The rules of stakeholder engagement are being rewritten – not by boards, but by politics, protestors, and policy shifts. In a world of fragmented trade, mounting regulatory scrutiny, and rising ESG activism, mapping the networks that influence the strategic policy direction of countries is a strategic necessity. It’s not about identifying names; understanding influence means organisations can anticipate shifts in the operating environment connect engagement to risk and calibrate their strategies.

Drawing on our Global Risk Data and field experience in complex markets, this guide identifies five strategies to strengthen stakeholder mapping – that can help firms build resilience and credibility.

1. Ground stakeholder mapping in political context

Effective stakeholder engagement starts with understanding power and context. Organisations that succeed go beyond generic labels to understand influence, incentives, and potential for risk. This is critical in high-risk markets, where volatility and weak institutions can shift influence overnight. Engagement grounded in context is the foundation for credibility, alignment, and long-term resilience.

Our indices reflect these dynamics clearly. For example, in recent years, Turkey has experienced sharp declines in our Borrowing Costs, Democratic Governance, Freedom of Opinion and Expression, and Government Finance indices. These trends – now playing out in the form of public unrest – signal rising risk in both institutional capacity and civil society space. Understanding these shifts allows companies to anticipate stakeholder behaviour – and shape more timely, credible, and informed engagement strategies.

Our Political Risk Data helps companies move beyond surface-level stakeholder lists to understand the underlying forces that shape influence. From civil unrest and corruption to regulatory volatility and government stability, our indices enable businesses to track how political risks evolve – and how those shifts affect stakeholder behaviour, influence, and alignment.

2. Build evidence-based engagement strategies

Smart firms don't just listen – they apply data to understand the context stakeholders operate in.

In markets such as Indonesia or Chile, issues like land rights and environmental degradation often emerge well before protests, litigation, or regulatory action. The most effective companies treat these early signals as data – not noise – tracking them systematically to anticipate where pressure is building to develop well-calibrated, proactive engagement structures.

By linking stakeholder concerns to our proprietary risk indices, organisations replace perception with data-led evidence. In Chile, for example, a rise in community concern around land rights can be mapped against our Resource Nationalism and Land Rights indices, which can then be tracked in a risk dashboard to monitor trends over time. This helps companies cut through anecdote, sharpen priorities, and ensure strategic consistency across the organisation.

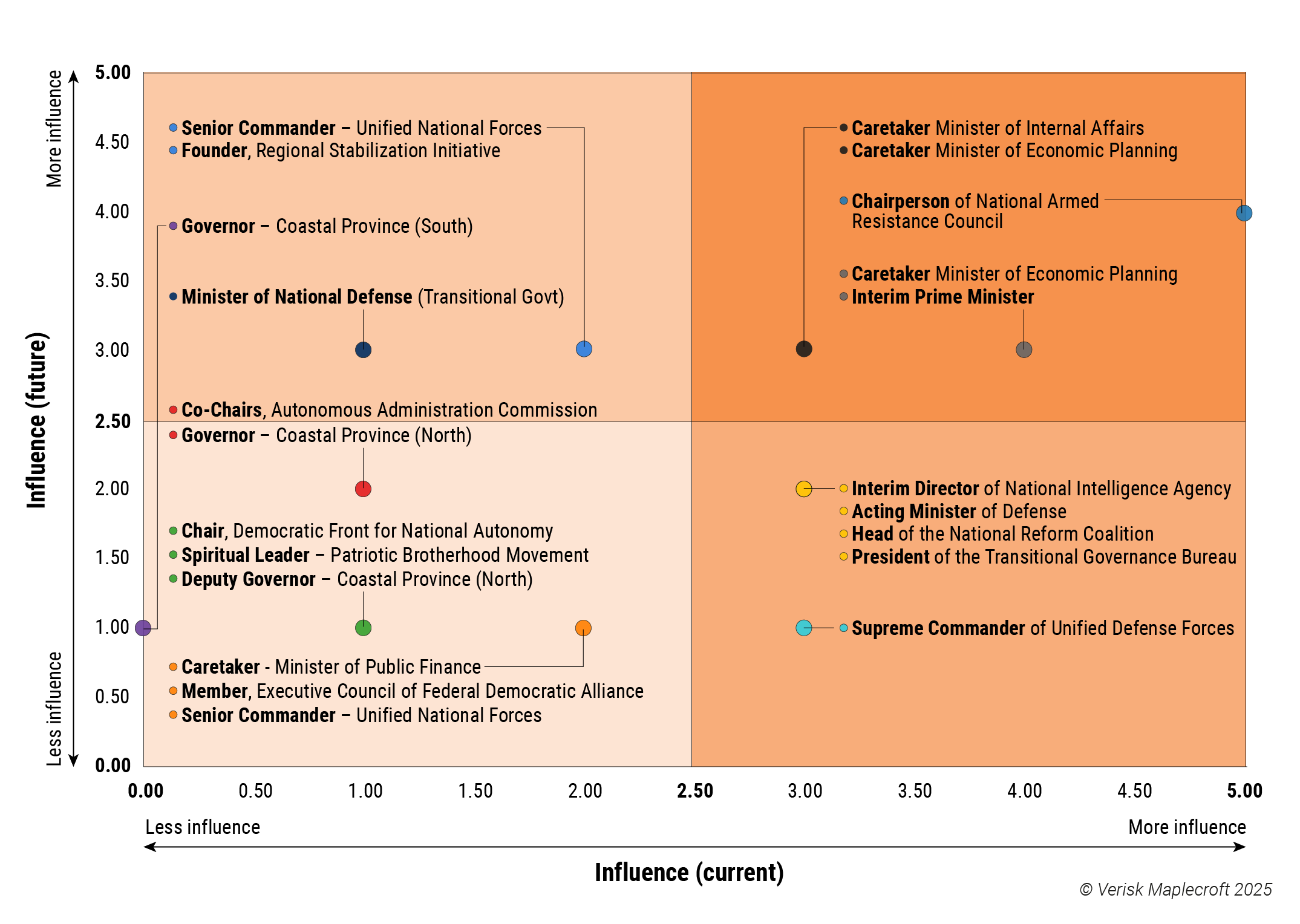

Recently, we supported a client in mapping Syria's post-revolution powerbrokers to inform its stakeholder strategy. Using our risk indices – covering themes such as civil unrest, political stability, and governance breakdown – alongside expert insight, we analysed the motivations, constraints, and likely trajectories of the key actors with influence over the sector the client operated in. We assessed each stakeholder's level of power and interest, building a framework to monitor how shifting dynamics could reshape influence over time.

The result: clearer risk signals, sharper prioritisation, and a basis for executive-level decision-making grounded in evidence, not instinct.

3. Identify cross-border and subnational differences

Strategies that succeed across borders are those rooted in the political and regulatory realities of each jurisdiction. Our national-level risk indices – such as Political Stability, Regulatory Risk, and Governance Effectiveness – enable companies to compare jurisdictions, anticipate where stakeholder dynamics are most likely to shift, and design strategies that reflect the broader political landscape.

Regulatory and stakeholder landscapes often diverge within regions, creating opportunities for companies that employ localised strategies. In the Democratic Republic of Congo, for instance, stakeholder engagement in the extractives sector is shaped by entrenched local power structures and regulatory opacity – factors far less prominent in neighbouring Zambia, despite superficial similarities in stakeholder groups. These differences, visible in our national risk data, help companies create approaches that account for the politically complex realities of each region.

Our Global Risk Data helps companies account for such nuances through subnational risk indices, highlighting where stakeholder sensitivities vary at the local level. This added layer helps organisations understand how community expectations, environmental risk, and reputational exposure to human rights issues can diverge significantly from national narratives.

4. Develop differentiated engagement models

Stakeholders may share a label, but not a mindset. Businesses that adapt their engagement playbook to different contexts strengthen relationships with key stakeholders – and identify early signs of reputational or regulatory developments. This is particularly evident in the energy sector, where projects depend on early buy-in from regulators and communities.

We draw on extensive project experience in politically complex and high-stakes markets to tailor clients’ engagement strategies. Our global team of regional and thematic experts provide clients with nuanced, locally grounded insights into political, environmental and human rights risks that inform both strategic planning and engagement design.

We map stakeholder interest and influence to distinguish between those who can shape outcomes and those who drive risk narratives. From tracing corruption risks in Mongolia's mining approvals process to navigating environmental licensing in Brazil, we help clients chart stakeholder landscapes, anticipate pressure points, and develop strategies that align with shifting dynamics on the ground.

5. Integrate stakeholder insights into strategic decision-making

To succeed, a stakeholder strategy must integrate these insights into broader decision-making. Engagement teams can collect valuable insight and ensure it connects with enterprise risk models, strategic planning and boardroom conversations.

When stakeholder mapping is treated as a strategic exercise, it generates both visibility and actionable intelligence. Used systematically, it becomes a tool for anticipating pressure points – and responding early. Our tools allow companies to map stakeholder feedback against risk themes such as land rights, corruption, or regulatory pressure. These insights can be tracked over time, weighted for materiality, and integrated into enterprise risk platforms and C-suite reporting to ensure stakeholder dynamics inform decisions on investment, expansion, and crisis response.

Working with a multilateral, we designed a stakeholder mapping framework to assess key political and regulatory actors across Latin America. Through expert workshops and qualitative analysis, we evaluated influence dynamics and emerging risks – visualising results in Power BI to support strategic discussions at senior levels. An API-enabled dashboard ensured the framework stayed live and responsive to change.

From mapping to mastery

Stakeholder engagement must sit at the core of corporate resilience, market access, and reputational strength. Companies that do it well don't rely on instinct – they use intelligence that is structured, data-driven and rooted in political and regulatory context.

We equip organisations to shift from reactive stakeholder management to a proactive, risk-aligned strategy that is underpinned by data, local context, and political insight. The companies that lead will be those who treat stakeholder intelligence not as insurance, but as a source of strategic advantage.