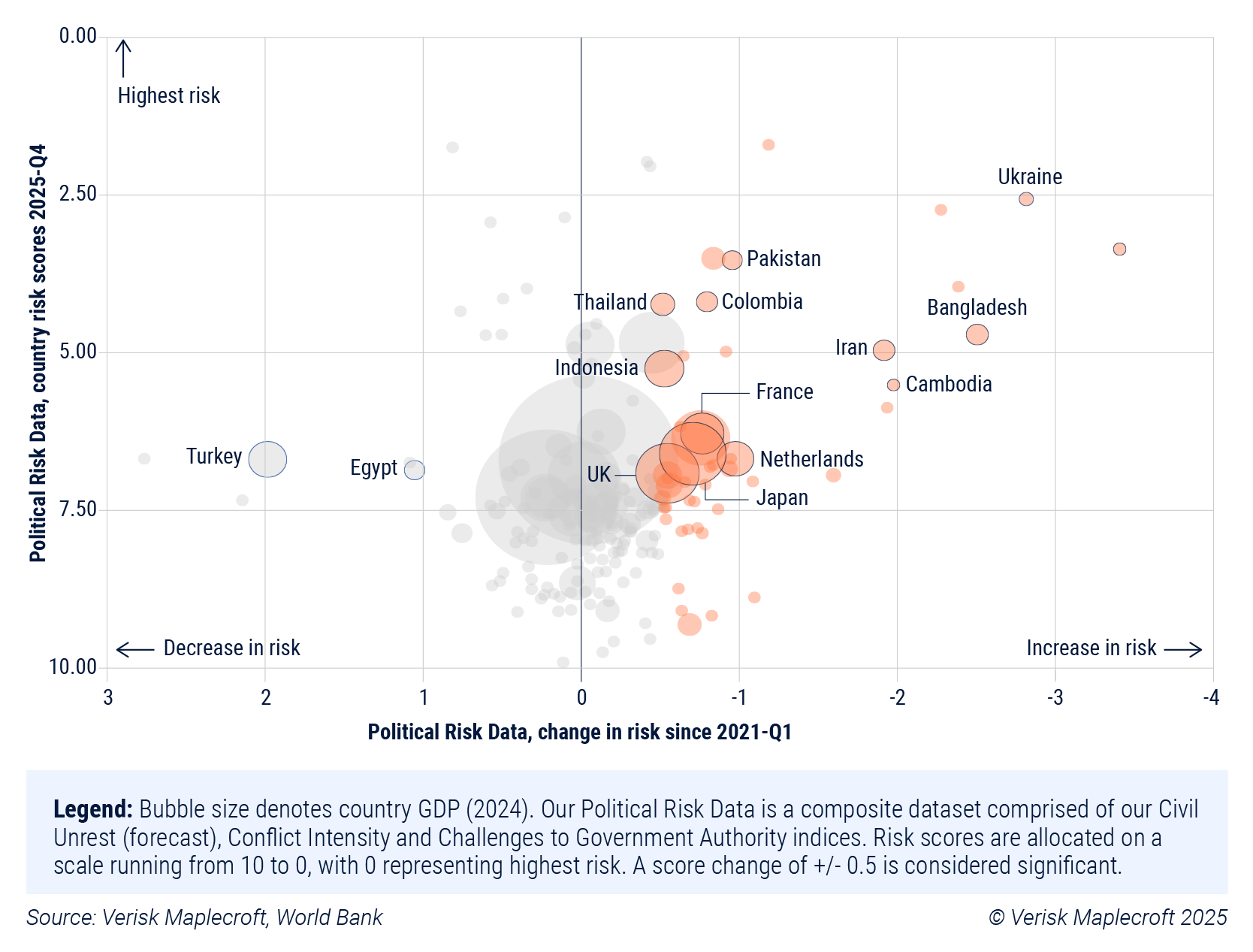

Political risk has become a defining topic for discussion (and debate), not only in the headlines but also within global businesses. Since 2021-Q1, 136 countries have seen rising levels of political risk, with 50 experiencing a significant increase according to our data.

While historically this might have been characteristic for emerging and frontier markets, political risk is now rising in a growing number of developed economies. Tangled geopolitical tensions, trade protectionism, rising cost of living, and political disenfranchisement are no longer confined to episodic events. Instead, this is becoming a norm that global business will have to contend with.

For businesses and investors, this shift translates into a multitude of challenges, ranging from higher operating costs and regulatory uncertainty through to rethinking global value chains and transitioning business strategies. A critical element of the latter will be how boards and execs across all industries rebalance their political risk exposure across operations, supply chains and investment portfolios. The ability to effectively understand and anticipate shifts and build them into decision-making will become even more critical, not only from a risk management perspective but as a core element of competitive advantage.

For this year’s Political Risk Outlook, we bring together our proprietary Country Risk Data and our team of experts to explore five topics designed to surface new ideas and shape new perspectives for global business.

Brazil, China, India well placed to weather tariffs, as global trade realigns

Geopolitics is redrawing the global trade map and supply chains need to adapt. Companies now face three fundamental questions: how to maximise supply chains to access the US market while avoiding penalties, how to diversify export destinations without losing share in large economies, and which emerging markets are the most resilient to trade volatility and offer the best mix of incentives and lower geopolitical risk exposure.

Using our Country Risk Data, we’ve assessed 20 of the most important emerging markets on their resilience and exposure to trade shocks and geopolitical risks. The key takeaway is that major supply chain hubs, including Brazil, China, India and Mexico are currently well positioned to absorb tariff shocks. However, nothing is set in stone. Change will become part of the norm and companies must create a more nuanced view of resilience to identify future markets and position themselves to succeed.

Global conflict zones nearly double since 2021, rising to 6.6 million km2

As geopolitical tensions continue to widen, armed conflict is rising in tandem. Analysis of our Conflict Intensity Index shows that armed conflict has expanded by 89% over the past five years, now covering 4.9% of the world’s six inhabited continents.

Conflict’s profound negative impacts on people, society and economies cannot be understated. But the associated effects on business have also intensified. Companies must now contend with volatility in commodity and energy markets, operational disruption, impacted trade flows, increased insurance and security costs, and elevated compliance risks related to sanctions and export controls. Anticipating how and where these risks will develop is a key challenge for business leaders looking to shield their staff, assets, supply chains, investments and underwriting portfolios.

Europe witnesses biggest rise in political instability, spelling greater uncertainty for business

Beyond conflict, domestic political instability is compounding external pressures for countries. Our data shows that liberal democracies have experienced some of the greatest increases in political instability over the past five years – particularly in Europe, where over 60% of the 44 tracked countries have seen rising governance risks. The region remains a bastion of stability, but the direction of travel is negative. How it manages external economic and trade pressures going forward is crucial, as this will determine its appeal to domestic and foreign investors.

Escalating unrest, polarisation, economic woes set stage for disruptive 2026

In parallel, social unrest has intensified. Our Civil Unrest Index reveals that 108 countries have seen elevated unrest risk over the past year, with large-scale protests and riots more frequent in 2025 than in the previous two years. Five of Europe’s largest economies – France, Germany, Italy, Spain, and the UK – rank among the world’s 10 most exposed countries, alongside Brazil, India, and Mexico.

But while episodes of civil unrest are relatively common (and notoriously difficult to predict), the potential for escalation into damage and disruption to business is relatively low. Yet, this trend further adds to the growing array of risks and issues businesses must contend with and develop deeper understanding around.

Beyond the storm: How geopolitical risk will reshape global business by 2030

Closing out our Outlook, we dig into our geopolitical scenarios, where our leading analysts map out three pathways for how geopolitical risk could develop and affect global business over the next five years. Our analysis concentrates on our most likely scenario – Drift – which sees a continuation of the current risk trajectory, where geopolitical competition, shifting alliances, the deterioration of global institutions and trade volatility drive persistent uncertainty for business. In such an environment, what resilience means for companies needs to be rethought and having an explicit approach to minimise the risks is an imperative.

For deeper insight into these trends and their implications, we invite you to explore the full Political Risk Outlook and engage with our team to understand how our data and foresight capabilities can support your strategic decision-making.