Europe has recorded a sharper rise in political instability than any other region since 2020, according to our latest research. As it juggles intensifying geopolitical competition, trade disruptions, demographic pressures, the ongoing cost-of-living crisis and fiscal belt-tightening, our analysis signals that greater unpredictability and widening political divisions have the potential to become an entrenched feature of Europe’s political landscape, generating new costs and uncertainty for business.

Europe has recorded a sharper rise in political instability than any other region since 2020, according to our latest research. As it juggles intensifying geopolitical competition, trade disruptions, demographic pressures, the ongoing cost-of-living crisis and fiscal belt-tightening, our analysis signals that greater unpredictability and widening political divisions have the potential to become an entrenched feature of Europe’s political landscape, generating new costs and uncertainty for business.

These strains are already disrupting policymaking at both the national and EU level, slowing progress on industrial strategies, trade, defence, climate change, and immigration in the face of competing priorities. Heightened policy and regulatory volatility in the years ahead could also further shake the business environment at a time when much-needed economic growth is a priority and companies looking to invest need clarity from legislators in the face of a volatile global trade environment.

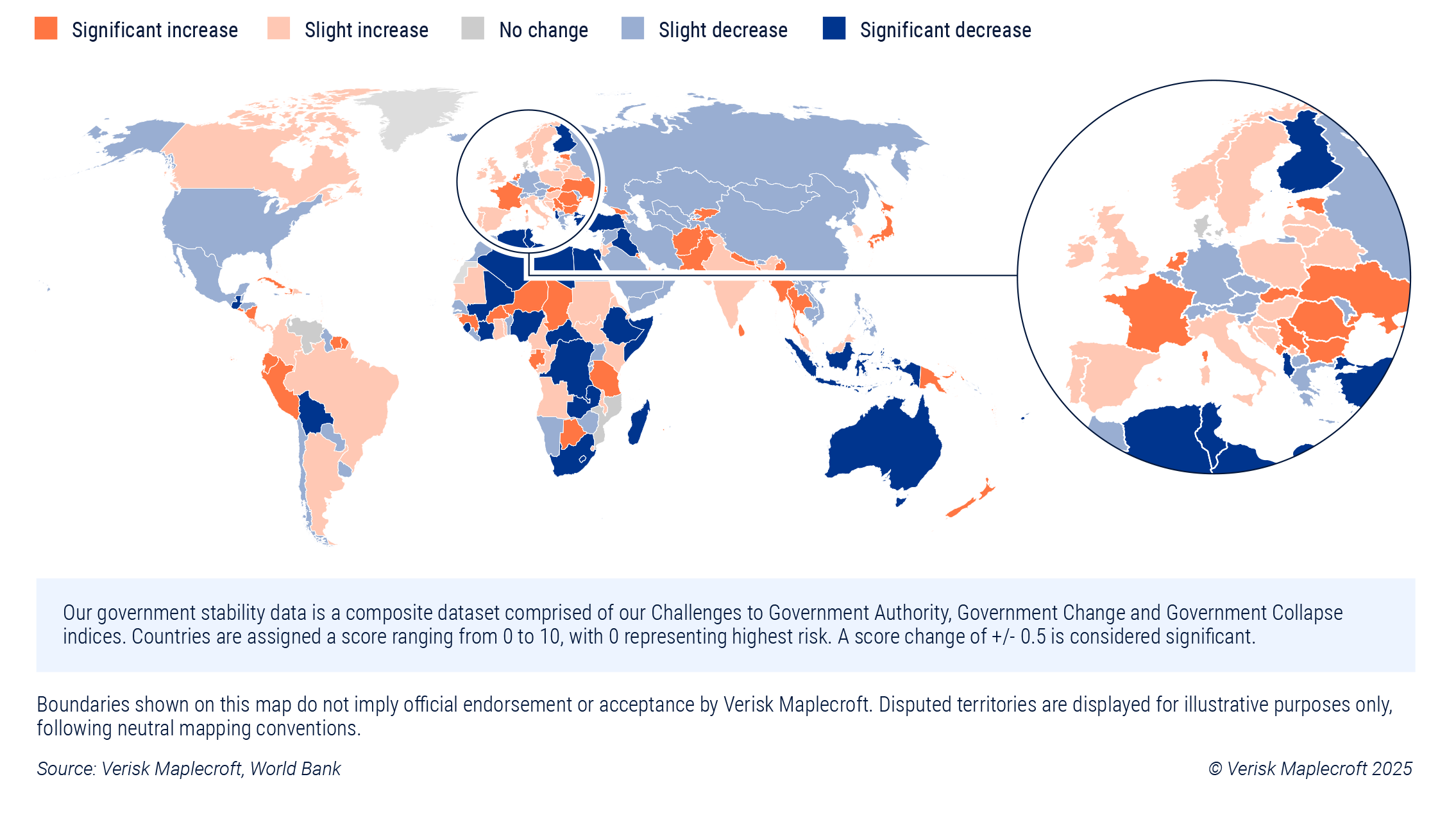

Political stability declines in over 60% of European countries

Measuring the strength of a country’s political leadership, the potential for irregular and regular transfers of power and how well a government can implement its policies, our findings show that political instability is a growing challenge for governments across the world, but most of all in Europe.

Of the 44 European countries tracked by our data, over 60% (27) have seen an increase in risk over the past five years – the highest share of any region – with nine registering a spike that we consider ‘significant’. The trend stretches from the emerging markets of Bulgaria, Romania and Slovakia to the developed economies of France and the Netherlands.

With mainstream parties losing ground amid rising anti-incumbency sentiment, a more fractured political environment is resulting in broad but fragile coalitions or minority governments that struggle to govern effectively. Within the EU, this means less predictability in policymaking for business, something we are already seeing with the roll-back of landmark sustainability legislation in response to shifting political dynamics and rising economic concerns.

Europe acutely exposed to geopolitical tensions

In global terms, the data shows that Europe stills ranks as low-risk in terms of political governance. It is, however, the direction of travel that is concerning as the region manages multiple challenges that could increase levels of business disruption and operational uncertainty.

Geopolitics is high on the list. Proximity to the wars in Ukraine and the Middle East, coupled with dependence on imported energy and open trade, leaves the region particularly exposed to geopolitical shocks and market contagion.

Around half of all European states have recorded an increase in risk on our Interstate Tensions Model over the past year. The majority of that increase stems from tenser relations with Russia over the war in Ukraine and wider European security. Suspected Russian sabotage on European territory, as well as violations of NATO airspace have increased the stakes for Europe, while tensions have also risen between the EU’s major powers and the US over issues as far reaching as the continent’s defence spending and free speech.

EU efforts to pursue self-reliance are unlikely to materialise in the near future given persistent disagreements between member states over strategy, policy and costs, which are curtailing European competitiveness. Managing geopolitical dynamics will remain a major and growing challenge for governments and businesses across the region, particularly if the political environment continues its current trajectory.

European economic headaches to persist

The twin shocks of the pandemic and Russia’s invasion of Ukraine created a perfect storm from which many European economies are still struggling to recover. Germany’s faltering industrial output continues to weigh heavily on the EU’s economic performance, with Europe as a whole ranked as the worst-performing region globally on our Forecasted Economic Growth Index. For businesses, this is already playing out in terms of rising inflation and supply chain shortages, factors set to be exacerbated by ongoing tariff negotiations with the US.

Fiscal pressures are mounting at the same time. Public debt already exceeds over 60% of GDP in more than a dozen European states, and this is set to climb as ageing populations and increased defence spending see debt burdens widen further. This will undermine monetary loosening by central banks, as increased government borrowing keeps overall market rates elevated. Coupled with weak investor confidence, many large European economies have a difficult path ahead in pursuit of fiscal sustainability.

Economic pressures stoking political fragmentation

Economic challenges are also contributing to a fracturing of the political landscape. Frustration with traditional parties amid a perceived drop in living standards has seen voters turn toward antiestablishment candidates on both the left and right of the political spectrum. Indeed, the average share of seats held by far-right or right-wing populist groups across EU-27 parliaments has grown from 18% to 25% since 2020.

The consequences are increasingly visible even among the continent’s traditional powerbrokers. In France, President Macron’s bid to outflank the far-right RN backfired during the 2024 snap election, leaving parliament split into three rival blocs. The country has since seen two prime ministers ousted – and another resign before being reinstated – over their efforts to rein in the country’s strained public finances, and further instability is likely as fiscal pressures intensify.

Despite seeing some stability restored following the formation of a new government in May, Germany has also seen its political centre squeezed. The current centrist coalition is governing with one of the slimmest majorities in the country’s post-war history – in no small part due to the far-right AfD’s surge in the February election – leaving it with little room for manoeuvre.

With anti-establishment parties polling strongly across much of Europe, these fissures look set to deepen, with implications for the continent’s economic trajectory and the business environment. These dynamics are already apparent, with political volatility contributing to declining business sentiment in the EU and companies delaying investment and hiring plans in the face of rising uncertainty.

Perceptions that governments are failing to tackle widening economic inequalities are also eroding public trust in key institutions and fuelling more disruptive unrest, as seen in France in September. Europe already ranks as the worst-performing region globally on our predictive Civil Unrest Index, and the combination of rising fiscal strains, political polarisation and socioeconomic discontent points to more frequent disruption.

Turbulence to test the resilience of Europe’s foundations

Our research shows that political risk is rising globally, but for Europe, managing the current turbulence will determine whether it can preserve the stability and predictability that have traditionally made it one of the most attractive investment destinations. Despite mounting governance, economic and social challenges, the region retains deep structural advantages, from its robust institutional foundations and liberal trade regime to its vast consumer and manufacturing base.

While there are signs that some of its advantages are beginning to erode, our data still ranks Europe as the strongest region globally across several measures of institutional strength, underpinned by robust democratic governance and adherence to the rule of law. But with the risk signals flashing orange, corporates, investors and insurers cannot afford to be complacent.