Geospatial ESG investing

Learn more

Greenflation from Europe to China

Even as the UK and European gas price crisis is bringing home to consumers and business in a very real way the costs of the energy transition (‘greenflation’), China is going through a similarly rude awakening.

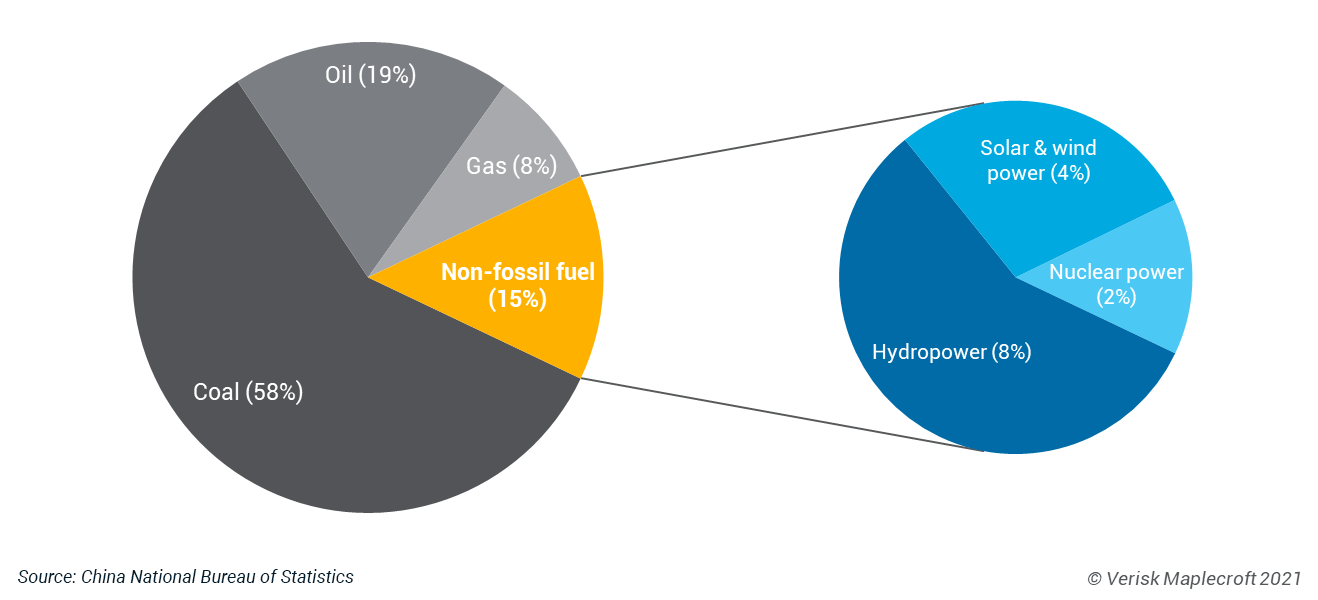

China’s latest domestic power crisis shows once again the inherent difficulties for Beijing in marrying a green strategy with the country’s basic economic needs. The energy shock, driven by a combination of tightening emissions standards, rising electricity demand and also political pressure to ensure ‘blue skies’ for the February 2022 Winter Olympics, demonstrates that renewables and nuclear alone are not able to sustain China's electricity demand. Fossil fuels – led by coal – will remain a substantive part of the energy mix.

As ever, what happens in China has ripple effects around the globe, particularly for supply chains. Energy-intensive companies such as steel mills, textile firms and electronics components manufacturers in major industrial hubs have been forced to close or reduce activities.

Given the existing strains on global supplies of everything from medical devices to automotive parts to toys, this couldn’t come at a worse time for the global economic recovery – which is very far from consolidated, in our view.

As in the UK (which has back-up plans for coal use in the event of natural gas supply shortages this Winter), China has reverted to coal as its energy backstop – at some expense, given record prices – citing national security needs.

On 26 September, the National Energy Administration (NEA) told coal companies to increase output so to ensure energy supplies for power generation and heating in the upcoming winter.

In tandem, China’s banking and insurance regulator told financial institutions to boost financing for coal plants and mines so ‘that the people can live warmly through the winter’. It also warned the financial sector against speculation in bulk commodities (coal/steel/metals). Asian media reports suggest that China has even been unloading some locally-berthed Australian coal left stranded after the official import ban imposed last year amid political tensions.

Our Asia team expects the political pressure to restrict energy consumption to continue at least until the Winter Olympics. As President Xi is keen to show the international community that the Beijing authorities are serious about decarbonising. The upshot is that disruption to power supplies, public services and industrial activities will occur intermittently over the next few months.

Ahead of COP26, the fact of coal being put back to widespread use in China, Western Europe, the US and elsewhere is an irony not lost.

The brutal reality is that the path to net-zero 2050 is going to be complex and painful.

And with many governments simply unable to take (or fund) the difficult policy and political decisions required, we will never tire of reiterating that the role of global finance - shoulder to boulder - will be utterly decisive this coming decade.

Eileen Gavin

Principal Analyst, Global Markets & Americas

ESG+ Matters notification

SubscribeChart of the week

Quote of the week

Gas markets, coal markets, other sources of energy need a regulator. This situation is telling us that people need to copy and paste what OPEC+ has done and what it has achieved.

Prince Abdulaziz bin Salman

Saudi Energy Minister Prince Abdulaziz bin Salman address the European fuel crisis

What we’re reading

- Can debt capital markets save the planet? A new WWF report provides four scenarios on how debt capital markets can be transformed to harness the world’s largest and deepest finance pool for reducing carbon emissions and reversing nature loss

- Aukus commits Australia to geopolitical competition - Joseph Parkes, Verisk Maplecroft Risk Insight

- How capital markets will drive the decarbonisation of oil and gas. The Edge, Wood Mackenzie

The week ahead

- Our Human Rights Outlook 2021 is released, with our pick of the key issues impacting global human rights post pandemic

- German political parties will launch talks with a view to forming a new coalition government by year-end, with policy and geopolitical implications for the EU and beyond. We expect an SPD-Greens-FDP coalition arrangement