Outlook darkens for energy transition, but there is light for renewables

by Franca Wolf and Dr Kaho Yu,

The double whammy of oversupply and demand shock is severely limiting the financial resources of oil majors at a time when most of them have set road maps to reduce emissions to comply with government policies and offset pressure from institutional investors and the public.

The rules of the game have now changed. In response to the collapse in oil prices and the impact of the COVID-19 pandemic, nearly all of the oil majors have announced deep cost-cutting measures that will likely limit large-scale industry investments in the energy transition. However, the one chink of light we see is that there will be room for greater investments in renewables as oil majors seek more stable returns in the long term.

Carbon capture and EVs at highest risk

While the oil price crash means we do not expect increases in investment for energy transition projects for 12-18 months at least, this does not mean budgets will be zeroed out completely. Instead, cost-cutting plans announced to date suggest cuts will be proportionally spread across business units. The majors’ energy transition budgets will still exist, but they will prioritise some areas over others.

Carbon capture and electric vehicles (EVs) investments are at the greatest risk from the cutbacks. Demand for EVs is likely to weaken amid a lower oil price and recession-induced consumption constraints. Our sister company Wood Mackenzie expects up to a 43% decrease of new EV sales over 2020. Carbon capture technologies are still in their infancy and require large-scale investment over the coming decades to become operational at large-scale, i.e. no quick investment returns are expected.

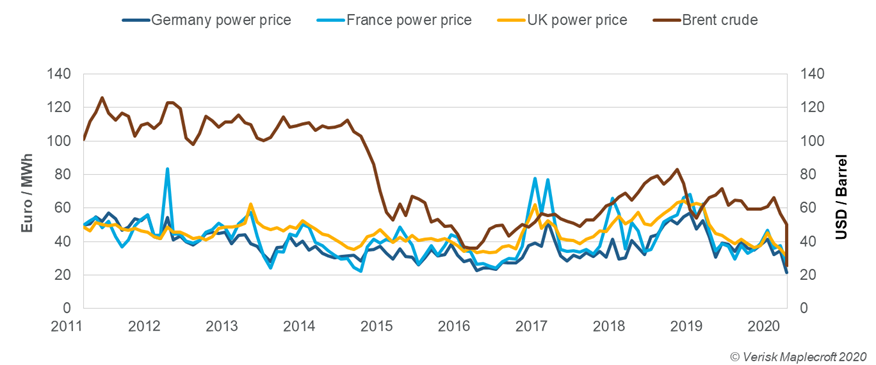

However, while investment cuts are likely in these areas, we see the potential for a renewed focus from the majors on renewables as a hedge against fuel price fluctuation. So far, oil majors account for only about 2% of global renewables investments, but the oil price collapse has seen zero carbon energy become a more appealing investment option. Admittedly, a lower price also incentivises higher demand for oil. However, one of the major benefits of renewables is their long-term stability of cashflows (see visual below on the relative power price stability versus volatile crude prices).

At a lower-for-longer oil price, majors can benefit from investing in low-risk renewable energy sources, while hedging against oil price volatility. The majors will now be screening oil and gas at lower oil prices, which means the returns will be lower. That will favour allocating more capital to new energy, once capital is available again. Total and Shell top the list of European majors with the highest investments in renewables and we expect them to continue on this diversified trajectory. In turn, there is a potential for majors with a lower uptake of renewables, such as ExxonMobil and Chevron, to increase their stake in response to the prospect of sustained lower oil prices.

Short-term disruption to the renewables industry

Nevertheless, disruptions to the global economy will hamper the renewables industry in 2020 and cause short-term hurdles for greater investment.

While the shutdown of Chinese factories in February has temporarily interrupted the production of key components for existing renewables developments, delays in construction timelines and grid connection due to market lockdowns remain a bigger challenge. Late delivery of wind or solar projects could create pressure for renewable companies to meet subsidies deadlines despite possible extension. 2020 is a critical deadline for wind farm developers in the US and China to complete projects that qualified for subsidies.

We expect that once highly automated production lines resume work, the pressure on the supply of key components and equipment is likely to ease. So far, the COVID-19 outbreak has not led to any large-scale ban on Chinese photovoltaic goods exports. However, it requires a longer time to fully restore international supply chains, and resume a smooth supply of equipment, machinery, raw materials and workers.

Join our Webcast: COVID-19 and its impact on the global energy supply chain

Register nowEscalating infection numbers in Europe and the US have shifted the concerns to weaker energy demand, less deal-making and limited finance available amid a global economic slowdown. Policymakers will also likely pay less attention to the renewables sector and subsidy policy due to the escalating pandemic.

Majors need to adjust to new realities, but climate issues will not go away

Just as the energy transition was gaining momentum in the oil industry, some of the greatest supply and demand side shocks in modern history emerged, posing immense financial hurdles. Deep spending cuts will likely constrain investment in the energy transition by majors in the coming years.

However, with emissions and expansion targets remaining in place, the climate challenge will not go away. While the promise of price stability and increased competitiveness will likely persuade majors to focus more of their capital on renewables, other energy transition investments such as EVs or carbon capture face a higher risk of being cut in the near-term.

With the COVID-19 outbreak set to disrupt the Asia-focused renewables industry over the coming months, the majors will also need to think about diversifying their supply chains and will likely try and pivot towards localised manufacturing, especially for batteries and renewables equipment.

Climate priorities may take a backseat for some time in a cash constrained, post-COVID world, but the energy transition will still move forward. It’s how the industry adapts to new realities that will shape the pace this happens.