US undergoing an emerging market moment

by Camilla Ogunbiyi and James Lockhart Smith,

An election night where the two top contenders both express confidence about winning. One calls for patience until all votes are tallied, the other claims fraud and calls for the vote count to be halted. A potential court battle looms, while observers watch anxiously for political violence. This is a typical emerging market narrative, but it’s taking place in one of the world’s wealthiest developed markets, the United States of America.

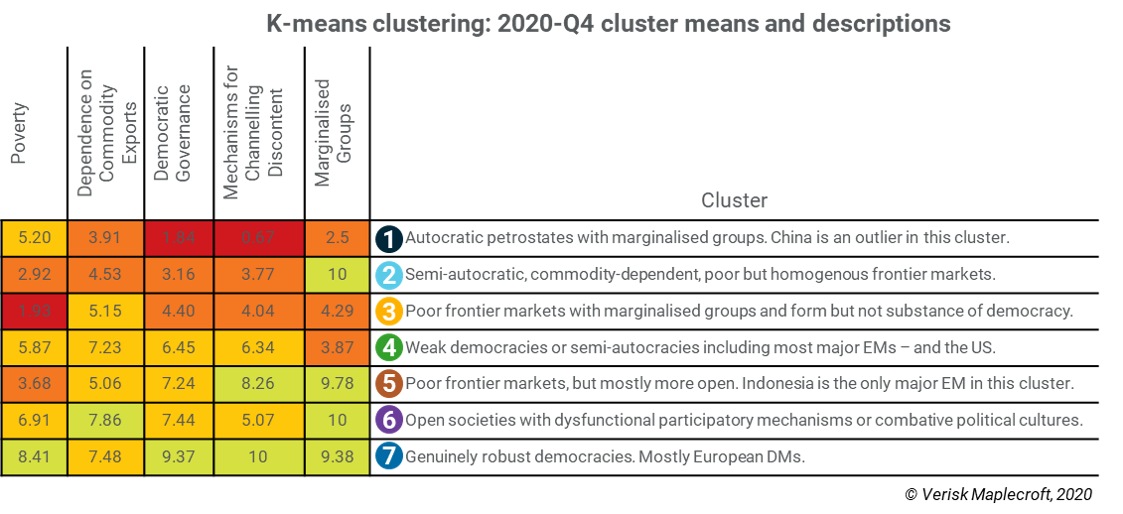

Of course, the US isn’t actually an emerging market nor likely to become one any time soon. However, in a global study we published last week, we used our data to group countries based on five typical determinants of political stability (see Figure 1) and found some instructive parallels. According to the cluster analysis, the US belongs in the fourth grouping, which otherwise almost entirely consists of emerging markets, including Brazil, Hungary, Russia, Thailand and Turkey.

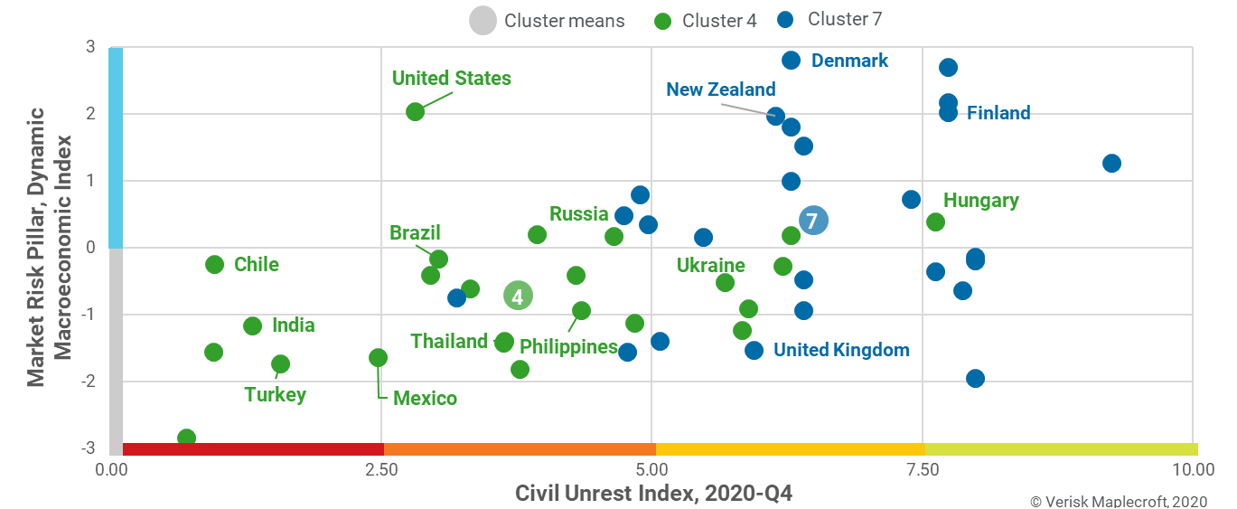

The position of the US among emerging markets captures structural changes this year in the country’s democratic credentials. These changes have left the US more vulnerable to political instability than markets appear to have priced in. When we map the US/emerging markets cluster (no. 4) to the developed market cluster (no. 7) on both civil unrest and market risk (Figure 2 below), we see that the US does have levels of civil unrest that are typical of an emerging market – but trades like a developed market.

Of course, there are very good reasons why the US trades as it does. Despite persistent inequality, it enjoys enviable per capita wealth. It sets the benchmark for global debt markets and arguably owns the world’s most objectively valuable companies. However, both of these characteristics are not just under threat from China but would also be at risk following any systemic change in the country’s political system.

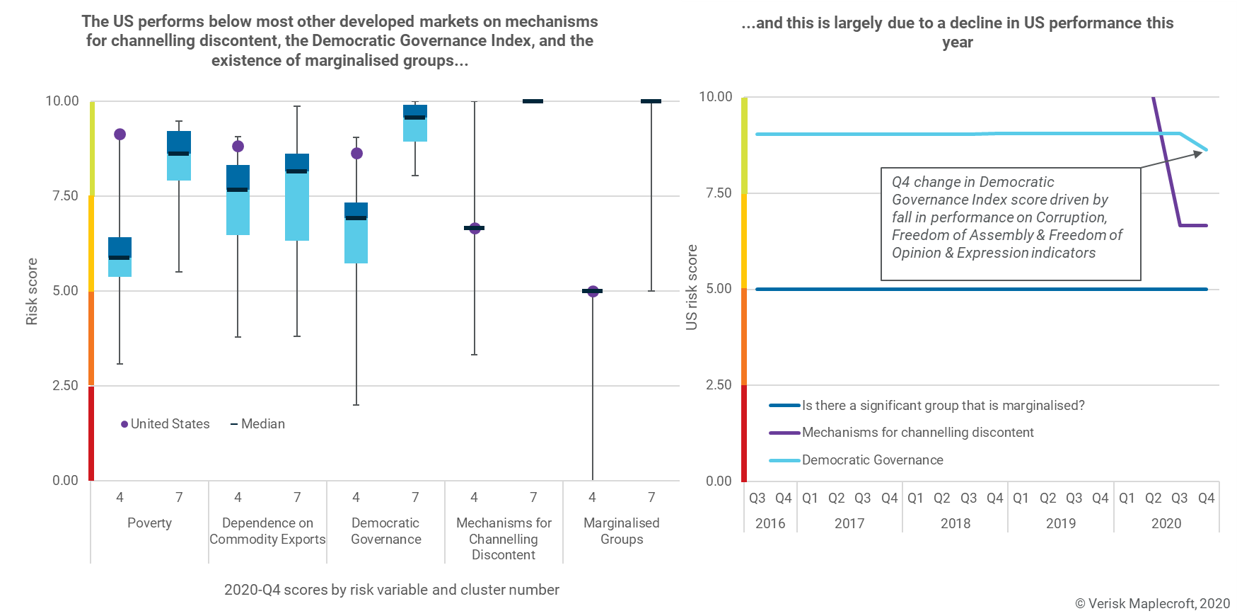

When we explore why our cluster analysis categorised the US alongside emerging markets, we see that until this year the country would have been sat among more robust democracies, including most European developed markets.

Download the full insight below now

The country has long been unusual among developed markets due to its marginalisation of racial minorities, but this year its performance also declined on the Mechanisms for Channelling Discontent indicator. Our broader analysis shows this single variable to be critical in determining the risk of protests disrupting business or undermining political stability. The US’ score has, moreover, worsened on three indicators in our Democratic Governance Index as its institutions have begun to fray. The US now ranks as the 52nd most democratic state among 214 scored in our index – a drop of ten places from 42nd one year ago.

The gulf between the market pricing of the US and that of its emerging market counterparts should not be taken literally – but it is illustrative of what is at stake, particularly if the aftermath of the election turns into a fully-fledged political crisis.

Americans and markets face uncertainty as wrangling over the outcome will almost certainly deepen social and political divides. Regardless of what happens next, the 2020 presidential election has shed light on the emerging weaknesses of American institutions – weaknesses we are unlikely to have seen the back of.