and FTSE 100 from the current level of just USD34.8 billion.

India and emerging markets move towards eye of storm

Looking beyond just the physical threats posed by more frequent severe weather events, the CHVI evaluates three key factors across 198 countries. These include exposure to eight different climate hazards; the sensitivity of populations in terms of health, poverty, agricultural dependence and infrastructure; and the capacity of countries to adapt to climate change through economic resilience, the strength of institutions and political stability.

Several of the world’s key emerging markets that are home to swathes of corporate assets are set to be among the hardest hit, including India, Nigeria, Kenya, Bangladesh and Pakistan.

Significantly, the data shows the rising importance of India to global business, its burgeoning status as an economic superpower, and its high level of vulnerability to climate-related issues. Across the five stock markets, India is home to more than 95% of the assets currently hosted by countries categorised as ‘very high’ risk in the CHVI by 2050.

“While many companies report on their physical exposure to climate hazards, lesser understood socio-economic factors do not feature as part of corporate strategies, creating a blind spot for long-term resilience planning,” says Will Nichols, our Head of Climate and Resilience. “As the severity of climatic events accelerate, socio-economic factors could pose as big a risk as physical disruptions.”

Global markets not insulated from rising climate vulnerability

Our Asset Risk Exposure Analytics (AREA), which combines the four million global asset locations of 50,000 public companies with data assessing 85 sustainability and political risks, including the CHVI, identifies where the risks are most likely to manifest for business and investors. It does so by assessing companies’ total value (using their market capitalisation), weighting this across global assets based on their revenue contribution, and evaluating how many sit within the highest risk locations in the CHVI.

On the surface, Western companies headquartered in climate “safe havens” might seem insulated, but the global reach of operational footprints means that threats to foreign operations should not be discounted. Indeed, the most-exposed assets of companies in the S&P 500, DAX, CAC 40, Nikkei 225 and FTSE 100 are primarily in lower-income countries.

The full set of 48 countries rated ‘very high’ risk on the CHVI by 2050 brings several emerging market investment destinations into view. These include Ethiopia (ranked 21st highest risk), Kenya (35), Bangladesh (40), India (41) and Pakistan (48), while countries such as Indonesia (53) and the Philippines (58) sit just outside the highest risk category.

In the current climate, just USD34.8 billion in market capitalisation across companies making up the five major global stock markets is situated in countries facing a ‘very high’ risk of exposure. That figure skyrockets to USD1.14 trillion by mid-century in an intermediate emissions scenario (based on current asset locations and valuations), reflecting increased financial exposure to climate hazards and related risks like declining workforce productivity, rising civil unrest, and increased political and economic instability.

India is the country that companies and investors will have to pay closest attention to. It is home to just over USD1 trillion in market capitalisation across the five market indices. The country’s vulnerability is driven by its dependence on climate-sensitive industries like agriculture, high rates of poverty, and the rising threat posed by climate hazards such as extreme heat, drought and flooding. At USD818 billion the S&P 500 stands out as the most-financially exposed stock market to the risks in India.

“Markets tend to price risk at the corporate level, yet climate vulnerabilities manifest where assets are located, not just where companies are domiciled,” says Franca Wolf, Principal Markets Analyst. “Rising exposure to the direct and indirect risks of climate change could threaten the long-term viability of investments.”

Rising climate risks set to transcend borders

The CHVI has been developed to examine the potential for socio-economic risks to emerge as a result of interactions between physical climate threats, national resilience and vulnerable populations.

The countries facing the greatest risks by 2050 are spread across sub-Saharan Africa, the Americas and Asia, reinforcing concerns that societies in fast-growing, lower-income nations will bear the brunt of the climate crisis despite their low overall contribution to global emissions.

Sub-Saharan Africa stands as the highest risk region in an intermediate emissions scenario, with Chad, Central African Republic, Niger, Somalia, Nigeria, Sudan, South Sudan, Burkina Faso, Togo and Sierra Leone ranked as the 10 most vulnerable countries.

While Western nations are relatively insulated – bolstered by their comparatively strong economies, resilient populations and better adaptive capacity – they are far from immune to climate-induced instability.

“The interconnected nature of modern corporate operations, supply chains and investment networks means that disruption brought about by climate change in the most exposed jurisdictions will have a major impact the world over,” adds Nichols.

Market capitalisation figures based on March 2025 valuations.