Scenario planning: Can you read the signals that matter?

Part I in a series on data science and strategy

by Sondra Scott,

In an increasingly unpredictable global business environment, it’s more important than ever for organisations to think about the ‘what if’. However improbable some might seem at the time, high impact events can, and do, come to pass. They can rock stock prices, shake reputations and make or break an investment.

Planning for these events is crucial, and mapping out the various scenarios and pathways is the first step in understanding your risk and identifying opportunity. Traditionally, scenario planning has relied on creative long-term thinking and rigorous qualitative processes. These two tools still form the foundation, but the application of big data and data science stands to enhance our thinking by bringing scenarios alive and keeping them relevant to the dynamic, uncertain world we work in. This can apply to building strategy at the boardroom level or understanding the potential risks to site-level operations.

Understanding the smoke on the horizon

My first experience in building scenarios came in the early 1990s, when I had the privilege of learning the ropes from Ted Newand, one of the early innovators of scenarios along with his Royal Dutch Shell colleague, Pierre Wack. Over the past two decades, I have used these skills to build numerous sets of global, regional and industry scenarios to help my teams and my clients have a broad, non-deterministic framework for understanding uncertainty.

These scenario frameworks have been a handy tool for decision-making by allowing leaders to understand how their decisions today could play out under various, equally plausible future environments. While there are many different approaches to scenario development, the common thread holding their success together is the identification of high impact, high uncertainty drivers or forces which, depending on how they play out, will shape the future environment.

The benefits of scenarios are well understood, but they have created challenges, too, particularly how to keep them from becoming stale and irrelevant as a key business tool. This challenge is only being exacerbated by the increasingly dynamic, connected, 24/7 decision-making environment that most businesses face today.

Building an early-warning system

Scenarios are a long-term planning tool which, if done well, should not need to be changed annually. How, therefore, do we design them, so they remain fresh and relevant? In our highly digital world where streams of content are fired at us continuously, we are at risk of being swayed by the last particle of information we ingest. The key is to make this rich flow of information relevant. To do this, the onslaught of content must be corralled into sensible signals that are connected to your scenario framework.

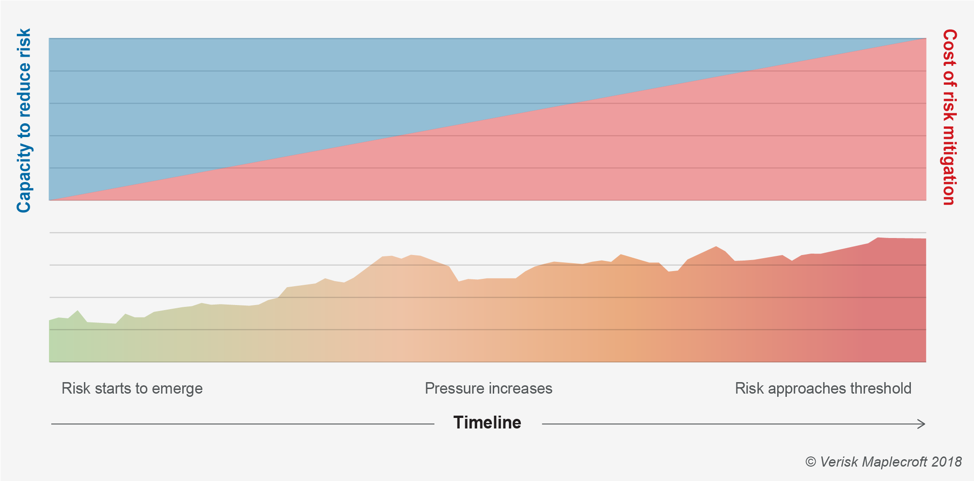

A successful melding of a long-term scenario framework with these signals creates an early warning system that can help you to stay ahead of trends. It allows you to positively influence a trend while it is unfolding, and before it becomes entrenched. The example below imagines the ability to influence versus the cost of influencing for a political issue, but this could play out equally with other trends, including, but not limited to, regulatory, consumer, corporate and technological issues.

Creating this early warning signal may sound simple, but it is a complex process and requires a solid track record in identifying scenario uncertainties and associated signposts, as well as significant data science skills.

For example, let’s assume a key uncertainty for an energy scenario is whether there will be a critical breakthrough in battery technology to allow for economic storage of energy. A key signpost for this uncertainty is the level of investment in battery technology. Using advanced data collection and analysis techniques, at Verisk Maplecroft we scrape news feeds, social media and other open and proprietary data sources to produce ‘signals’ as to where investment levels are heading and the information about outcomes of these investments.

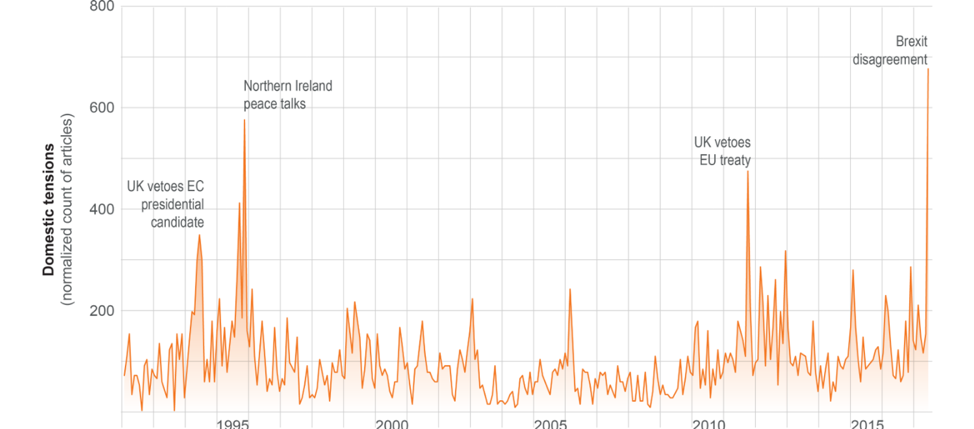

Another example might be domestic political tensions in the UK as a bellwether for European unity. The chart below shows a count of articles consumed from various news feeds, clustered using natural language processing into domestic political tension events and normalised to account for changes in total news volume over time.

Each of these signals will be associated with a signpost that can act as an early warning signal as to how a key uncertainty in the scenario framework is unfolding. Importantly, it is a flag to the business that something is changing and that some decisions about quantity, type and or location of investment (for example) should be reviewed. This is not to say that you will necessarily change course, but that you may adjust your course to capture an opportunity and / or put in place contingencies to protect against a risk. It is important to underscore that the ‘signal’ is triggered not so much by an absolute level of activity but more by the rate and magnitude of change in activity.

We are building more of these dynamic datasets and successfully applying them to scenario building and other long-term planning tools. We see it as the coming together of tried and tested qualitative methods with cutting edge quantitative methods; each independently useful but together creating a superior planning tool.

What are the 6 steps to building a more responsible, resilient supply chain?

Read our latest article