Sovereign ESG Ratings: Transition and political risk challenges loom despite market enthusiasm

by Emma Whiteacre,

For investors focused on sustainable opportunities in sovereign debt, 2024 is shaping up to be an important year. It started with a flurry of issuance by sovereigns like Saudi Arabia, Mexico, and Indonesia capitalising on easing market conditions. And even where constrained financing otherwise threatens to undermine the delivery of better sustainability outcomes, Cote d’Ivoire has shown that investors will still flock to fund labelled issuance.

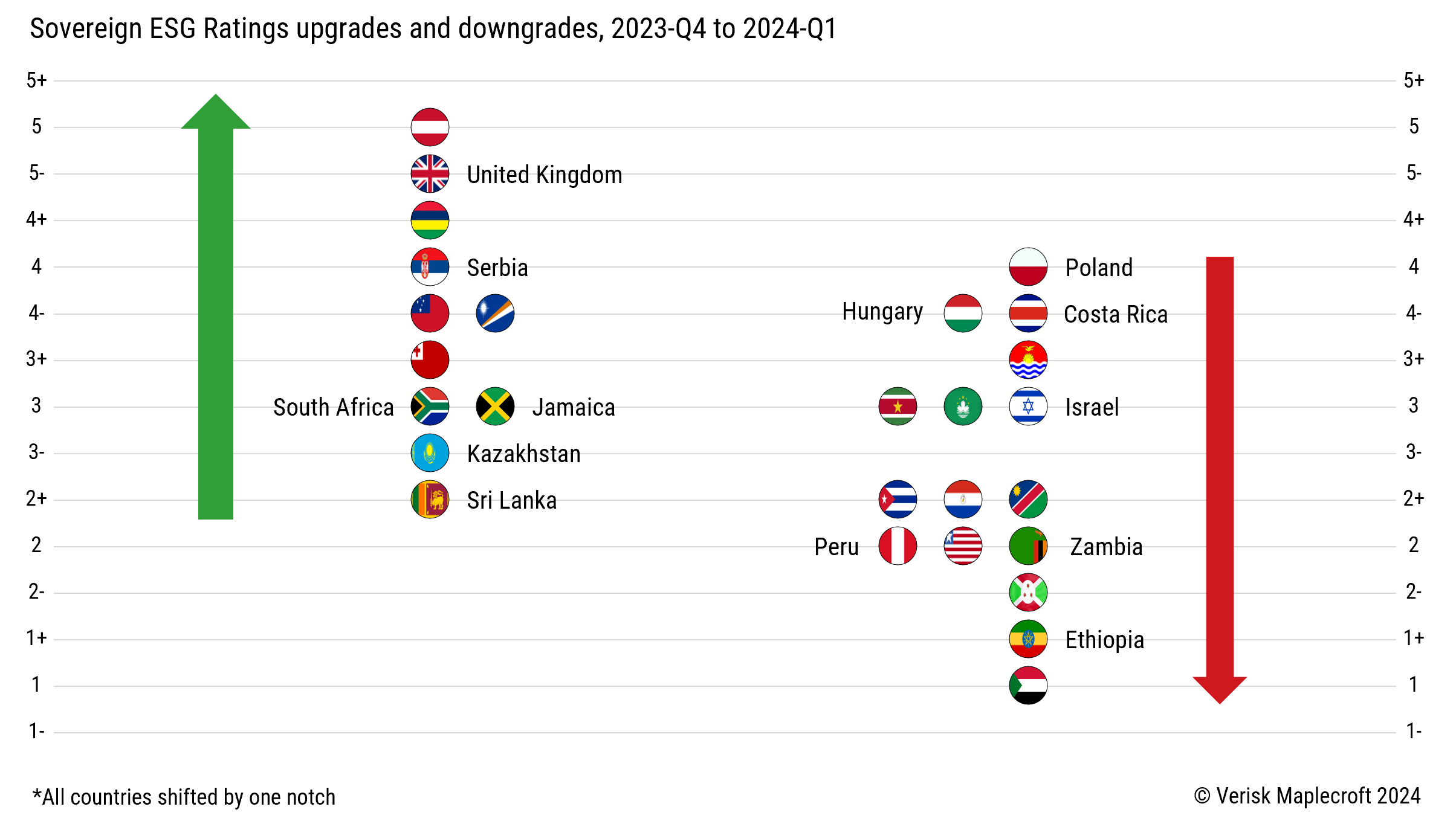

But those hoping for universal good news on progress will be disappointed. As data from our Sovereign ESG Ratings shows, delivering sustained improvements is no simple matter. This quarter, 40 countries improved, with 11 including South Africa, Sri Lanka and the UK seeing upgrades on the Ratings, but 70 declined, resulting in 16 downgrades in countries including Hungary, Israel, Poland and Peru.

Transition topping the agenda of investor concerns

Decarbonisation is the issue of most growing importance to sovereign investors, especially those funding labelled bonds, but it is here that most is at stake. True, while failure to keep pace with emissions targets was a key driver of incremental deterioration for a number of countries in the environmental pillar, the policy environment continues to gradually improve.

However, our data does not tell an encouraging story about the prospects of a fair and inclusive, or ‘Just Transition'. Ninety countries, including many such as Thailand, South Africa, Azerbaijan, Kazakhstan and Peru that are either oil exporters or otherwise important for global emissions reduction, saw a quarterly decline in their performance in either or both the human or labour rights dimensions of our Ratings, against only 37 who improved. In this context, the likelihood that rights will be protected during this epochal reshaping of national economies looks increasingly slim.

Political risk shaping the ESG outlook

Beyond these key E and S challenges, governance was a comparative bright spot in this quarter’s Ratings moves, with most countries either holding steady or improving. But even governance too will face considerable flux this year, as around half of humanity heads to the polls – and this will also shape E and S in turn.

The good news is that policies on decarbonisation, climate risk management, immigration, corruption, crime – alongside the health of democracy itself – will be under scrutiny. The bad news is that these policies may change for the worse, including in developed markets where the very same social and economic challenges of transition are looming ever larger for voters. Either energy transition or other ESG concerns will be at stake – and in some cases in the spotlight – at the polls in countries including South Africa, Ghana, Brazil, the United States, Mexico, Tunisia, Sri Lanka, and the UK.

In 2024, in sum, the increasingly urgent energy transition will impact on the human rights landscape; political realities will threaten to push countries off their pathways to sustainability, especially where voters are due to head to the polls; and in all cases any progress will be hard-won and non-linear, with governments facing tough and sometimes irresolvable trade-offs. Investors re-engaging with government debt markets after a tough 2023 will be wise to take heed.