Social license to operate, the most pressing risk to shale projects in the Vaca Muerta

by Jimena Blanco,

Political and economic instability have become part and parcel of the operating environment in Argentina, but for oil and gas companies investing in the Vaca Muerta these issues no longer constitute the biggest risk they face. The strongest headwinds now emanate from a broad set of social risks that could widely disrupt projects unless the industry can maintain its social licence to operate (SLO), amid the rapid and somewhat uncontrolled expansion of the play to date.

As the Argentinian general election approaches, there appears to be a unifying theme from across the political spectrum that the shale plays of Vaca Muetra need to be shielded from potential policy shifts. The upshot of this is that the role of IOCs as crucial partners in Vaca Muerta will not be questioned over the next four years. And while the ongoing economic crisis promises to continue delivering regulatory surprises and short-term hurdles the risks are largely manageable for the sector.

Companies will now have to shift their focus to mitigating the most pressing factors that could impact the commercial viability of projects by unravelling their social licence to operate. Issues including a sharp rise in the number of fatal workplace accidents, the very-slow development of non-technical infrastructure, and the judicialisation of community grievances all threaten operators. If the Oil and Gas sector fails to deliver the local development promised by the authorities, moreover, there is a latent risk of social opposition in Neuquén – and communities in Mendoza, Rio Negro, and La Pampa could move to restrict activity.

Learn more about Human rights due diligence

Accidents and infrastructure gap risk tensions with workforce and residents

A series of workplace incidents is jeopardising the industry’s SLO at site level, with a rise in the number of fatal accidents a risk factor for labour discontent. These accidents also threaten recent addendums to collective bargaining agreements; since the first addendum in 2018, eight workers have died. Unions claim that safety standards have been compromised in favour of production increases; with operators accusing the unions of inadequate vetting and training for new workers.

However, it remains the fact that contract workers, who make up the bulk of the labour force, have accounted for all fatalities to date. With a rise in fatalities, unionised contractors will become more likely to mobilise and pressure union leaders to take a tougher stance during negotiations with the private sector.

Housing at drilling sites is another likely bone of contention. Workers claim that lodging facilities are inadequate and demand to reside with their families. Housing is scarce and unaffordable in nearby towns and associated services, such as electricity, gas, and water, are also unreliable (or unavailable). The absence of residential gas provision in the heart of the world’s second largest unconventional gas deposits is an irony often cited by residents.

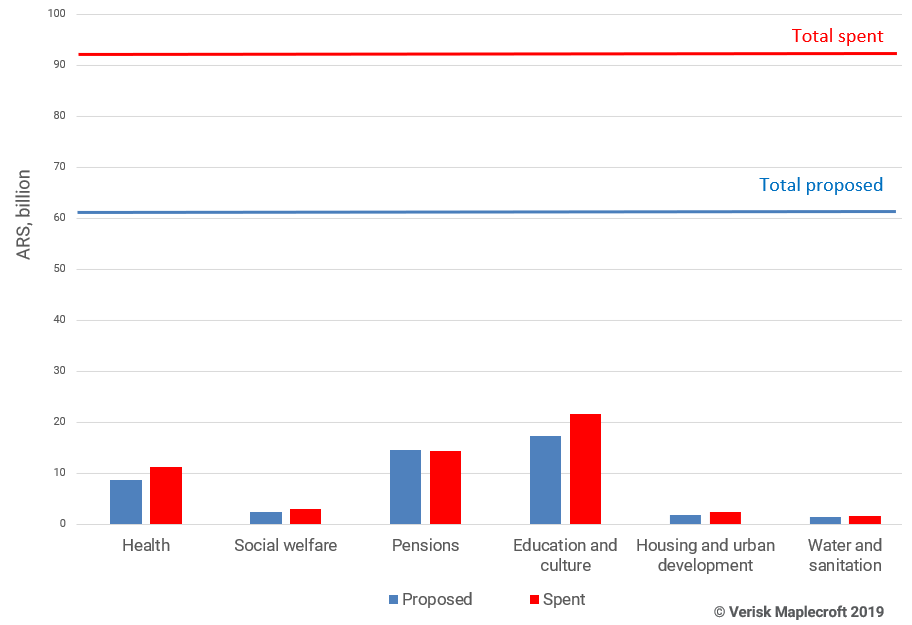

A failure by the authorities and/or the sector to deliver major infrastructure improvements would clearly risk broader community rejection. The 2018 provincial budget data shows that only a small fraction of planned expenditure was allocated to housing and sanitation.

Indigenous communities to intensify use of legal channels in land ownership dispute

Argentina and Neuquén have a well-organised and mature civil society. The risk is that these organisations opt to permanently judicialise their claims, particularly those involving indigenous communities.

At 8% of the population, with 54 legally-registered communities (federal or provincial), Neuquén has one of the largest indigenous populations in Argentina.

The protracted delay in the completion of a territorial survey around Vaca Muerta means that formally recognised indigenous communities could yet halt or delay the development of operations.

Conflicts with indigenous communities also risk external financing, as institutional investors are increasingly focused on ESG risks to portfolios. Our Corporate Exposure Tool (CET) indicates that the main Vaca Muerta players face a high-exposure risk to indigenous peoples’ rights violations. Operators - who acquire acreage in good faith – risk being on the front line of unresolved land ownership disputes, and association with violations of to community rights to land, territories and natural resources.

We also expect communities to successfully turn to the courts in relation to environmental incidents. In 2018, Greenpeace and the Environment and Natural Resources Foundation (FARN) published a video of a spill at Bandurria Sur, prompting the temporary suspension of YPF’s licence and a fine of ARS33 million (USD 936,435 at the time). Subsequently, three organisations - including the Mapuche Confederation of Neuquén - filed a claim before the provincial prosecution, seeking the criminal liability of company executives.

Elsewhere, in Allen and General Fernández Oro, in neighbouring Río Negro, residents are calling on the authorities to limit O&G activities. Locals cite a lack of consultation for O&G operations sited close to agricultural lands. They argue that these sites risk negative impacts including water pollution, crop damage, noise pollution, vibration and other environmental damage.

Becoming a good neighbour to ensure future industry development

Sustaining the SLO will require a more proactive industry response to the evolving needs of local communities. We see potential for private operators to play a more strategic role, such as acting as a bridge between communities and public authorities.

Moving forward, a basin-wide SLO assessment could support remediation plans, detect potential risks for mitigation, and give a better understanding of broader social perceptions about the industry. This would be to the benefit of the sector, as well as local and provincial authorities tasked with allocating and managing development resources for communities.

With the rapid growth of unconventional production having a hugely beneficial effect on the provincial budget - income from the sector now accounts for a third of Neuquén’s fiscal revenue - local authorities have a vested interest in protecting the industry. The province is now the second least-dependent jurisdiction on federal government budget transfers.To safeguard investments, Vaca Muerta operators must develop a cohesive social-licence strategy that promotes the buy-in of interest groups. Companies should understand and factor-in community expectations in their decision-making. Yet such efforts may ineffective if only done by some players and not others. An industry-wide baseline assessment to provide a social-licence roadmap should be a priority, in our view.

Find out more about our human rights impact assessment

Our human rights impact assessment (HRIA) methodology mixes data-driven risk exposure benchmarking with expert analyst research to evaluate company policies and procedure. Extensive on-the-ground stakeholder engagement helps determine real impacts (positive and negative), potential impacts (risks), and measures perceptions, to develop an effective mitigation strategy.