America’s thirst for consumption is not matched by an appetite for recycling, reveals new data identifying the country is the world’s top producer of waste and one of the worst of any industrialised nation for managing its trash.

In two new indices, we’ve measured the waste generation and recycling performance of 194 countries to uncover a global picture of how countries are dealing with the waste they produce at a time where the world is facing a mounting crisis, primarily driven by plastics.

The research calculates that over 2.1 billion tonnes of municipal solid waste (MSW) are generated globally each year – enough to fill 822,000 Olympic-size swimming pools, which would stretch 41,000 kms if laid out end-to-end. However, only 16% (323 million tonnes) of this is recycled each year, while 46% (950 million tonnes) is disposed of unsustainably.

The gulf between what we produce and what we recycle is creating profound challenges for governments and populations. But it is the companies producing large volumes of waste that may find themselves footing the bill if they do not find sustainable solutions to drive a more circular economy.

US creates three times the global average of waste

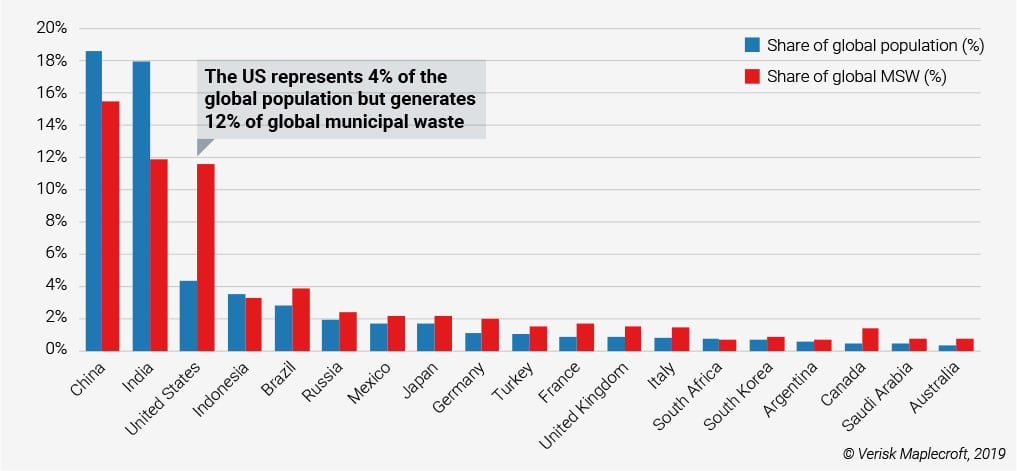

Our Waste Generation Index (WGI), which captures per capita rates of MSW, plastic, food and hazardous waste production, shows that US citizens and businesses are the largest contributors to the waste problem across the four indicators measured. At 773kg per head, the country generates 12% of global MSW, approximately 239 million tonnes, while only accounting for 4% of the world’s population.

In contrast, China and India make up over 36% of the global population, but generate 27% of global municipal waste. American citizens produce over three times as much waste as their Chinese counterparts and 7 times more than the people of Ethiopia, the lowest risk country in the index.

The US is not alone though. Highly developed European and North American countries are disproportionately responsible for the highest levels of waste generation. The highest risk countries in the Waste Generation Index feature the US, the Netherlands, Canada, Austria, Switzerland, Germany, France and Australia.

The UK ranks 14th in the WGI, with its residents generating 482 kgs of household waste each per year.

The Evening Standard: US top of the garbage pile in global waste crisis

Fill in your details at the bottom to download our Waste Generation and Recycling Indices 2019 report

US circling the circular economy

Given the US is the world’s largest economy it may not be surprising that it is one of the largest producers of household waste, but what is significant is its lack of commitment to offsetting its waste footprint.

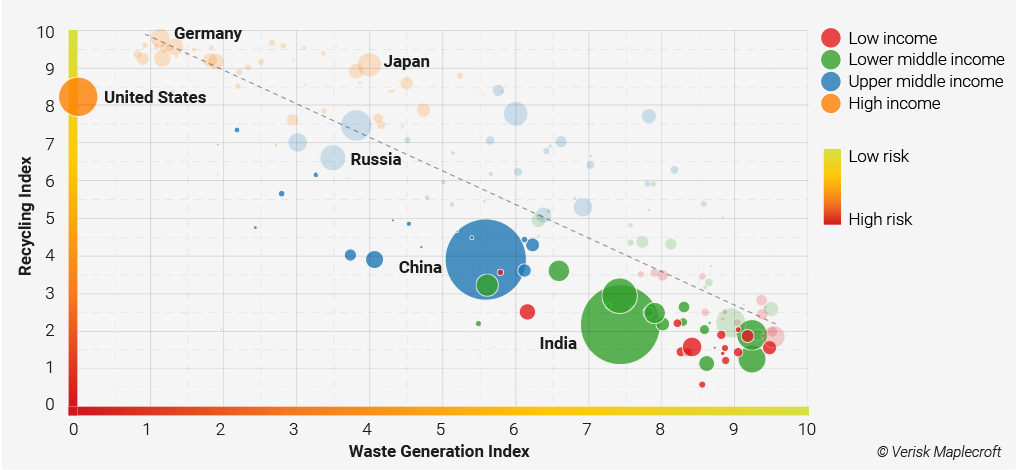

In our Recycling Index (REI), we capture the willingness and ability of countries to manage solid waste and promote circular material flows by measuring national rates of recycling, collection and adequate disposal, as well as government’s commitment to international treaties on waste.

The index shows that the US falls well behind other industrialised nations. The country only recycles 35% of its MSW. In comparison, Germany, which has the world’s most efficient record on waste management according to the REI, recycles 68% of MSW. Even in the best-performing countries, there is plenty of room for improvement though.

Progress in the UK for instance has stalled for the best part of a decade. While it is the 7th best performing country in the REI globally, it still only has a recycling rate of 44%.

In the visual below, it is evident that many developing economies do not have the resources to recycle efficiently, while the United States is shown as a laggard on the global stage.

The US is the only developed nation whose waste generation outstrips its ability to recycle, underscoring a shortage of political will and investment in infrastructure. The country’s seeming lack of resolve to deal with waste domestically may become a mounting problem in the face of plastics import bans from China and many developing countries, where the US currently exports a large proportion of its plastic waste.

China, Thailand, Vietnam and Malaysia have all banned, or are set to ban, imports of solid waste, including a host of plastics. Additionally, in May, almost all the world, with the notable exception of the US, agreed to restrict shipments of hard-to-recycle plastic waste to developing nations.

These emerging shifts in policy are going to make it all the harder for countries such as the US who are underperforming in relation to recycling.

The world is also witnessing rising number of international incidents between developing and developed nations over waste shipments. Most notably tensions have risen considerably between Canada and the Philippines’ government, which has sent 69 shipping containers of waste back to Vancouver after a diplomatic spat escalated over imports of trash.

Companies will need to join the circular economy or pay the price

With the world’s attention firmly fixed on the problem of waste, we expect governments to act, with businesses footing the bill.

-Niall Smith, Senior Environmental Analyst

Beyond the potential financial impacts, the reputational risks for business are high if they ignore intensifying interest in the issue from consumers and investors. Using data from our suite of waste indices, we identify the Netherlands, the US and the UK as the most likely countries to pass new regulations on plastic materials that could hit companies in the pocket. But, France, Canada, Australia and Belgium are also flagged as jurisdictions to watch.

It’s going to be vital for companies to get ahead of these issues. Investing in circular economy measures can not only mitigate risk but can open up new markets and improve brand reputation.