Beijing faces a tricky balancing act between continuing with its efforts to contain the coronavirus and the urgent need to resume business as usual. Disruptions to air travel and production have already played havoc with global supply chains, and companies are increasingly having to find alternative suppliers or reduce or stop production.

To date, there have been more than 39,800 confirmed coronavirus cases in China, with at least 910 recorded deaths, and these figures are climbing daily.

As a means to control the outbreak, the Chinese government extended the Chinese New Year holiday to halt business across almost all sectors and stepped up lockdown and transport restrictions.

However, starting from 10 February 2020, businesses in over 25 Chinese provinces and municipalities – including Hubei, Guangzhou, Shanghai and Shenzhen – are scheduled to resume work gradually amid the escalating coronavirus outbreak. Yet the return of workers to crowded environments, such as mines and factories, could push the outbreak to another peak.

And this could cause problems for Beijing beyond dealing with an escalating epidemic; namely, rising popular discontent and political pressure for failing to control the crisis.

Return to business unlikely to be smooth

As part of the measures to mitigate the epidemic’s economic impact, the People’s Bank of China injected 1.7 trillion yuan of liquidity into the market on 3 February, and on 5 February the National Energy Administration urged coal miners to resume production to keep the market supplied and transportation smooth.

Both measures are designed to ensure sufficient power supply and a stable market for restarting the economic engine, but an ongoing transport lockdown remains an obstacle to business because industrial facilities are finding it increasingly difficult to procure raw materials and equipment. Therefore, a delay in resuming business is expected, depending on the sector.

Supply chain disruption to last for months

The coronavirus outbreak has seriously interrupted global supply chains across various industries, such as the petrochemical, machinery, automotive and hi-tech sectors. Most of the affected Chinese regions, such as Hubei, Guangzhou and Shenzhen, are the manufacturing hubs of both raw and intermediate products. Disruption to air travel and delayed production would largely impact companies that require quick delivery from China.

Multinational companies that rely on China as a core supplier face reduced production output in products such as plastics, chemicals, steel, auto parts and hi-tech components. They will then have to compete for alternative suppliers and even be forced to reduce or stop production. For example, factory closures have forced Apple and Bosch to scale down their planned production targets.

We expect the disruption to last until 2020-Q3, but the final impact on industries will depend largely on companies’ capability to source alternative suppliers as well as the progress of virus containment worldwide. Many US businesses that have already diversified their supply chains due to large tariffs on Chinese goods are likely to face less of an impact from the supply chain disruption in China.

Find out more about Disruption risk

Political stability is everything

The next two weeks will be crucial for determining whether the coronavirus outbreak can be contained following the resumption of business. If containment measures are not effective, Beijing will likely delay the 13th National People’s Congress, a top legislative meeting scheduled for early March.

We expect the People’s Bank of China to launch further monetary stimulus in the coming weeks, such as cutting the reserve requirement ratio, in order to sustain China’s economy and support manufacturing and construction in particular – in the face of a collapsing services sector.

However, the overriding priority for China’s central leadership is mobilising nationwide resources and implementing measures to ensure political and social stability.

For example, Beijing formed a leading group on 26 January 2020 to handle the outbreak. While the structure of the group (led by the Premier Li Keqiang instead of the President) is similar to that formed during the SARS outbreak in 2003, the higher rankings of other group members imply greater concerns from Beijing over the epidemic’s impact. The involvement of key leaders from the Central Propaganda Department and Public Security Ministry also reflects a heavy political and social element to the group, whose broad agenda likely includes the maintenance of social cohesion and domestic stability.

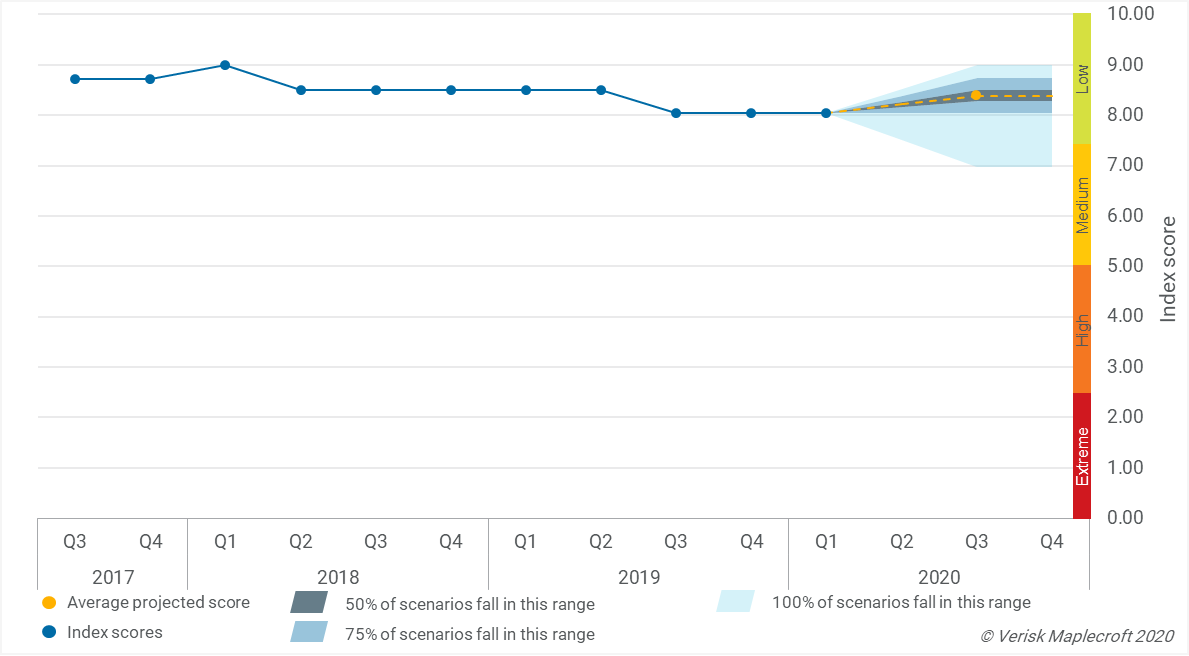

We expect that some of the government’s precautionary measures will affect how daily business is done, and this is likely to undermine the efficiency of commercial operations. But while the coronavirus has triggered public anger, the coronavirus is unlikely to reduce government stability in China over 2020, as shown in the figure below.