Shareholders press BP to disclose Paris-aligned strategy

by Niall Smith,

Disclosure of BP's climate strategy in pursuit of Paris goals

Climate action 100+ - a coalition of investors with USD32 trillion in assets under management - aims to ensure that the largest GHG emitting companies take the necessary actions to achieve global climate goals through engagement and corporate disclosure. BP accepted a shareholder resolution to detail how its Capital Expenditure investments align with the Paris Agreement climate goals. This includes what metrics and targets have been set to ensure consistency with these goals. BP is expected to disclose the requested information at its 2019 Annual General Meeting in May.

Climate disclosure in the spotlight for oil and gas companies

This stakeholder resolution further demonstrates the mounting concerns of investors surrounding the disclosure of climate-related risks, following the publication of the Task Force on Climate-related Financial Disclosures (TCFD) guidelines in 2017. The announcement includes recognition of BP’s climate change efforts to date, such as contributing to the Oil and Gas Climate Initiative (OGCI) and publishing the BP Energy Outlook, which includes a range of scenarios.

Investors are keeping a watchful eye

BP ranked highly on the latest CDP leaderboard, performing particularly well under ‘Transition Opportunities’, scored by considering factors like low carbon assets and R&D efforts. However, despite an awareness of BP’s climate-positive steps, investors felt that the company has not yet demonstrated that its business strategy – which includes both diversification to low carbon technologies and growth in oil and gas - aligns with Paris goals. This development strongly implies that similar shareholder resolutions will proliferate within the industry and that even firms which have been recognised for taking considerable mitigative actions are not safe.

How are BP’s capex investments exposed to transition risks?

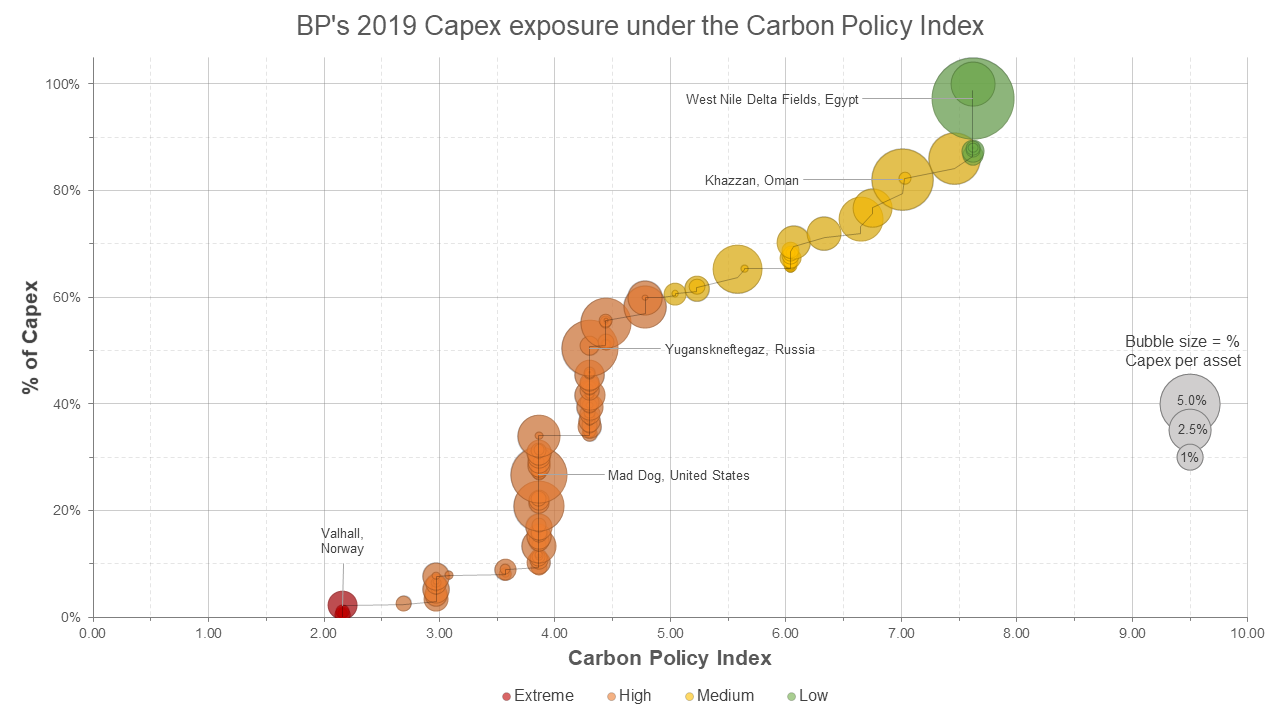

We took a unique inside look at the exposure of BP’s Capital Expenditure investments to transition risks using data from our Corporate Exposure Tool. We examined the company’s global assets under the Carbon Policy Index (CPI), which captures the risk of more stringent GHG emissions reduction policies being implemented.

BP’s current levels of Capex are slightly skewed towards high levels of transition risk, with 60% of the total annual Capex being allocated to onshore and offshore assets located in countries rated as high or extreme risk.

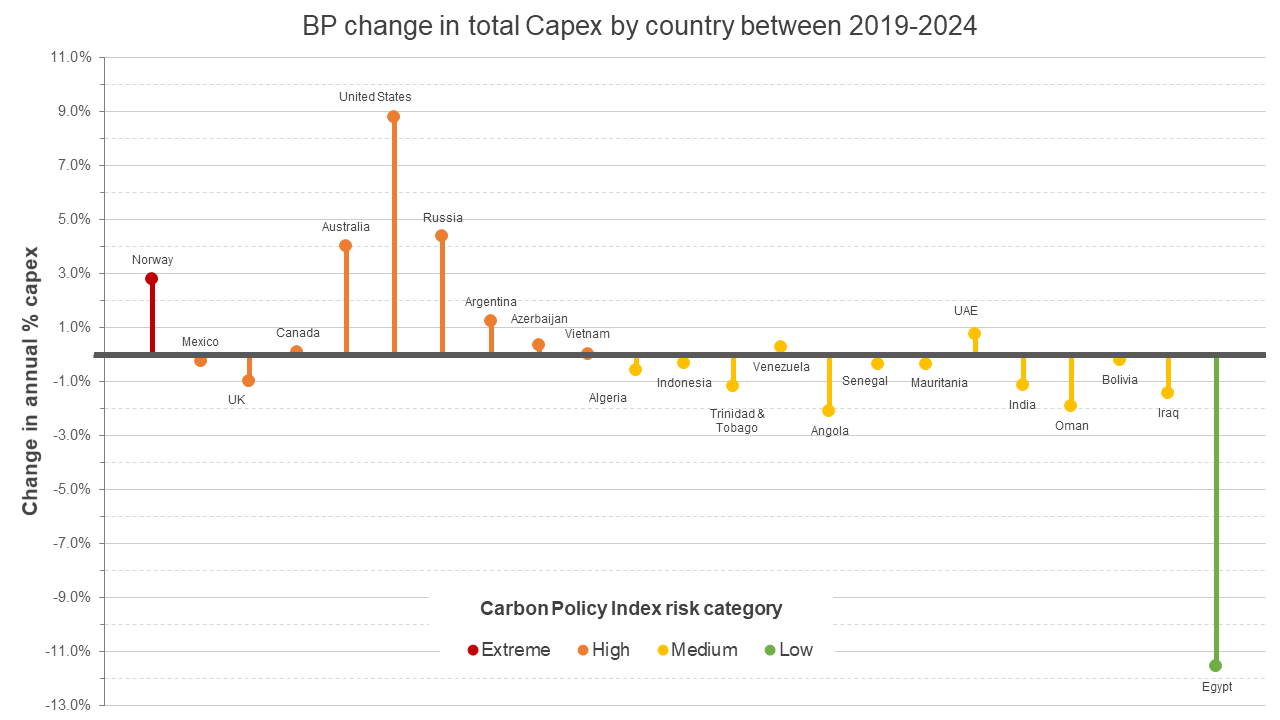

If you look at the change in BP’s Capex investment by country over the next five years, you can see that between 2019 and 2023 the level of Capex investment shifts away from low risk countries and towards assets in high and extreme risk countries. Across BP’s global portfolio of assets, the proportion of Capex in high and extreme locations increases from 60% in 2019 to 80% 2023.

Future production is more likely to take place in countries where carbon pricing is effective and the costs of GHG emissions are somewhat internalised. On the one hand, this demonstrates that BP’s climate change strategy is aligned with Paris goals in at least one aspect. Conversely, it demonstrates that BP’s future production is exposed to higher regulatory costs, which might raise a different set of concerns with investors.

What is the outlook for BP’s alignment with Paris climate change goals?

Investors will not suffer any major shocks regarding BP's alignment with Paris goals, as capex appears to be designated increasingly towards countries with carbon pricing mechanisms in place and a substantial level of political commitment to a low carbon transition. In the event of similar shareholder resolutions arising, investors with exposure to oil and gas companies will do well to stay ahead of the curve by leveraging the powerful capabilities of our Corporate Exposure Tool.

Learn more about our Mining & Metals Solutions