Geospatial ESG investing

Learn more

Climate finance rises up the agenda ahead of COP27

UN Secretary-General António Guterres didn’t mince his words at the 2022 General Assembly.

Few were spared, including global energy companies, accused of "feasting on hundreds of billions of dollars in subsidies and windfall profits while household budgets shrink and our planet burns”.

Guterres also took aim at the international financial sector as ‘an enabler’ of fossil fuel companies, calling for banks, private equity, asset managers and other financial institutions that continue to invest and underwrite carbon pollution to be held to account. “It is high time to put fossil fuel producers, investors and enablers on notice: Polluters must pay,” he declared.

Echoing our own warnings of a coming ‘winter of global discontent’, the secretary general issued a call on all governments to tax the windfall profits of fossil fuel companies, with the funds put towards struggling economies and global climate change mitigation.

While the European Commission is proposing that EU states take a 33% share of the fossil fuel sector’s surplus profits, Guterres’ call will unlikely be heeded by the new UK PM Liz Truss, who has declined to extend the UK’s temporary 25% windfall tax imposed earlier this year (meaning taxpayers will ultimately foot the bill of circa USD150 billion for her Winter 2022 fuel price freeze package); while President Joe Biden has also discounted the notion, which would be anathema in the US.

Guterres wasn’t the only one pressing the international financial sector for more action. The US climate envoy John Kerry also called for reform of IFIs including the World Bank, citing their failure to deliver on climate finance, particularly for emerging economies.

Meanwhile, pension funds and US banks are threatening to abandon Mark Carney’s Glasgow Financial Alliance for Net Zero (GFANZ), on concerns about legal/litigation risk around the strict targets for phasing out coal, oil and gas financing set and accredited by the UN’s Race to Zero campaign.

GFANZ - and the wider financial sector – is under pressure on all sides in the climate debate, with environmental activists demanding more action, and others (including the ‘anti-ESG’ US Republican-led movement) pushing back.

But there is also a valid argument to say that the demands being placed upon the Western financial sector - including the SEC’s proposed mandatory climate disclosure regulations and the onerous demands of the EU’s SFDR - are not being matched by anything near equivalent government policy efforts.

Most notably, this includes the USD100 billion a year pledged some 13 years ago by industrialised nations to help developing countries with climate change mitigation and adaptation.

As we warned after last year’s COP26, more robust government policy action, and concrete climate finance for the increasingly restive global south, is set to be a critical focus of COP27 in Egypt in November. Indeed, the success of this year’s conference will very likely hinge upon it.

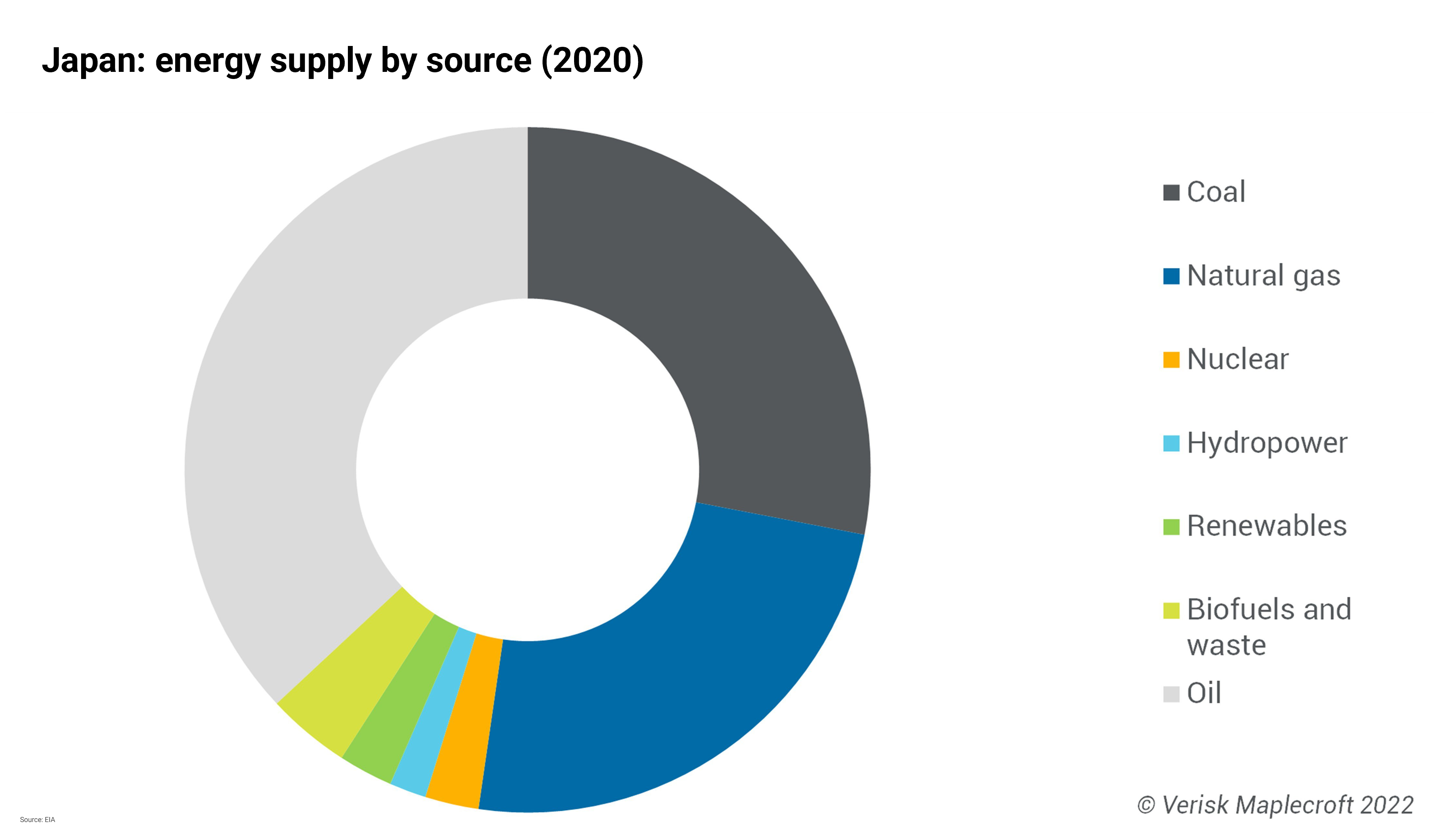

Chart of the week

Quote of the week

It makes me very sorry to say, but I think the UK is behaving a bit like an emerging market turning itself into a submerging market.

Larry Summers

Former US Treasury Secretary Larry Summers, 23 September 2022

What we’re reading

- Barbados strikes $150m biodiversity debt conversion, Environmental Finance, 21 September 2022

- Denmark breaks ranks on paying for climate damage, Politico, 21 September 2022

- Investor appetite drives pricing benefits for sustainability-linked bond (SLBs), Climate Bonds Initiative, 21 September 2022

- Why Beijing wants Bolsonaro to win, Foreign Policy, 22 September 2022

- Russia is losing India, Foreign Affairs, 22 September 2022

- Boom time in the Gulf, The Economist, 22 September 2022

- The return of fascism in Italy, The Atlantic, 23 September 2022

- Uruguay’s step-down SLB will call investors’ bluff, Global Capital, 23 September 2022

- Vanuatu makes bold call for global treaty to phase out fossil fuels, The Guardian, 24 September 2022

- Al Gore calls out ‘greenwashing’ risks as funds quit green club, Bloomberg Green, 25 September 2022

- Global climate leaders push for overhaul of IMF and World Bank, FT, 25 September 2022

- If companies really want to do some good, they should unbundle ‘ESG’ and ‘DEI’, Adrian Wooldridge, Bloomberg Opinion, 26 September 2022

- The UK should be worried about emerging market comparisons, Bloomberg, 26 September 2022