The Yemen-based Houthi’s campaign against Red Sea shipping dramatically escalated last month with the sinking of two cargo ships on 6 and 7 July, alongside the deaths and abduction of mariners. It is unlikely that insurers and shipping companies can expect an end to Houthi disruption before the end of 2025 as the militant group leverages the campaign for domestic goals.

Shipping companies face insurance and security dilemmas

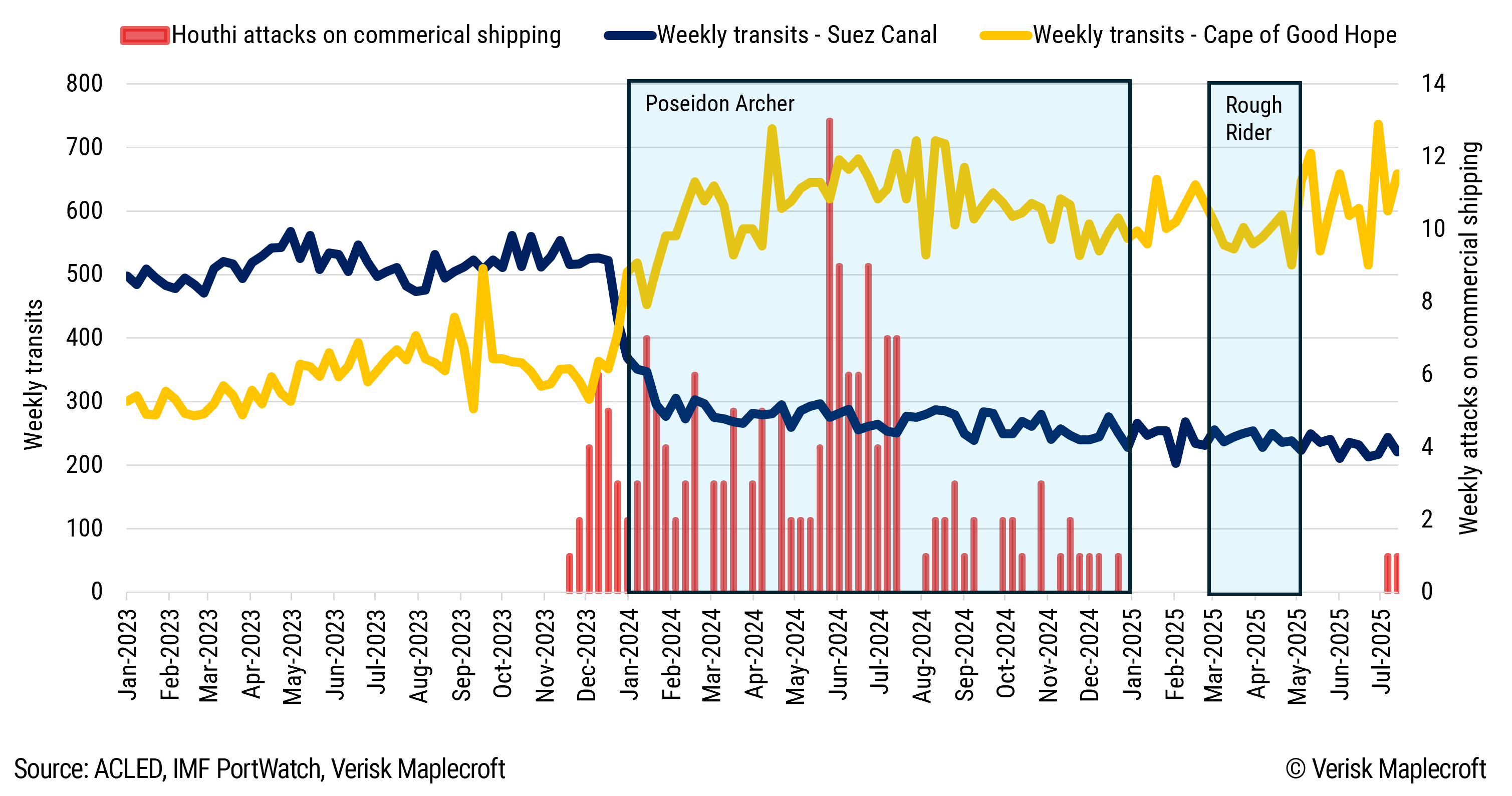

From its start in November 2023 the Houthi campaign caused major disruption to maritime trade flows as the spike in war risk premiums redirected ships to transit around the Cape of Good Hope (see below). The overhaul of regional shipping routes has stayed consistent despite aerial military campaigns by the US, UK, and Israel to attempt to contain and degrade the Houthis. Even the US-Houthi ceasefire in May, when the US ended its ‘Rough Rider’ campaign of airstrikes in return for the Houthis easing their campaign against Western shipping, led to no significant change in shipping traffic.

On 28 July, the Houthis warned that they would begin to target ships belonging to any companies “dealing with Israeli enemy ports”, regardless of their nationality. Previously, the Houthis claimed that they were only targeting ships that had direct ties to Israel through port calls or ownership: the ships Magic Seas and Eternity C were targeted in early July on the basis that they had docked at Israeli ports.

Although the 28 July statement upped the ante, in practice the Houthis were already casting a wide net in their choice of targets. Shipping operators have attempted to appeal to the religious and geopolitical sensibilities of the Houthis by broadcasting that mariners on board are Muslim or citing Russian and Chinese affiliation. The Houthis even established the Humanitarian Operations Coordination Centre (HOCC) in part to coordinate with shipping companies unconnected to Israel or its allies. Yet ships with links to China and Russia, or even ships bound for Houthi-allied Iran, have been targeted since 2023.

One source cited in a UN report claimed that the Houthis may be collecting USD180 million per month from charging illegal maritime transit fees. The figure stretches credibility given that Suez Canal receipts in 2024 were around USD300 million per month. That implies that shipping companies are willing to pay a further premium of more than 50% on the Suez Canal transit cost instead of circumnavigating the Cape of Good Hope. If payment of de facto bribes is proven, however, shipping companies based in more heavily regulated jurisdictions would be put at a competitive disadvantage.

Still more risky is ships deciding to sail without war risk insurance cover at all, as was reportedly the case with Eternity C, exposing owners to millions of dollars in uninsured losses.

Economic impact of Red Sea disruption mainly felt in the region

Two clear outcomes from the Red Sea crisis are higher insurance costs and less efficient markets. Container shipping costs have decreased since 2024 highs, easing global inflationary pressures, but regional states continue to feel the reverberations.

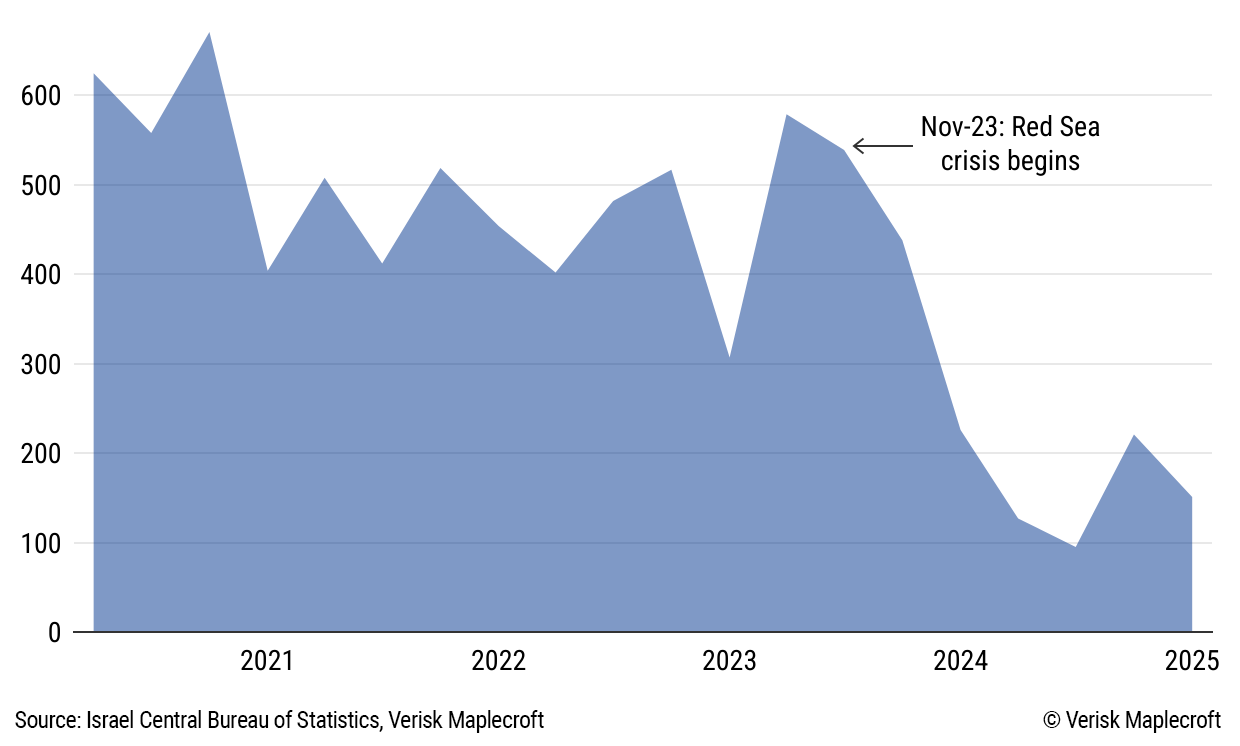

Houthi drone and missile attacks have also caused flight disruptions in Israel, while Israel’s sole Red Sea port of Eilat halted operations on 20 July as a direct result of the decline in shipping caused by the Houthi campaign (see below). Israel’s government has reportedly approached insurers on the question of war risk coverage.

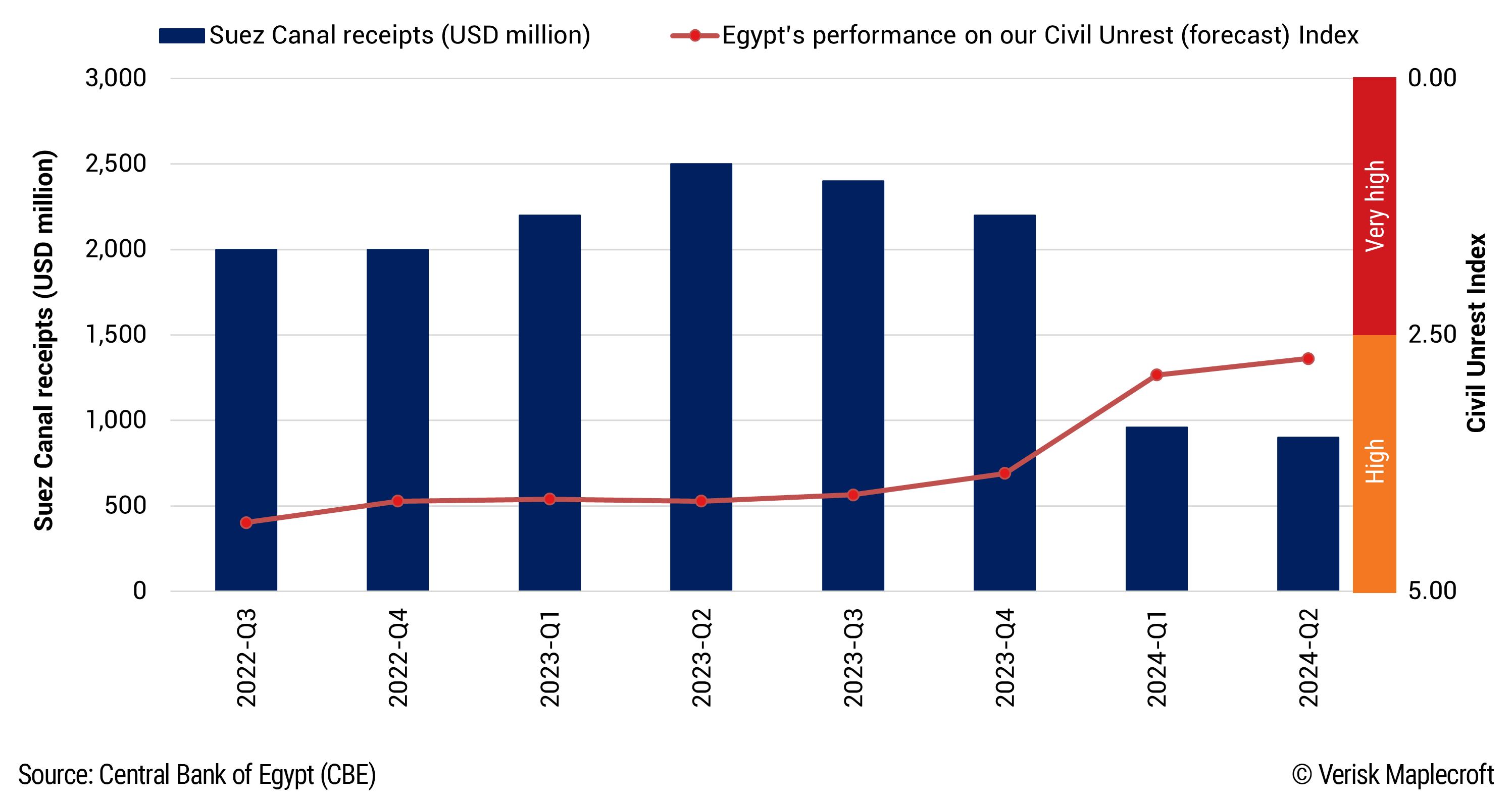

Ultimately, Israel can shoulder the economic fallout. At about 7%, Eilat accounted for a small slice of overall port traffic even before the Red Sea crisis, and activity has since shifted to Israel’s Mediterranean ports. Egypt is more exposed given the importance of the Suez Canal, with receipts dropping by more than 50% in 2024 (see below). The Red Sea crisis has therefore hobbled one of Egypt’s more sustainable revenue sources, adding to fiscal pressures that feed into Egypt’s performance on our Civil Unrest (forecast) Index.

An intensifying campaign – but to what end?

The resumption of attacks against commercial shipping by the Houthis – after a seven-month pause – is driven primarily by domestic priorities. Since the start of the group’s campaign against shipping, conflict with Israel and the US has boosted its domestic profile, support and recruitment.

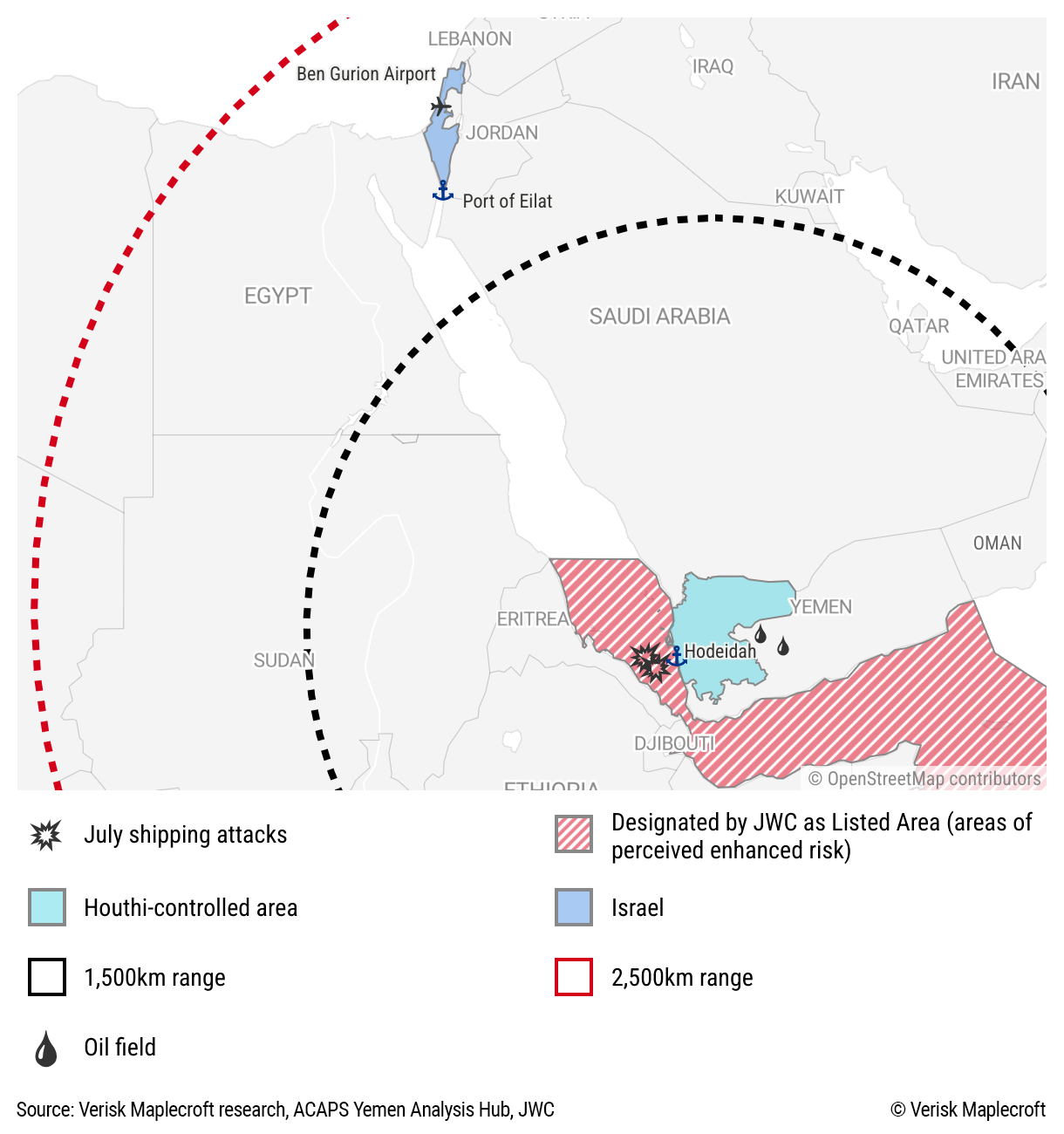

Longer term, the aim of the Houthis is to extend their territorial control within Yemen (see below), especially to areas where the country’s oil fields are concentrated. For the Houthis, high-profile attacks against shipping – ostensibly linked to the war in Gaza – help to maintain momentum in the fight against a disjointed coalition of anti-Houthi forces aligned with the UN-recognised government. The severity of Yemen’s political crisis is underscored by its performance on our Challenges to Government Authority Index, where it is one of only two countries with a score of 0.00/10.00.

The pause in attacks against shipping during the first half of 2025 has allowed the Houthis to regroup after a seven-week bombing campaign by the US form mid-March to early May. The cost of the US operation exceeded USD1 billion, with thousands of bombs and missiles targeting the Houthis across northern and western Yemen. But as demonstrated by the recent attacks, the group retains the capability to target and sink commercial ships.

Despite increasingly intense US military action against the Houthis, nothing suggests that the group can be deterred from targeting shipping. Only a significant degradation of the group’s capabilities could convince most shipping companies to return to the Red Sea. Given the Houthis’ range of attack options– including missiles, drones, fast boats, unmanned surface vessels, and sea mines – airstrikes alone are unlikely to deliver this.

Neither Saudi Arabia nor the UAE want to be dragged back in to direct involvement in Yemen’s civil war for fear that the Houthis would resume missile and drone attacks against them. The appetite in the US for military operations that involve ground troops in Yemen is even lower, especially as the Trump administration views the Red Sea crisis as a bigger problem for Europe than the US.

Threat to shipping likely to remain elevated

The bottom line for international shipping and marine underwriters is that the Houthis have both the motivation and capacity to continue to target ships in and around the Red Sea. Although the focus will be on ships with ties to Israel, the group is likely to target ships with only tenuous or no links in the absence of higher-priority targets. And as we highlighted in June 2024, a ceasefire in Gaza would bring down regional tensions but would not guarantee an end to Houthi attacks against shipping.