Geospatial ESG investing

Learn more

The UK hits a little turbulence

With terrible timing on 27 September – the very day the Bank of England (BOE) was forced to intervene in the market, citing a “material risk to UK financial stability – the Treasury’s Debt Management Office (DMO) was scheduled to re-open GBP4.5 billion (USD5.1 billion) of a 2053 sovereign green bond.

The bond drew some GBP24 billion (USD25 billion) in early bids, at the highest yield since 1998, as long-dated 30-year gilts nudged 5.10% - before the BOE at midday stepped with an emergency purchase of government bonds to stabilise the market.

The offer was eventually finalised the next day, with the DMO reporting total orders of GBP30 billion and proceeds of about GBP2.4 billion (USD2.7 billion). The yield was 4.2947%. Given the circumstances, it wasn’t a terrible result, but clearly came in beneath expectations.

While the issue was 5-6 times oversubscribed, a previous offering last year drew a much heftier GBP74 billion orderbook, analysts noted, underlining the fact that the UK’s soaring sovereign risk was dominating sentiment, even within the medium/long-term ESG investor class.

Having raised GBP16.1 billion (USD18. 25 billion) via two green bond sales in FY 2021-2022, the DMO aims to raise a further GBP10 billion (USD11.3 billion) in FY 2022-23. The proceeds support investment in sectors including clean transport, climate change adaptation, energy efficiency, renewable energy and living & natural resources.

In its latest (September 2022) Green Financing Allocation Report, the DMO noted that its FY 2021-2022 transactions saw strong demand and priced favourably to conventional bonds. It cited “significant interest” from both conventional and dedicated ESG investors.

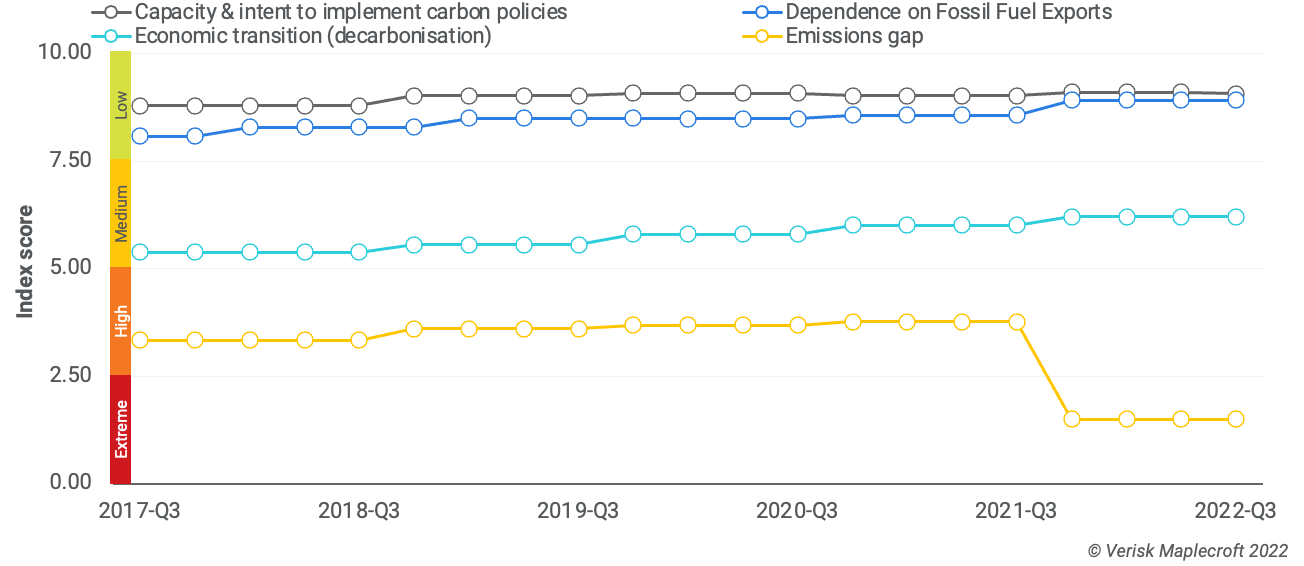

We will be keeping a close eye on the UK’s Sovereign ESG performance under the Truss government, amid signs of labour market and environmental permitting deregulation, and moves to restart fracking and expand North Sea oil, all of which would weigh negatively on our S and E pillars, and would unlikely improve the UK’s extreme-risk score in our Emissions Gap Index.

Citing major changes to the economic and political landscape post-Ukraine, PM Truss has also ordered a three-month ‘rapid review’ of the UK’s Net Zero strategy, to be led by former energy minister Chris Skidmore, tasked with ensuring the transition is ‘pro-business’, ‘pro-growth’ and ‘economically efficient’.

Skidmore (himself a fracking sceptic) has a tricky balancing act ahead. In July, a High Court judge ordered the UK government to update its Net Zero Strategy to set out concrete decarbonisation policies by March 2023, as per its legal obligations under the Climate Change Act (CCA, 2008), in a case taken by leading environmental and law charities including ClientEarth.

A month prior, the Westminster government’s own Climate Change Committee had reported that credible plans existed for just two-fifths of the UK’s required emissions reductions.

‘In Liz we Truss’, a slogan at the Tory party conference in early October, is not a sentiment entirely shared by investors at this point. The UK’s wider international reputation as a climate policy leader is also at stake ahead of COP27 in Sharm El-Sheikh in November, with the Egyptian government on 4 October warning the UK (which under Boris Johnson hosted COP26 in Glasgow last year) against “backtracking from the global climate agenda” – after No.10 apparently advised King Charles, a longstanding climate activist, against a scheduled attendance at the summit.

Chart of the week

Quote of the week

These laws are, in essence, forced fossil fuel financing laws.

Sarah Bloom

Former US deputy Treasury secretary Sarah Bloom on US state ‘anti-ESG’ laws, FT, 2 October 2022

What we’re reading

- No longer invisible: Study values nature-based markets at $7tr, Business Green, 27 September 2022

- The change Chileans really want, Foreign Affairs, 28 September 2022

- The fundamental contradiction of ESG is being laid bare, The Economist, 29 September

- Pushback on ESG is a 'denial of capitalism', Environmental Finance, 30 September 2022

- US Federal Reserve announces inaugural climate stress tests in 2023, Responsible Investor, 30 September 2022

- Asia's ticking debt bomb: Sri Lanka crisis sounds alarm bells across the region, Nikkei Asia, 3 October 2022

- A landmark $8.5 billion climate finance deal hangs in the balance, Bloomberg Africa, 3 October 2022

- Jair Bolsonaro’s ‘beef, bible and bullets’ coalition is here to stay, FT, 3 October 2022