Strengthening critical mineral supply chains has become a top priority for Western countries seeking to reduce dependence on China. Recent White House announcements on strategic stockpiles and last week’s 55-country meeting to create a preferential critical minerals trade bloc reflect the growing convergence of tech dependence, supply-chain security and geopolitics. However, with significant reserves confined to just a few countries, it is essential for governments, mining companies and the tech industries dependent on these minerals to identify which markets offer the greatest policy certainty and political stability to ensure the resilience of their supply chains. South America could hold the key.

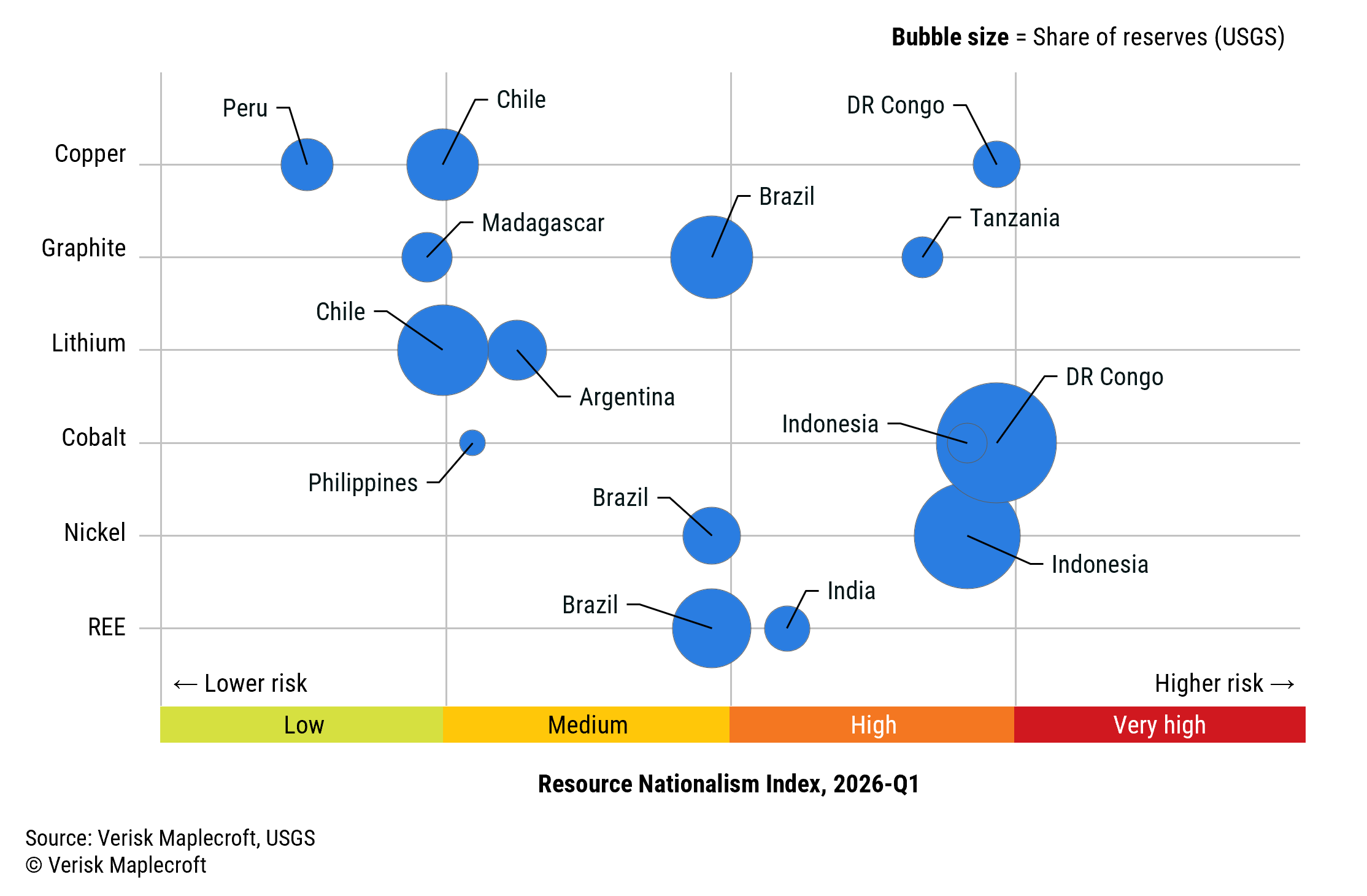

Using our Political Risk Data and Resource Nationalism Index, which measures government control of economic activity within the extractives sector, we assessed 10 emerging markets with major reserves of cobalt, copper, graphite, lithium, nickel, and Rare Earth Elements (REEs). The findings show that Argentina, Brazil, Chile and Peru sit at the centre of the opportunity to rebalance tech-critical mineral supply chains. Other emerging markets assessed include DR Congo, India, Indonesia, Madagascar, the Philippines, and Tanzania (see Figure 1).

Crucially, most of these jurisdictions do not rank among the world’s highest-risk environments for resource nationalism; and within the sub-group, Peru, Chile and Argentina are among the strongest performers. Only DR Congo (8th), Indonesia (10th) and Tanzania (16th) sit within the global top 20 most-exposed jurisdictions out of the 198 countries assessed by our index.

What differentiates South America is not the scale of reserves, but the distribution of risk. South American producers consistently combine large endowments of tech-critical minerals with comparatively moderate levels of resource nationalism and political risk. This helps explain the intensifying US and EU focus on South America as a cornerstone of the ongoing realignment.

The overall risk-adjusted opportunity in South America is highly favourable. But the geographic concentration of certain minerals, like cobalt, means some exposure to higher-risk jurisdictions will be unavoidable. This is already visible in the EU’s recent Free Trade Agreement (FTA) with India, partly linked to REEs supply ambitions, and in the US’s Strategic Minerals Cooperation Framework with DR Congo, set up in December 2025.

Striking a balance: resource nationalism and political risk

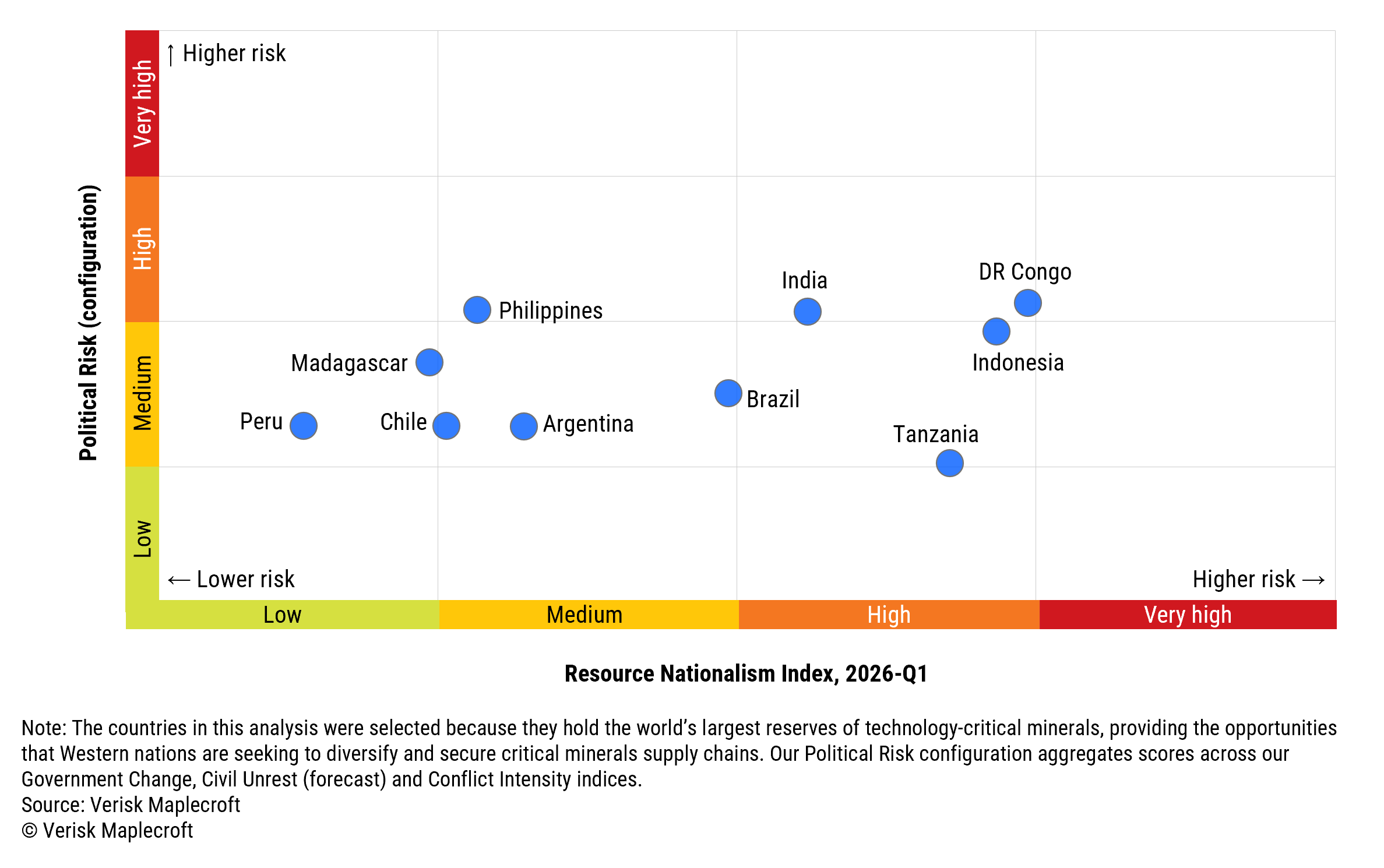

Risk exposure varies considerably when political risk is considered alongside interventionism. Overlaying our Resource Nationalism Index with our Political Risk Data highlights that many jurisdictions with large reserves of lithium, copper, cobalt, nickel, graphite and REEs sit in the medium-risk category (see Figure 2). This suggests that most supply-relevant countries offer relatively favourable conditions for long-term investment and supply-chain planning.

Yet some critical mineral producers sit in the higher risk end of the scale, where exposure to political volatility amplifies the potential for, and impact of, greater protectionist measures, such as India’s state ownership, export controls and domestic value-addition requirements for REEs. DR Congo, and Indonesia also exemplify this dynamic, combining higher political risk and resource nationalism with large tech-critical mineral endowments.

The implication for western diversification strategies is clear: while engagement with higher-risk producers cannot be avoided for certain minerals, South America offers a comparatively stable anchor within an otherwise constrained risk landscape.

Supply meets geopolitical strategy: western alignment outperforms expectations

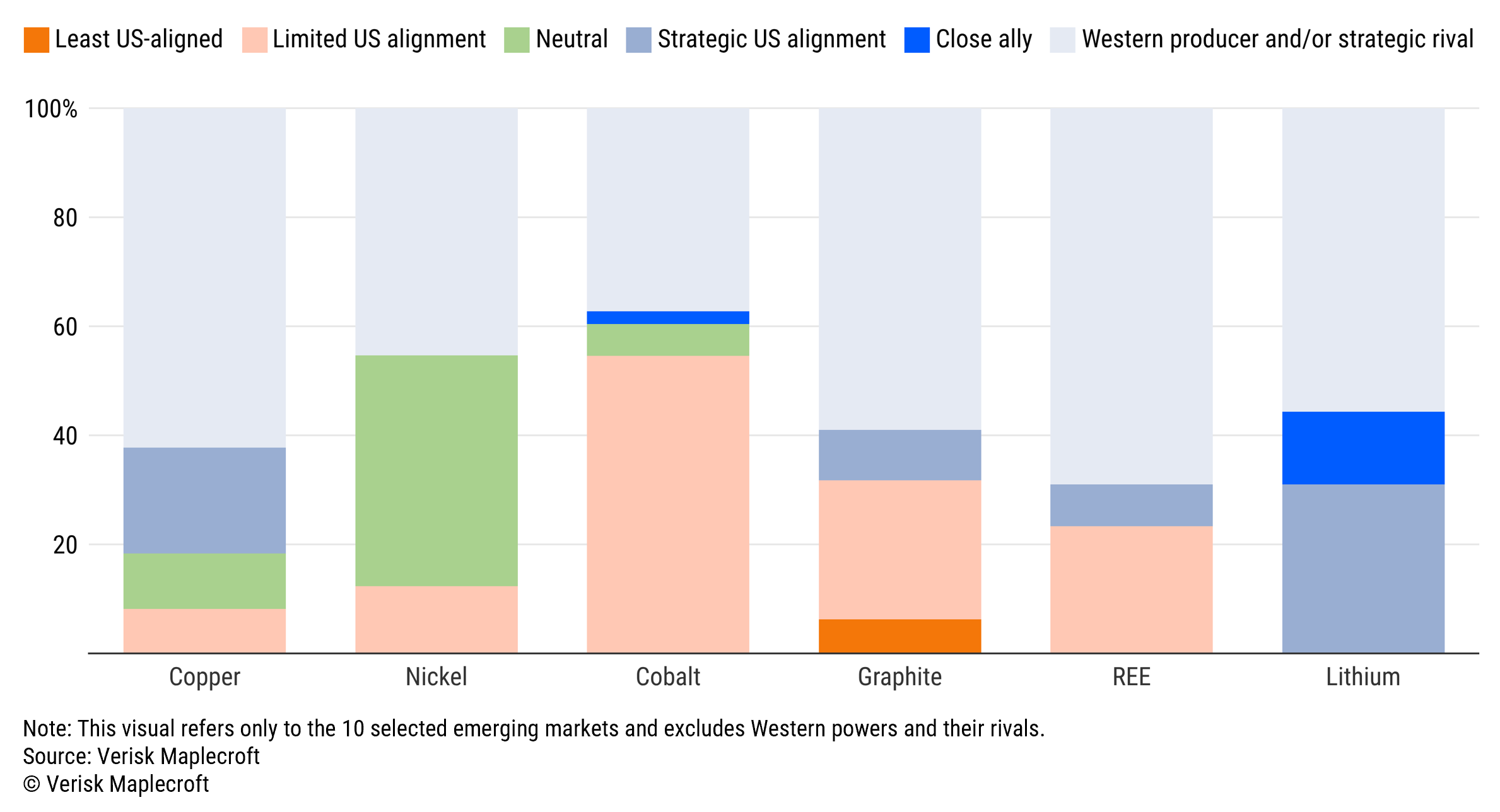

The 10 selected emerging markets present a more favourable geopolitical profile than is often assumed. While policy debates in western capitals frequently frame critical mineral strategy as a race to catch up with entrenched Chinese influence — particularly in refining capacity and mining investments across Asia, Africa and South America our analysis of geopolitical alignment tells a more nuanced story.

Drawing on our Country Risk Data and external sources covering factors such as trade agreements, security pacts and UN voting patterns we have evaluated 15 factors across 190 countries to assess levels of US alignment. Most of the 10 selected jurisdictions sit on the pro-Western or neutral portion of this spectrum (see Figure 3). South American producers feature prominently in this group, reinforcing the region’s attractiveness not only from a resource and risk perspective, but also from a geopolitical one.

Argentina and the Philippines fall at the ‘close ally’ end of the spectrum, while Chile, Madagascar and India occupy a middle zone of ‘strategic US alignment’. Peru and Indonesia are broadly ‘neutral’. Only Brazil, Tanzania and the DR Congo lie closer to the lower end of the US alignment scale, largely driven by strong trade, investment and diplomatic relations with US rivals. Their positioning reinforces the strategic value of concentrating new supply sources where geopolitical alignment, political and resource governance stability intersects most clearly.

Resource, risk and opportunity - the key to a calibrated western strategy

Our data underscores that securing tech-critical minerals is increasingly a strategic exercise. While exposure to higher-risk jurisdictions may be unavoidable due to their concentration of key reserves, most supply-relevant countries, particularly in South America, present a manageable risk profile. This provides a foundation for long-term investment and supply-chain diversification that is more favourable than is frequently believed.

Western policymakers and companies face a choice between unmanaged exposure and calibrated strategy. The effectiveness of initiatives such as strategic stockpiling and the recent Washington summit will ultimately depend on how well they are anchored to jurisdictions that combine viable reserves with durable risk conditions.

Ultimately, the race for critical minerals will be won not by eliminating risk, but by managing it better than competitors. Success will depend on integrating geopolitical foresight, resource nationalism and political risk assessment to delineate the clearest pathway to building resilient, western-aligned critical mineral supply chains. South America will be at the core of diversification strategies in this increasingly fragmented geopolitical landscape.