Companies trading internationally will rightly be focused on the immediate costs of evolving tariffs and ongoing geopolitical tit-for-tat. But business must also consider how a trade war can intensify security risks for supply chains, especially if socio-economic conditions deteriorate in key export markets.

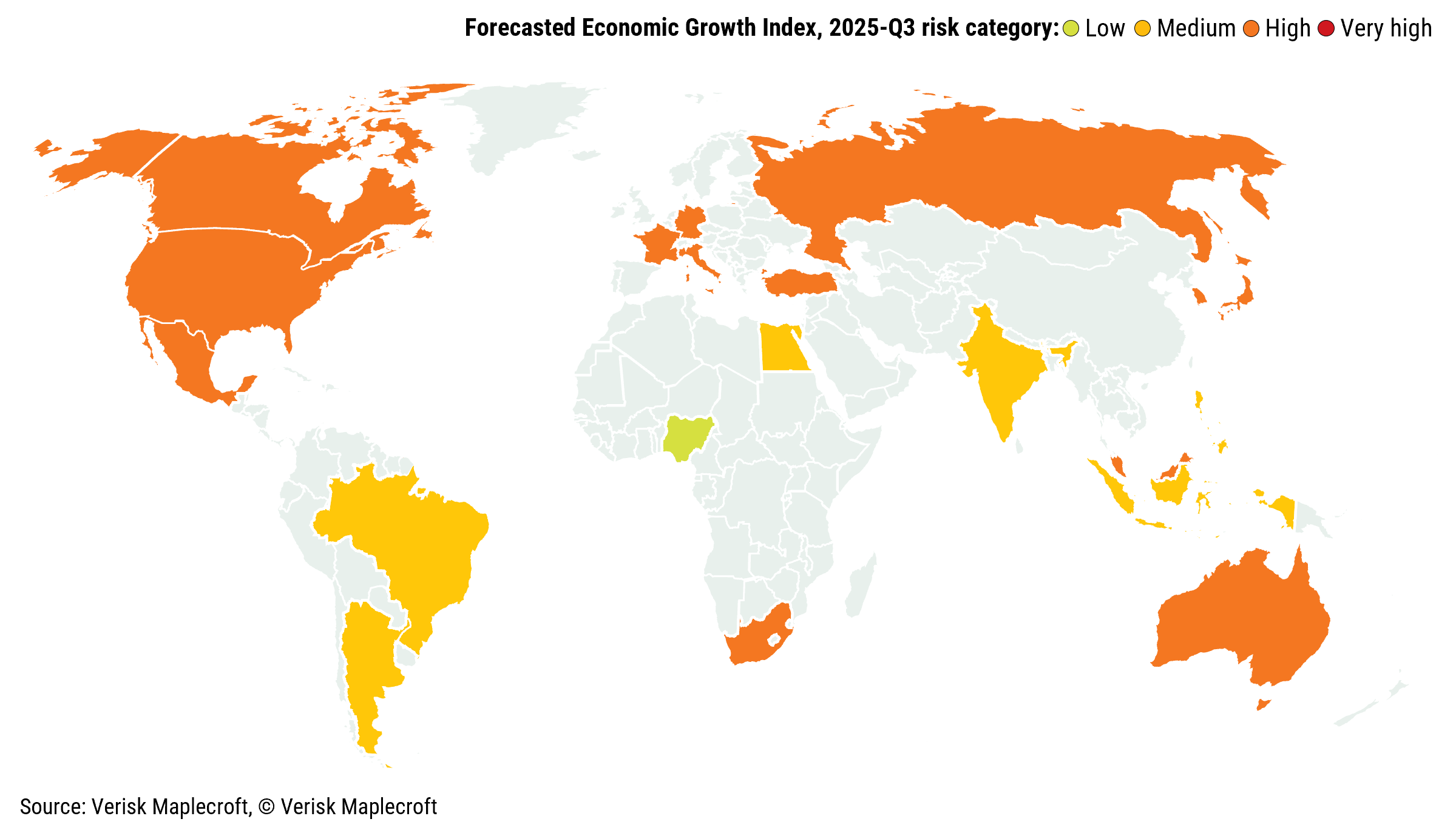

Our data reveals that the land and sea networks that form global supply chains are already highly exposed to a range of security risks, such as civil unrest, strikes, riots and crime. However, with 89 countries classified as ‘high’ or ‘very high’ risk in our Economic Growth Index in 2025 Q3, rising cost of living pressures, fuelled in part by increasing trade volatility, could stoke domestic tensions and result in further challenges in countries that form key nodes in supply chain distribution networks. On top of this, mounting geopolitical competition has the potential to spur more cyberattacks by state and non-state actors against rival countries, with critical infrastructure an attractive potential target.

Significant exposure to civil unrest risks around major transit hubs

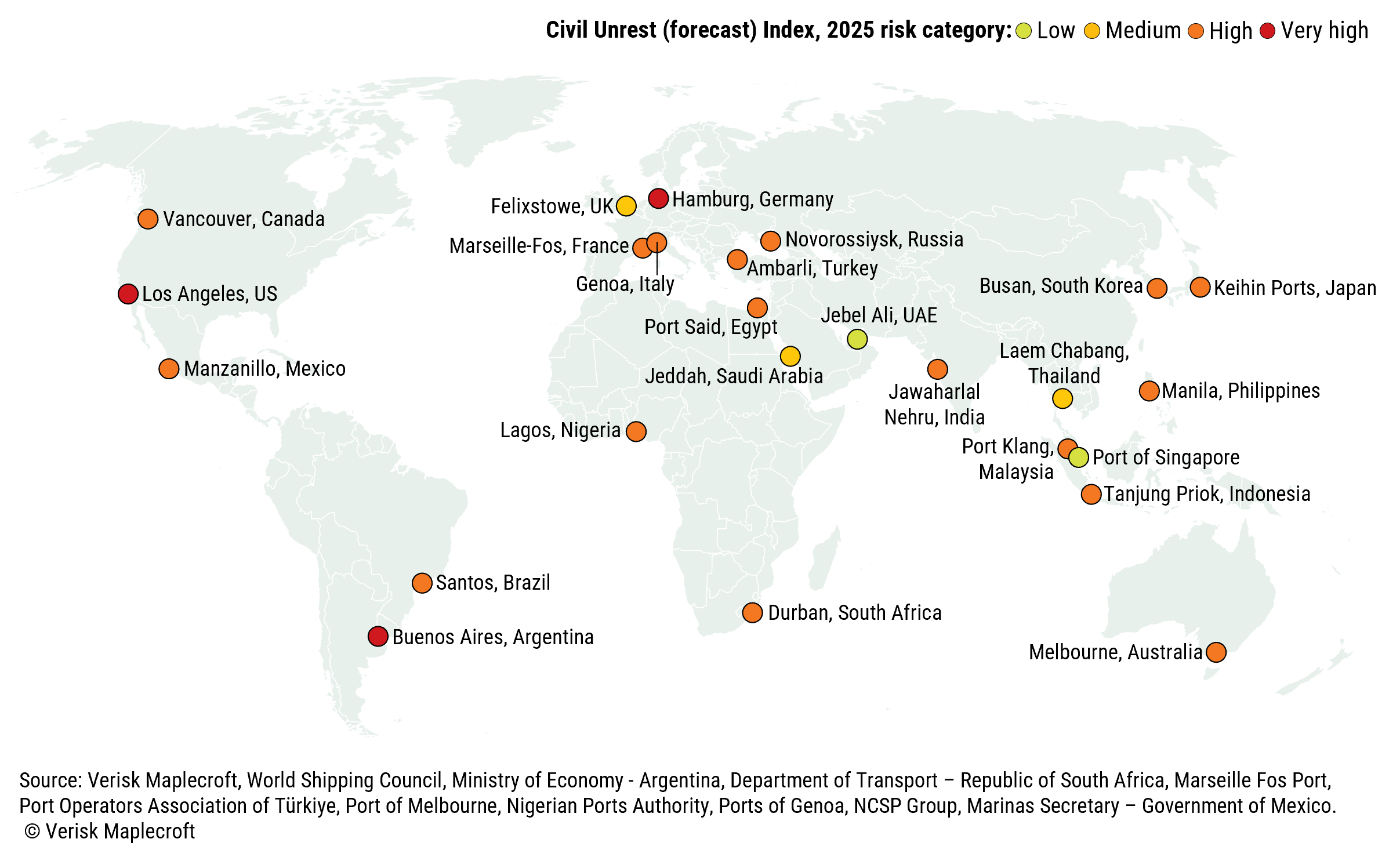

Over 80% of goods are transported by sea, with ports and canals comprising large, complex operations that are core to the continuity of global trade for multiple industries. For this reason, they also represent a point of vulnerability in supply chains, where a single incident – intentional or accidental – can affect multiple industries all reliant on the same node or route.

Looking at a selection of 25 key emerging and developed economies, we assessed the risk of civil unrest for the busiest port in each country. The majority are categorised as ‘high’ or ‘very high’ risk in the coming 12 months, according to our predictive Civil Unrest Index. Less than a quarter are classified ‘medium’ or ‘low risk’.

Even short-term disruption to operations can be significant for maritime infrastructure. In October 2024, a three-day strike by longshoremen over a wage dispute shut down port activity along the East and Gulf Coasts of the US, with estimated costs running into billions of US dollars. Impacts can also come from indirect exposure: ports are vulnerable to disruption from civil unrest in their immediate surroundings, which may block access routes and delay goods using these hubs for transit.

These ‘high risk’ hubs are in countries that are also facing economic headwinds (see chart below). Should current trade hostilities exacerbate these economic difficulties further, supply chain hubs will represent an attractive symbolic target for demonstrations.

Motivation and scope for cyberattacks on critical infrastructure increasing

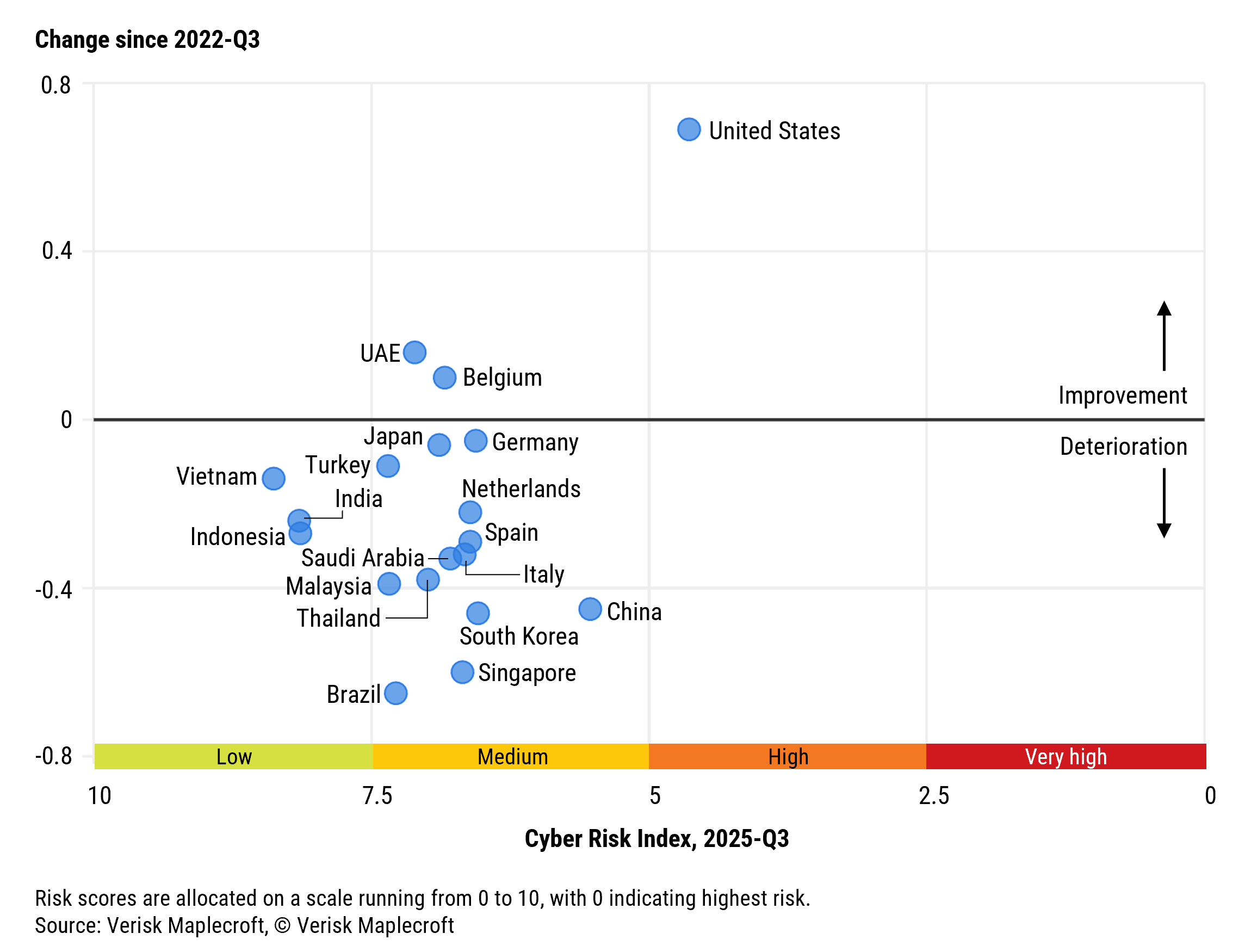

With trade wars stoking some already volatile relationships around the globe, the emergence of cybercrime as a geopolitical tactic offers another avenue for increased disruption to ports.

Cyberattacks can bring port operations to a standstill. In November 2023, Australia’s largest port operator was forced to disconnect from the internet in response to detecting unauthorised network access, halting activity at ports in four cities for three days. Earlier in 2023, one of Japan’s largest shipping hubs, the Port of Nagoya, suffered a ransomware attack that disrupted operations for two days. The downtime in both instances resulted in a backlog of shipments.

Our Cyber Risk Index indicates that over the past three years, cyber risks have increased in all but three of the top 20 busiest countries for container port traffic, with Brazil and Singapore seeing some of the greatest deteriorations over this period, and risks in the US remaining high despite some improvement.

As the logistics industry expands its use of technology to map and track supply chains and meet ever-expanding due diligence compliance requirements, the attack surface for cybercrimes will increase. With our Interstate Tensions Index 2025-Q3 classifying 16 of the top 20 busiest countries for maritime container traffic as ‘high’ or ‘very high’ risk for the next calendar year, politically motivated cyberattacks on critical infrastructure such as ports remain a real prospect.

High levels of crime for land routes in nearshoring locations

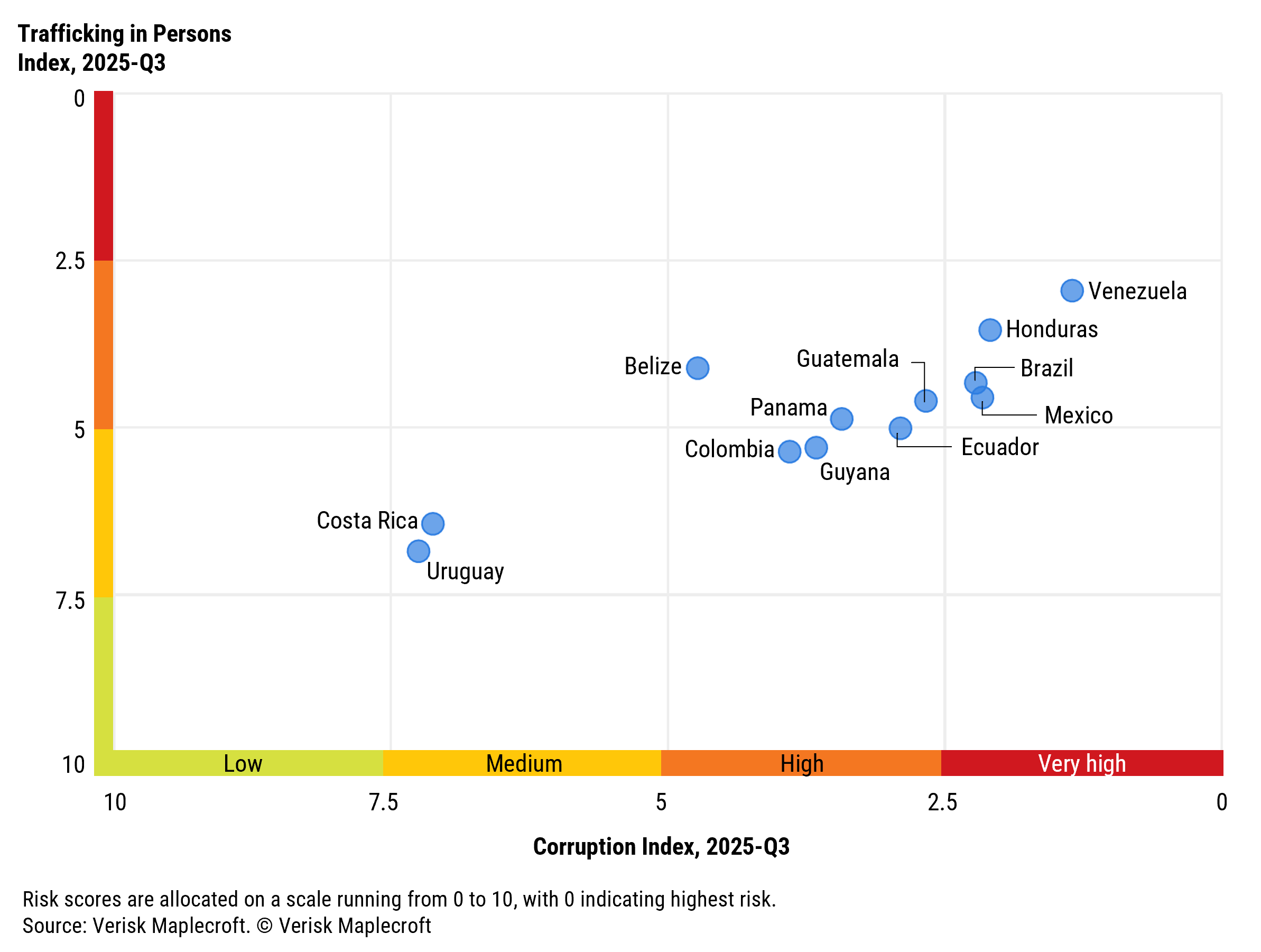

In response to rising geopolitical risks companies have sought to derisk supply chains through diversification and friendshoring strategies. However, this practice can result in higher exposure to other risks with costly consequences.

Many Latin American countries may present attractive prospects for nearshoring to US companies, being largely free of conflict, but the presence of high levels of crime and weak governance mean there are other operational and reputational issues for supply chains to deal with.

Logistics networks are increasingly a target for criminal activity, both for theft and exploitation. Our data identifies 11 Central and South American countries, as well as Mexico, where at least 60% of the major road networks are in regions of ‘high’ or ‘very high’ crime risks. The sophistication of organised crime operations in the region adds a further layer of peril for logistics networks, as does the presence of corruption and human trafficking risks in many of these countries (see chart below).

Our recent research has highlighted that these high levels of crime and other structural challenges may be exacerbated by rising tensions between states as the trade war drags on, which is likely to decrease external support – via aid and remittances – to Latin America.

Investment in supply chain risk management becoming a high priority

Managing risks in the supply chain is now an enterprise-level consideration for many organisations who recognise the scale of the threat posed by disruptions. Understanding the cascading impacts current geopolitical tensions could ultimately have on supply chains is an important component of building resilience in this context. Tools such as scenario analysis can provide a useful way to explore the potential implications of further changes on business operations.

With high levels of uncertainty and change, the more an organisation understands about its supply chain networks, including identifying key infrastructure hubs, the more insight can be gained into potential vulnerabilities. Data is already a vital component in supply chain risk management – from shipment tracking to network mapping – and in the current situation it will continue to play a central role in successful risk identification and control.